Wells Fargo 2008 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2008 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

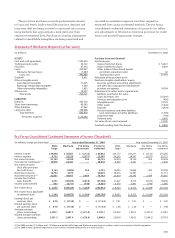

Premises and Equipment

Premises and equipment are carried at cost less accumulated

depreciation and amortization. Capital leases are included in

premises and equipment at the capitalized amount less accu-

mulated amortization.

We primarily use the straight-line method of depreciation

and amortization. Estimated useful lives range up to 40 years

for buildings, up to 10 years for furniture and equipment, and

the shorter of the estimated useful life or lease term for lease-

hold improvements. We amortize capitalized leased assets on

a straight-line basis over the lives of the respective leases.

Goodwill and Identifiable Intangible Assets

Goodwill is recorded in business combinations under the pur-

chase method of accounting when the purchase price is high-

er than the fair value of net assets, including identifiable

intangible assets.

We assess goodwill for impairment annually, and more

frequently in certain circumstances. We assess goodwill for

impairment on a reporting unit level by applying a fair-value-

based test using discounted estimated future net cash flows.

Impairment exists when the carrying amount of the goodwill

exceeds its implied fair value. We recognize impairment loss-

es as a charge to noninterest expense (unless related to dis-

continued operations) and an adjustment to the carrying

value of the goodwill asset. Subsequent reversals of goodwill

impairment are prohibited.

We amortize core deposit and other customer relationship

intangibles on an accelerated basis based on useful lives not

exceeding 10 years. We review such intangibles for impair-

ment whenever events or changes in circumstances indicate

that their carrying amounts may not be recoverable.

Impairment is indicated if the sum of undiscounted estimated

future net cash flows is less than the carrying value of the

asset. Impairment is permanently recognized by writing

down the asset to the extent that the carrying value exceeds

the estimated fair value.

Operating Lease Assets

Operating lease rental income for leased assets is recognized

in other income on a straight-line basis over the lease term.

Related depreciation expense is recorded on a straight-line

basis over the life of the lease, taking into account the esti-

mated residual value of the leased asset. On a periodic basis,

leased assets are reviewed for impairment. Impairment loss is

recognized if the carrying amount of leased assets exceeds

fair value and is not recoverable. The carrying amount of

leased assets is not recoverable if it exceeds the sum of the

undiscounted cash flows expected to result from the lease

payments and the estimated residual value upon the eventual

disposition of the equipment. Leased assets are written down

to the fair value of the collateral less cost to sell when 120

days past due.

Pension Accounting

We account for our defined benefit pension plans using an

actuarial model required by FAS 87, Employers’ Accounting

for Pensions, as amended by FAS 158, Employers’ Accounting

for Defined Benefit Pension and Other Postretirement Plans –

an amendment of FASB Statements No. 87, 88, 106, and 132(R).

This model allocates pension costs over the service period of

employees in the plan. The underlying principle is that

employees render service ratably over this period and, there-

fore, the income statement effects of pensions should follow a

similar pattern.

FAS 158 was issued on September 29, 2006, and became

effective for us on December 31, 2006. FAS 158 requires us to

recognize the funded status of our pension and postretire-

ment benefit plans on our balance sheet. Additionally, FAS

158 requires us to use a year-end measurement date begin-

ning in 2008. We conformed our pension asset and our pen-

sion and postretirement liabilities to FAS 158 and recorded a

corresponding reduction of $402 million (after tax) to the

December 31, 2006, balance of cumulative other comprehen-

sive income in stockholders’ equity. FAS 158 does not change

the amount of net periodic benefit expense recognized in our

income statement.

One of the principal components of the net periodic pen-

sion expense calculation is the expected long-term rate of

return on plan assets. The use of an expected long-term rate

of return on plan assets may cause us to recognize pension

income returns that are greater or less than the actual returns

of plan assets in any given year.

The expected long-term rate of return is designed to

approximate the actual long-term rate of return over time and

is not expected to change significantly. Therefore, the pattern

of income/expense recognition should closely match the stable

pattern of services provided by our employees over the life of

our pension obligation. To ensure that the expected rate of

return is reasonable, we consider such factors as (1) long-term

historical return experience for major asset class categories

(for example, large cap and small cap domestic equities,

international equities and domestic fixed income), and

(2) forward-looking return expectations for these major asset

classes. Differences between expected and actual returns in

each year, if any, are included in our net actuarial gain or loss

amount, which is recognized in other comprehensive income.

We generally amortize any net actuarial gain or loss in

excess of a 5% corridor (as defined in FAS 87) in net periodic

pension expense calculations over the next five years.

We use a discount rate to determine the present value of

our future benefit obligations. The discount rate reflects the

rates available at the measurement date on long-term high-

quality fixed-income debt instruments and is reset annually

on the measurement date. In 2008, we changed our measure-

ment date from November 30 to December 31 as required

under FAS 158.

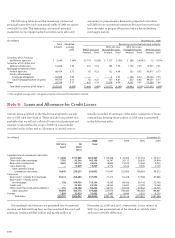

Income Taxes

We file consolidated and separate company federal income

tax returns, foreign tax returns and various combined and

separate company state tax returns.

We account for income taxes in accordance with FAS 109,

Accounting for Income Taxes, as interpreted by FASB