Wells Fargo 2008 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2008 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

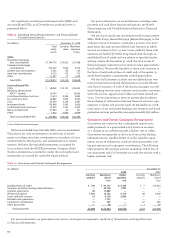

Table 18: Commercial Real Estate Loans by State and Property Type

(in millions) December 31, 2008

Other real Real Total % of

estate estate commercial total

mortgage construction real estate loans

By state:

SOP 03-3 loans:

Florida $ 1,355 $ 1,159 $ 2,514 *%

California 1,589 233 1,822 *

Georgia 515 545 1,060 *

North Carolina 459 586 1,045 *

Virginia 549 334 883 *

Other (1) 3,295 1,646 4,941 *

Total SOP 03-3 loans (2) 7,762 4,503 12,265 1

All other loans:

California 20,068 6,066 26,134 3

Florida 11,345 2,752 14,097 2

Texas 6,323 2,606 8,929 1

North Carolina 5,996 1,620 7,616 1

Georgia 4,797 974 5,771 1

Virginia 3,559 1,634 5,193 1

Arizona 3,060 1,431 4,491 1

New Jersey 3,430 824 4,254 *

New York 2,652 1,390 4,042 *

Pennsylvania 3,005 487 3,492 *

Other (3) 31,111 10,389 41,500 5

Total all other loans (4) 95,346 30,173 125,519 15

Total $103,108 $34,676 $137,784 16%

By property type:

SOP 03-3 loans:

Apartments $ 1,317 $ 1,292 $ 2,609 *%

Office buildings 2,022 221 2,243 *

1-4 family land 851 1,361 2,212 *

1-4 family structure 257 1,040 1,297 *

Land – unimproved 732 247 979 *

Other 2,583 342 2,925 *

Total SOP 03-3 loans (2) 7,762 4,503 12,265 1

All other loans:

Office buildings 25,246 3,159 28,405 3

Agricultural 16,284 1,889 18,173 2

Real estate – other 14,247 1,478 15,725 2

Retail 11,659 1,167 12,826 1

Apartments 7,178 4,471 11,649 1

Industrial 3,359 6,591 9,950 1

Land – unimproved 5,362 2,683 8,045 *

Shopping center 4,802 1,314 6,116 *

1-4 family structure 1,383 3,491 4,874 *

Hotel/motel 806 3,585 4,391 *

Other 5,020 345 5,365 *

Total all other loans (4) 95,346 30,173 125,519 15

Total $103,108 $34,676 $137,784 16%

* Less than 1%.

(1) Consists of 45 states; no state had loans in excess of $747 million.

(2) Includes owner-occupied real estate and construction loans of $7.0 billion.

(3) Consists of 40 states; no state had loans in excess of $3,266 million.

(4) Includes owner-occupied real estate and construction loans of $56.9 billion.

Other real estate mortgages and real estate construction

loans that are diversified in terms of both the state where the

property is located and by the type of property securing the loans

are presented in Table 18. The composition of these portfolios

was stable throughout 2008 and the distribution is consistent

with our target markets and focus on customer relationships.

Approximately $63.9 billion of other real estate and con-

struction loans are loans to owner-occupants where more

than 50% of the property is used in the conduct of their busi-

ness. Of this amount, 11% represented SOP 03-3 loans.