Wells Fargo 2008 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2008 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management and Retirement Services, Commercial Banking,

Investment Banking, Mortgage, Card Services, and Technology

and Operations. St. Louis is headquarters for Wachovia

Securities, retail broker. Boston is headquarters for Wachovia’s

Evergreen Investments, asset management.

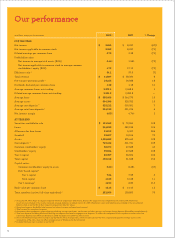

Our 2008 performance

In addition to the achievements I mentioned at the beginning,

we also built the foundation for future growth of our combined

company with these achievements in 2008:

• Our revenue grew 6 percent, and our expenses declined

one percent — the best such revenue/expense ratio among

our large peers, and the one we consider the best long-term

measure of a company’s e ciency.

• Our return on equity (after-tax profi t for every shareholder

dollar) was 4.79 cents for every dollar of our shareholders’

equity, best among our large peers.

• To help fi nance the Wachovia acquisition, we issued

422.7 million shares of common stock valued at $12.5 billion

at year-end. Excluding initial public o erings, this was the

largest single issue of common stock in U.S. history. The

enthusiastic response to this o ering in a very di cult

market again showed broad investor confi dence in our

long-term growth potential, time-tested vision and

diversifi ed business model.

• Our average Retail Banking household had a record

5.73 products with us (5.5 in 2007; 3.8 in 2001), and one

of every four has eight or more products with us.

• We added 6.2 percent net new checking accounts — a core

product that if our customers have with us makes them

much more inclined to come to us for their next fi nancial

services product.

• More than half our new Business Banking checking

customers bought a package of products from us when they

opened their accounts — such as a business debit card, credit

card, or a business loan or line of credit.

• Our average Wholesale Banking customer had a record

6.4 products per relationship with us; a record 7.8 products

per Commercial Banking customer relationship.

• Average core deposits from our Wealth Management

customers rose $7 billion, up 40 percent; Private Banking

average core deposits rose 38 percent.

• We originated $230 billion in mortgages, and our

owned-mortgage servicing portfolio was $2.1 trillion

(including Wachovia), up 39 percent from last year.

• Our most-used channel, wellsfargo.com, had a blockbuster

year — product “solutions” sold up 29 percent, total active

online customers surpassed 11 million, up 15 percent, active

consumer Bill Pay customers up 16 percent to two million,

and we introduced the vSafeSM personal online safe for

protecting and storing important documents.

• Besides Wachovia, we acquired the banking operations

of United Bancorporation of Wyoming, Flatiron Credit

Company (insurance premium fi nance), Farmers State

Bank (Morgan, Colorado), Century Bancshares (Dallas-Fort

Worth; Texarkana, Texas and Arkansas) and EMAR Group

(commercial insurance).

• Our team members as a whole are happier in their work

than ever before. In Community Banking, home to about

one of every three of them, the ratio of engaged to actively

disengaged team members was 8.7 to 1 (2.5 to 1 fi ve years

ago) versus a national average of 1.5 to 1. Our most senior

bankers — market presidents, district managers and

regional presidents — are more engaged than about nine

of every 10 work groups Gallup surveys.

• The $25 billion investment by the U.S. Treasury in

Wells Fargo preferred stock in fourth quarter 2008 gives our

company more resources and greater confi dence to make

more loans to credit-worthy customers. Our new lending

in the fourth quarter 2008 alone was almost three times

the government investment. In February 2009 we paid a

quarterly dividend of $371.5 million to the U.S. Treasury

on its Wells Fargo investment.

Lending discipline

We’ve said it for years and we’ll say it again because it’s

never been more important: Our #1 fi nancial goal is to have a

conservative fi nancial structure as measured by asset quality,

capital levels, diversity of revenue sources and dispersing risk

by geography, loan size and industry.

True to that and unlike many of our competitors we actually

built capital and shrunk our balance sheet in 2005 and 2006,

well before credit markets began to contract in 2008. We

understood our customers’ fi nancial needs. As a result, our

company is one of the world’s strongest fi nancial institutions.

Even as credit markets contracted in 2008, we still led the

“ We’re not satisfi ed with just being #1 in deposit market share.

We want to be known as the best in every product in every market

in which we do business, in retail banking, business banking,

investments and mortgage — and be the fi rst provider our

customers think of when they need their next fi nancial product.”