Wells Fargo 2008 Annual Report Download - page 159

Download and view the complete annual report

Please find page 159 of the 2008 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

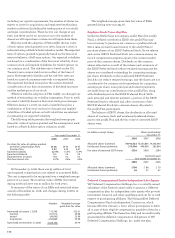

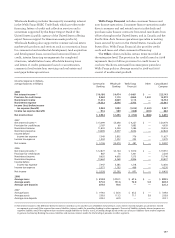

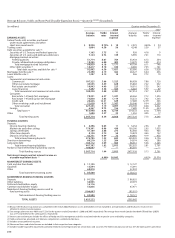

(income/expense in millions,

average balances in billions) Community Wholesale Wells Fargo Other Consolidated

Banking Banking Financial

Company

2008

Net interest income (1) $16,188 $4,474 $ 4,481 $ — $25,143

Provision for credit losses 9,560 1,115 4,063 1,241 15,979

Noninterest income 11,572 4,069 1,113 — 16,754

Noninterest expense 14,352 5,546 2,763 — 22,661

Income (loss) before income

tax expense (benefit) 3,848 1,882 (1,232) (1,241) 3,257

Income tax expense (benefit) 916 589 (468) (435) 602

Net income (loss) $ 2,932 $1,293 $ (764) $ (806) $ 2,655

2007

Net interest income (1) $ 13,099 $ 3,648 $ 4,227 $ — $ 20,974

Provision for credit losses 3,187 69 1,683 — 4,939

Noninterest income 11,832 5,300 1,284 — 18,416

Noninterest expense 14,695 5,077 3,052 — 22,824

Income before

income tax expense 7,049 3,802 776 — 11,627

Income tax expense 1,943 1,332 295 — 3,570

Net income $ 5,106 $ 2,470 $ 481 $ — $ 8,057

2006

Net interest income (1) $ 12,877 $ 3,164 $ 3,910 $ — $ 19,951

Provision for credit losses 887 16 1,301 — 2,204

Noninterest income 9,620 4,605 1,515 — 15,740

Noninterest expense 13,663 4,368 2,806 — 20,837

Income before

income tax expense 7,947 3,385 1,318 — 12,650

Income tax expense 2,571 1,193 466 — 4,230

Net income $ 5,376 $ 2,192 $ 852 $ — $ 8,420

2008

Average loans $ 218.8 $112.1 $ 67.6 $ — $ 398.5

Average assets 375.0 151.6 72.0 5.8 604.4

Average core deposits 254.6 70.6 — — 325.2

2007

Average loans $ 194.0 $ 85.6 $ 65.2 $ — $ 344.8

Average assets 330.6 113.3 71.1 5.8 520.8

Average core deposits 242.2 60.9 — — 303.1

(1) Net interest income is the difference between interest earned on assets and the cost of liabilities to fund those assets. Interest earned includes actual interest earned

on segment assets and, if the segment has excess liabilities, interest credits for providing funding to other segments. The cost of liabilities includes interest expense on

segment liabilities and, if the segment does not have enough liabilities to fund its assets, a funding charge based on the cost of excess liabilities from another segment.

In general, Community Banking has excess liabilities and receives interest credits for the funding it provides to other segments.

Wholesale Banking includes the majority ownership interest

in the Wells Fargo HSBC Trade Bank, which provides trade

financing, letters of credit and collection services and is

sometimes supported by the Export-Import Bank of the

United States (a public agency of the United States offering

export finance support for American-made products).

Wholesale Banking also supports the commercial real estate

market with products and services such as construction loans

for commercial and residential development, land acquisition

and development loans, secured and unsecured lines of

credit, interim financing arrangements for completed

structures, rehabilitation loans, affordable housing loans

and letters of credit, permanent loans for securitization,

commercial real estate loan servicing and real estate and

mortgage brokerage services.

Wells Fargo Financial includes consumer finance and

auto finance operations. Consumer finance operations make

direct consumer and real estate loans to individuals and

purchase sales finance contracts from retail merchants from

offices throughout the United States, and in Canada and the

Pacific Rim. Auto finance operations specialize in making

loans secured by autos in the United States, Canada and

Puerto Rico. Wells Fargo Financial also provides credit

cards and lease and other commercial financing.

The Other column includes certain items recorded at

the enterprise level. The provision for credit losses for 2008

represents the $1.2 billion provision for credit losses to

conform Wachovia estimated loss emergence periods to

Wells Fargo policies. Average assets for 2008 and 2007

consist of unallocated goodwill.