Wells Fargo 2008 Annual Report Download - page 115

Download and view the complete annual report

Please find page 115 of the 2008 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

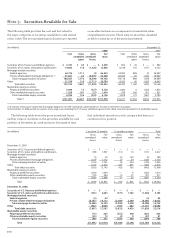

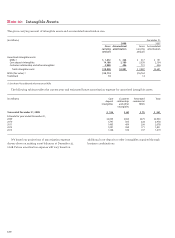

commercial mortgage servicing rights, and other interests

held related to residential mortgage loan securitizations

are presented in the following table.

Key economic assumptions and the sensitivity of the

current fair value to immediate adverse changes in those

assumptions at December 31, 2008, for residential and

($ in millions) Mortgage Other Other

servicing interests interests

rights held held –

subordinate

bonds

Fair value of interests held $15,246 $ 312 $ 244

Expected weighted-average life (in years) 4.3 5.6 5.0

Prepayment speed assumption (annual CPR) 16.0% 13.3% 15.9%

Decrease in fair value from:

10% increase $ 585 $ 13 $ 1

25% increase 1,337 31 3

Discount rate assumption 8.1% 18.6% 12.8%

MSRs and other interests held

Decrease in fair value from:

100 basis point increase $ 610 $ 13

200 basis point increase 1,168 24

Other interests held – subordinate bonds

Decrease in fair value from:

50 basis point increase $5

100 basis point increase 11

Credit loss assumption 3.1%

Decrease in fair value from:

10% higher losses $22

25% higher losses 45

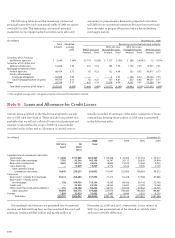

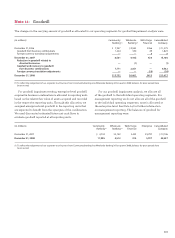

For securitizations completed in 2008 and 2007, we

used the following assumptions to determine the fair value

Mortgage Other Other interests held –

servicing rights interests held subordinate bonds

2008 2007 2008 2007 2008 2007

Prepayment speed (annual CPR (1) ) (2) 12.7% 13.5% 36.0% 14.1% 13.3% 24.3%

Life (in years) (2) 7.1 6.8 2.3 7.2 5.7 4.4

Discount rate (2) 9.4% 9.8% 7.2% 10.2% 6.7% 6.9%

Expected life of loan losses 1.1% 0.8%

(1) Constant prepayment rate.

(2) Represents weighted averages for all other interests held resulting from securitizations completed in 2008 and 2007.

of mortgage servicing rights and other interests held at the

date of securitization.

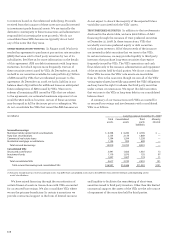

the other interests held is calculated independently without

changing any other assumptions. In reality, changes in one

factor may result in changes in others (for example, changes

in prepayment speed estimates could result in changes

in the discount rates), which might magnify or counteract

the sensitivities.

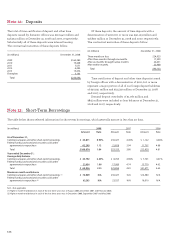

We also retained some AAA-rated fixed-rate and

adjustable rate mortgage-backed securities (MBS). The fair

value of the securities was $5,147 million and $7,423 million

at December 31, 2008 and 2007, respectively, and was deter-

mined using an independent third party pricing service.

Adverse changes in key economic assumptions used to

measure the fair value of retained interests in securitizations

that we acquired in the Wachovia acquisition were analyzed.

The price sensitivity to these adverse changes was not signif-

icant and, accordingly, are not included in the table above.

The sensitivities in the table above are hypothetical

and caution should be exercised when relying on this data.

Changes in fair value based on a 10% variation in assumptions

generally cannot be extrapolated because the relationship

of the change in the assumption to the change in fair value

may not be linear. Also, in the table above, the effect of

a variation in a particular assumption on the fair value of