Wells Fargo 2008 Annual Report Download - page 130

Download and view the complete annual report

Please find page 130 of the 2008 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

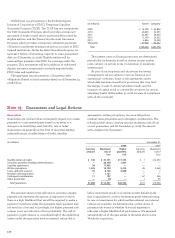

Legal Actions

Wells Fargo and certain of our subsidiaries are involved in

a number of judicial, regulatory and arbitration proceedings

concerning matters arising from the conduct of our business

activities. These proceedings include actions brought against

Wells Fargo and/or our subsidiaries with respect to corporate

related matters and transactions in which Wells Fargo and/or

our subsidiaries were involved. In addition, Wells Fargo and

our subsidiaries may be requested to provide information or

otherwise cooperate with governmental authorities in the

conduct of investigations of other persons or industry groups.

Although there can be no assurance as to the ultimate

outcome, Wells Fargo and/or our subsidiaries have generally

denied, or believe we have a meritorious defense and will

deny, liability in all significant litigation pending against us,

including the matters described below, and we intend to

defend vigorously each case, other than matters we describe

as having settled. Reserves are established for legal claims

when payments associated with the claims become probable

and the costs can be reasonably estimated. The actual costs

of resolving legal claims may be substantially higher or lower

than the amounts reserved for those claims.

ADELPHIA LITIGATION Wachovia Bank, N.A. and Wachovia

Capital Markets, LLC, are defendants in an adversary

proceeding previously pending in the United States

Bankruptcy Court for the Southern District of New York

related to the bankruptcy of Adelphia Communications

Corporation (Adelphia). The Official Committee of

Unsecured Creditors in Adelphia’s bankruptcy case filed

the claims; the current plaintiff is the Adelphia Recovery

Trust, which was substituted as the plaintiff pursuant to

Adelphia’s confirmed plan of reorganization. In February

2006, an order was entered moving the case to the United

States District Court for the Southern District of New York.

The complaint asserts claims against the defendants under

state law, bankruptcy law and the Bank Holding Company

Act and seeks equitable relief and an unspecified amount of

compensatory and punitive damages. On June 11, 2007, the

Bankruptcy Court granted in part and denied in part the

motions to dismiss filed by the two Wachovia entities and

other defendants. On January 17, 2008, the District Court

affirmed the decision of the Bankruptcy Court on the motion

to dismiss with the exception that it dismissed one additional

claim. On July 17, 2008, the District Court issued a ruling

dismissing all of the bankruptcy related claims. The remaining

claims essentially allege the banks should be liable to Adelphia

on theories of aiding and abetting a breach of fiduciary duty

and violation of the Bank Holding Company Act. The case

is now in discovery.

AUCTION RATE SECURITIES On August 15, 2008, Wachovia

Securities, LLC and Wachovia Capital Markets, LLC

(collectively the Wachovia Securities Affiliates) announced

they had reached settlements in principle with the Secretary

of State for the State of Missouri (as the lead state in the

North American Securities Administrators Association task

force investigating the marketing and sale of auction rate

securities), and with the New York State Attorney General’s

Office of their respective investigations of sales practice

and other issues related to the sales of auction rate securities

(ARS). Wachovia Securities also announced a settlement

in principle with the Securities and Exchange Commission

(SEC) of its similar investigation. Without admitting or deny-

ing liability, the agreements in principle require that the

Wachovia Securities Affiliates purchase certain ARS sold to

customers in accounts at the Wachovia Securities Affiliates,

reimburse investors who sold ARS purchased at the

Wachovia Securities Affiliates for less than par, provide liq-

uidity loans to customers at no net interest until the ARS are

repurchased, offer to participate in special arbitration proce-

dures with customers who claim consequential damages from

the lack of liquidity in ARS and refund refinancing fees to

certain municipal issuers who issued ARS and later refi-

nanced those securities through the Wachovia Securities

Affiliates. Without admitting or denying liability, the

Wachovia Securities Affiliates will also pay a total fine

of $50 million to the state regulatory agencies and agreed

to entry of consent orders by the two state regulators and

Wachovia Securities, LLC agreed to entry of an injunction

by the SEC. All three settlements in principle have been

finalized. The Wachovia Securities Affiliates began the buy

back of ARS in November 2008. The second and final phase

of the buy back will take place in June 2009.

Wells Fargo Investments, LLC (WFI), Wells Fargo

Brokerage Services, LLC, and Wells Fargo Institutional

Securities, LLC are engaged in discussions with regulators

concerning the sale of ARS. On November 20, 2008, the State

of Washington Department of Financial Institutions filed

a proceeding entitled In the Matter of determining whether

there has been a violation of the Securities Act of Washington

by: Wells Fargo Investments, LLC; Wells Fargo Brokerage

Services, LLC; and Wells Fargo Institutional Securities, LLC.

The action seeks a cease and desist order against violations

of the anti-fraud and suitability provisions of the Washington

Securities Act.

In addition, several purported civil class actions relating

to the sale of ARS are currently pending against various

Wells Fargo affiliated defendants.