Wells Fargo 2008 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 2008 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

10 Wachovia banking customers has a Wachovia credit card;

four of every 10 Wells Fargo customers have a Wells Fargo

credit card.

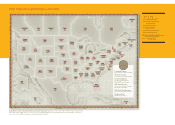

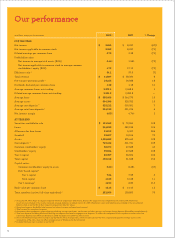

Wells Fargo’s Deposit Leadership

Market Share Rank

Alaska

Nevada

Utah

Arizona

Colorado

California

Minnesota

Idaho

Wyoming

Florida

Virginia

NorthCarolina

NewMexico

SouthCarolina

SouthDakota

Georgia

DC

NewJersey

Oregon

Texas

Delaware

Alabama

Montana

Pennsylvania

Iowa

Connecticut

Nebraska

NorthDakota

Washington

Maryland

Wisconsin

Kansas

Indiana

NewYork

Michigan

Illinois

Tennessee

Mississippi nm

Arkansas nm

Ohio nm

Source: SNL Financial. Deposit data 6/30/08. Pro forma for acquisitions. Exclude deposits

greater than $500 million in a single banking store.

(n.m.: not meaningful)

The mortgage and banking opportunity: huge!

With checking, investments and insurance, mortgage is one

of our four core products — one that our customers value so

much that if they have it with us, then they’re more likely to

buy more products from us. This makes it an indispensable

part of satisfying all their fi nancial needs. We’ve had a

signifi cant retail mortgage presence in the Eastern U.S. for

a long time; we now have a signifi cant Community Banking

presence there as well. This is one of the biggest cross-sell

opportunities of the Wachovia merger — the opportunity in

15 more states to earn all the banking business of our mortgage

customers and all the mortgage business of Wachovia’s banking

households. This opportunity alone could generate millions of

dollars of added revenue because we have about three million

Wells Fargo Home Mortgage customers in the 15 states we enter

with Community Banking through the Wachovia merger.

industry in lending to credit-worthy customers. We made more

loans at better price spreads while many of our competitors had

to cut back. In 2008 we provided $41 billion in new lending to

businesses and individuals. Our average loans rose 16 percent.

Our average commercial and commercial real estate loans rose

25 percent.

Wells Fargo + Wachovia: growth opportunities

Building on our strength and performance, this merger presents

us with signifi cant growth opportunities in each of our major

business groups. Here’s just a sample:

Community Banking: beyond deposits

In addition to our 24 Wells Fargo Community Banking states

in the Midwest, the Southwest, the Rockies and the West,

Wachovia introduces us to 15 more states: Alabama, Connecticut,

Delaware, Florida, Georgia, Kansas, Maryland, Mississippi,

New Jersey, New York, North Carolina, Pennsylvania, South

Carolina, Tennessee, Virginia and Washington, D.C. Our 2008

acquisition of Century Bancshares established our Community

Banking presence in Arkansas. At year-end 2008, our combined

company was #1 in deposit market share in 18 of our 39

Community Banking states and the District of Columbia.

Ninety-three percent of our deposits were in states in which

we rank #1, 2 or 3. We ranked #1 in 10 of the nation’s 20 largest

metro areas in deposit market share (excluding deposits

$500+ million in a single banking store).

There’s more to fi nancial services, however, than just

deposits. There’s signifi cant potential for more growth in all

these states because banking deposits are an important but

relatively small portion of average household assets. In fact, our

share of total household assets in any of these states is probably

no more than 5 percent. We want to go beyond deposits and

satisfy all the fi nancial needs of Wachovia’s retail banking and

brokerage households — not just deposits, loans and lines of

credit, but their credit cards, debit cards, insurance, brokerage,

401(k)s, mortgage, home equity, and on and on.

Take a quick inventory of all your own household’s fi nancial

products. You’ll probably come up with about 16, which you

bought from several providers. We believe you can save more

time and money if you have all your products with one trusted

provider that can o er you, and deliver on, a compelling

value proposition. The same goes for our business banking

customers. We want to satisfy all their fi nancial needs — not

just their deposits, loans and lines of credit but their private

banking, mortgage, treasury management, payroll processing,

merchant processing, insurance, and on and on. We’re not

satisfi ed with just being #1 in deposit market share. We want

to be known as the best in every product in every market in

which we do business, in retail banking, business banking,

investments and mortgage — and be the fi rst provider our

customers think of when they need their next fi nancial product.

Both our companies are learning from each other. Wachovia will

help Wells Fargo make the customer experience in our banking

stores even better. Wells Fargo will help further strengthen

the Wachovia sales process. For example, only one of every