Wells Fargo 2008 Annual Report Download - page 157

Download and view the complete annual report

Please find page 157 of the 2008 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

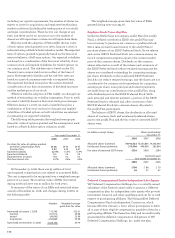

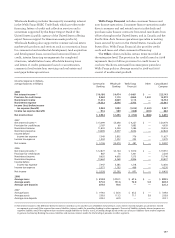

(in millions) Year ended December 31,

2008 2007 2006

Before Tax Net of Before Tax Net of Before Tax Net of

tax effect tax tax effect tax tax effect tax

Translation adjustments $ (93)$ (35)$ (58)$ 36 $ 13 $ 23 $ — $ — $ —

Securities available for sale:

Net unrealized gains (losses)

arising during the year (10,546) (3,958) (6,588) 86 36 50 264 93 171

Reclassification of gains

included in net income (35) (13) (22) (345) (131) (214) (326) (124) (202)

Net unrealized losses arising

during the year (10,581) (3,971) (6,610) (259) (95) (164) (62) (31) (31)

Derivatives and

hedging activities:

Net unrealized gains

arising during the year 955 363 592 645 246 399 46 16 30

Reclassification of net losses

(gains) on cash flow hedges

included in net income (252) (96) (156) (124) (47) (77) 64 24 40

Net unrealized gains arising

during the year 703 267 436 521 199 322 110 40 70

Defined benefit pension plans:

Net actuarial gain (loss) (2,165) (799) (1,366) 347 132 215 — — —

Amortization of net actuarial (gain)

loss and prior service cost

included in net income 6 2 4 44 17 27 — — —

Net gains (losses) arising

during the year (2,159) (797) (1,362) 391 149 242 — — —

Other comprehensive income $(12,130) $(4,536) $(7,594) $ 689 $ 266 $ 423 $ 48 $ 9 $ 39

Note 23: Other Comprehensive Income

The components of other comprehensive income and the related tax effects were:

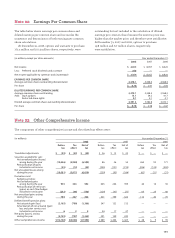

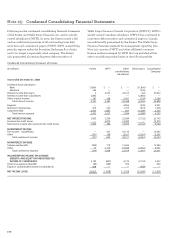

(in millions, except per share amounts) Year ended December 31,

2008 2007 2006

Net income $ 2,655 $ 8,057 $ 8,420

Less: Preferred stock dividends and accretion 286 — —

Net income applicable to common stock (numerator) $ 2,369 $ 8,057 $ 8,420

EARNINGS PER COMMON SHARE

Average common shares outstanding (denominator) 3,378.1 3,348.5 3,368.3

Per share $0.70 $ 2.41 $ 2.50

DILUTED EARNINGS PER COMMON SHARE

Average common shares outstanding 3,378.1 3,348.5 3,368.3

Add: Stock options 13.1 34.2 41.7

Restricted share rights 0.1 0.1 0.1

Diluted average common shares outstanding (denominator) 3,391.3 3,382.8 3,410.1

Per share $0.70 $ 2.38 $ 2.47

The table below shows earnings per common share and

diluted earnings per common share and reconciles the

numerator and denominator of both earnings per common

share calculations.

At December 31, 2008, options and warrants to purchase

172.4 million and 110.3 million shares, respectively, were

Note 22: Earnings Per Common Share

outstanding but not included in the calculation of diluted

earnings per common share because the exercise price was

higher than the market price, and therefore were antidilutive.

At December 31, 2007 and 2006, options to purchase

13.8 million and 6.7 million shares, respectively,

were antidilutive.