Wells Fargo 2008 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2008 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.computational processes, reporting and end-user controls of

the models are appropriate and well documented. In addition,

regulatory examiners review and perform detailed tests of

our allowance processes.

Forecasted losses are compared with actual losses and this

information is used by management in order to develop an

allowance that management believes adequate to cover losses

inherent in the loan portfolio as of the reporting date.

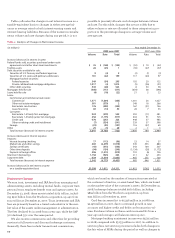

The portion of the allowance for commercial loans, com-

mercial real estate loans and lease financing was $4.5 billion

at December 31, 2008. We initially estimate this portion of the

allowance by applying historical loss factors statistically

derived from tracking losses associated with actual portfolio

movements over a specified period of time, for each specific

loan grade. Based on this process, we assign loss factors to

each pool of graded loans and a loan equivalent amount for

unfunded loan commitments and letters of credit. These esti-

mates are then adjusted or supplemented where necessary

from additional analysis of long-term average loss experi-

ence, external loss data or other risks identified from current

conditions and trends in selected portfolios, including man-

agement’s judgment for imprecision and uncertainty.

We also assess and account for certain nonaccrual com-

mercial and commercial real estate loans that are over $5 mil-

lion and certain consumer, commercial and commercial real

estate loans whose terms have been modified in a troubled

debt restructuring as impaired. We include the impairment

on these nonperforming loans in the allowance unless it has

already been recognized as a loss. At December 31, 2008, we

included $816 million in the allowance related to impaired loans.

Reflected in the portions of the allowance previously

described is an amount for imprecision or uncertainty that incor-

porates the range of probable outcomes inherent in estimates

used for the allowance, which may change from period to period.

This amount is the result of our judgment of risks inherent in the

portfolios, economic uncertainties, historical loss experience and

other subjective factors, including industry trends, calculated to

better reflect our view of risk in each loan portfolio.

In addition, the allowance for credit losses included a

reserve for unfunded credit commitments of $698 million at

December 31, 2008.

The total allowance reflects management’s estimate of

credit losses inherent in the loan portfolio at the balance sheet

date. To estimate the possible range of allowance required at

December 31, 2008, and the related change in provision expense,

we assumed the following scenarios of a reasonably possible

deterioration or improvement in loan credit quality.

Assumptions for deterioration in loan credit quality were:

• for consumer loans, a 55 basis point increase in estimated

loss rates from actual 2008 loss levels, prolonged residen-

tial real estate value deterioration, continued increase in

unemployment levels and higher bankruptcy levels; and

• for wholesale loans, a 17 basis point increase in estimated

loss rates from actual 2008 loss levels, an increase in cor-

porate bankruptcies and continued deterioration in the

homebuilder environment.

Assumptions for improvement in loan credit quality were:

• for consumer loans, a 24 basis point decrease in estimated

loss rates from actual 2008 loss levels, adjusting for resi-

dential real estate value stabilization and real estate sales

market improvement; and

• for wholesale loans, a 14 basis point decrease in estimated

loss rates, large unexpected losses not realized and an

improved home builder environment.

Under these assumptions for deterioration in loan credit

quality, another $3.2 billion in expected losses could occur

and under the assumptions for improvement, a $1.6 billion

reduction in expected losses could occur.

Changes in the estimate of the allowance for credit losses

and the related provision expense can materially affect net

income. The example above is only one of a number of rea-

sonably possible scenarios. Determining the allowance for

credit losses requires us to make forecasts of losses that are

highly uncertain and require a high degree of judgment. The

increase in the allowance for credit losses in excess of net

charge-offs in 2008 was primarily due to adjustments to con-

form to the most conservative methodology from Wells Fargo

and Wachovia, general deterioration in most of our portfolios

given the current economic environment, especially in the

Home Equity portfolios stemming from the steeper than

anticipated decline in national home prices and a lengthen-

ing in the loss emergence timing for consumer credit portfo-

lios. See Note 6 (Loans and Allowance for Credit Losses) to

Financial Statements and “Risk Management – Credit Risk

Management Process” for further discussion of our allowance

for credit losses.

Acquired Loans Accounted for under SOP -

Loans purchased with evidence of credit deterioration since

origination and for which it is probable that all contractually

required payments will not be collected are considered to be

credit impaired. Evidence of credit quality deterioration as of

the purchase date may include statistics such as past due and

nonaccrual status, recent borrower credit scores and recent

loan to value percentages. Purchased credit-impaired loans

are accounted for under SOP 03-3 and initially measured at

fair value, which includes estimated future credit losses

expected to be incurred over the life of the loan. Accordingly,

an allowance for credit losses related to these loans is not

carried over and recorded at the acquisition date. We esti-

mate the cash flows expected to be collected at acquisition

using our internal credit risk, interest rate risk and prepay-

ment risk models, which incorporate our best estimate of cur-

rent key assumptions, such as default rates, loss severity and

prepayment speeds.

Under SOP 03-3, the excess of cash flows expected at

acquisition over the estimated fair value is referred to as the

accretable yield and is recognized in interest income over the

remaining life of the loan, or pool of loans, in situations

where there is a reasonable expectation about the timing and

amount of cash flows expected to be collected. The difference

between the contractually required payments at acquisition

and the cash flows expected to be collected at acquisition,