Wells Fargo 2008 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2008 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

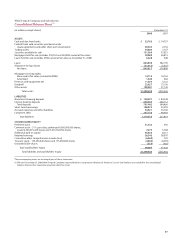

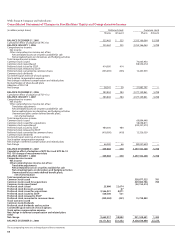

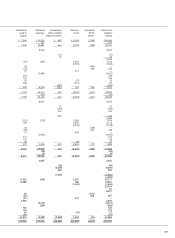

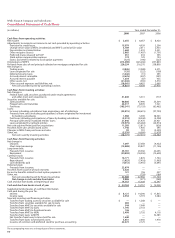

Wells Fargo & Company and Subsidiaries

Consolidated Statement of Changes in Stockholders’ Equity and Comprehensive Income

(in millions, except shares)

Preferred stock Common stock

Shares Amount Shares Amount

BALANCE DECEMBER 31, 2005 325,463 $ 325 3,355,166,064 $ 5,788

Cumulative effect of adoption of FAS 156

BALANCE JANUARY 1, 2006 325,463 325 3,355,166,064 5,788

Comprehensive income:

Net income

Other comprehensive income, net of tax:

Net unrealized losses on securities available for sale

Net unrealized gains on derivatives and hedging activities

Total comprehensive income

Common stock issued 70,063,930

Common stock repurchased (58,534,072)

Preferred stock issued to ESOP 414,000 414

Preferred stock released to ESOP

Preferred stock converted to common shares (355,659) (355) 10,453,939

Common stock dividends

Tax benefit upon exercise of stock options

Stock option compensation expense

Net change in deferred compensation and related plans

Reclassification of share-based plans

Adoption of FAS 158 __________ ________ _____________ ______

Net change 58,341 59 21,983,797 —

BALANCE DECEMBER 31, 2006 383,804 384 3,377,149,861 5,788

Cumulative effect of adoption of FSP 13-2

BALANCE JANUARY 1, 2007 383,804 384 3,377,149,861 5,788

Comprehensive income:

Net income

Other comprehensive income, net of tax:

Translation adjustments

Net unrealized losses on securities available for sale

Net unrealized gains on derivatives and hedging activities

Unamortized gains under defined benefit plans,

net of amortization

Total comprehensive income

Common stock issued 69,894,448

Common stock issued for acquisitions 58,058,813

Common stock repurchased (220,327,473)

Preferred stock issued to ESOP 484,000 484

Preferred stock released to ESOP

Preferred stock converted to common shares (418,000) (418) 12,326,559

Common stock dividends

Tax benefit upon exercise of stock options

Stock option compensation expense

Net change in deferred compensation and related plans __________ ________ _____________ ______

Net change 66,000 66 (80,047,653) —

BALANCE DECEMBER 31, 2007 449,804 450 3,297,102,208 5,788

Cumulative effect of adoption of EITF 06-4 and EITF 06-10

FAS 158 change of measurement date

BALANCE JANUARY 1, 2008 449,804 450 3,297,102,208 5,788

Comprehensive income:

Net income

Other comprehensive income, net of tax:

Translation adjustments

Net unrealized losses on securities available for sale

Net unrealized gains on derivatives and hedging activities

Unamortized losses under defined benefit plans,

net of amortization

Total comprehensive income

Common stock issued 538,877,525 781

Common stock issued for acquisitions 429,084,786 704

Common stock repurchased (52,154,513)

Preferred stock issued 25,000 22,674

Preferred stock discount accretion 67

Preferred stock issued for acquisitions 9,566,921 8,071

Preferred stock issued to ESOP 520,500 521

Preferred stock released to ESOP

Preferred stock converted to common shares (450,404) (451) 15,720,883

Stock warrants issued

Common stock dividends

Preferred stock dividends and accretion

Tax benefit upon exercise of stock options

Stock option compensation expense

Net change in deferred compensation and related plans

Other __________ ________ _____________ ______

Net change 9,662,017 30,882 931,528,681 1,485

BALANCE DECEMBER 31, 2008 10,111,821 $31,332 4,228,630,889 $7,273

The accompanying notes are an integral part of these statements.