Wells Fargo 2008 Annual Report Download - page 133

Download and view the complete annual report

Please find page 133 of the 2008 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

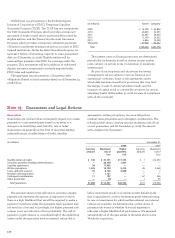

as targets of the DOJ’s investigation. Wachovia Bank has

been cooperating and continues to fully cooperate with the

government investigations.

Wachovia Bank, along with a number of other banks

and financial services companies, has also been named as a

defendant in a number of substantially identical purported

class actions, filed in various state and federal courts by

various municipalities alleging they have been damaged

by the activity which is the subject of the governmental

investigations. A number of the federal matters have been

consolidated for pre trial proceedings.

PAYMENT PROCESSING CENTER On February 17, 2006, the U.S.

Attorney’s Office for the Eastern District of Pennsylvania

filed a civil fraud complaint against a former Wachovia Bank,

N.A. customer, Payment Processing Center (PPC). PPC was

a third party payment processor for telemarketing and

catalogue companies. On April 12, 2007, a civil class action,

Faloney et al. v. Wachovia Bank, N.A., was filed against

Wachovia Bank in the U.S. District Court for the Eastern

District of Pennsylvania by a putative class of consumers

who made purchases through telemarketer customers of PPC.

The suit alleges that between April 1, 2005 and February 21,

2006, Wachovia Bank conspired with PPC to facilitate PPC’s

purported violation of RICO. On February 15, 2008, a second

putative class action, Harrison v. Wachovia Bank, N.A., was

filed in the U.S. District Court for the Eastern District of

Pennsylvania by a putative class of consumers who made

purchases through telemarketing customers of three other

third party payment processors which banked with Wachovia

Bank. This suit alleges that Wachovia Bank conspired with

these payment processors to facilitate purported violations

of RICO. On April 24, 2008, Wachovia and the Office of

the Comptroller of the Currency (OCC) entered into

an Agreement to resolve the OCC’s investigation into

Wachovia’s relationship with PPC and three other companies.

The Agreement provides, among other things, that

(i) Wachovia will provide restitution to consumers, (ii) will

create a segregated account in the amount of $125 million

to cover the estimated maximum cost of the restitution,

(iii) will fund organizations that provide education for

consumers over a two year period in the amount of $8.9 million,

(iv) will make various changes to its policies and procedures

related to customers that use remotely created checks and

(v) will appoint a special Compliance Committee to oversee

compliance with the Agreement. Wachovia Bank and the

OCC also entered into a Consent Order for Payment of a

Civil Money Penalty whereby Wachovia, without admitting

or denying the allegations contained therein, agreed to

payment of a $10 million civil money penalty. The OCC

Agreement was amended on December 8, 2008, to provide

for direct restitution payments and those payments were

mailed to consumers on December 11, 2008. Wachovia Bank

is cooperating with government officials to administer the

OCC settlement and in their further inquiries.

On August 14, 2008, Wachovia Bank reached agreements

to settle the Faloney and Harrison class action lawsuits. The

settlements received approval from the U.S. District Court for

the Eastern District of Pennsylvania on January 23, 2009.

OTHER REGULATORY MATTERS AND GOVERNMENT

INVESTIGATIONS In the course of its banking and financial

services businesses, Wells Fargo and its affiliates are subject

to information requests and investigations by governmental

and self-regulatory authorities. These authorities have

instituted various ongoing investigations of various practices

in the banking, securities and mutual fund industries, including

those relating to anti-money laundering, sales practices,

record retention and other laws and regulations involving

our customers and their accounts.

In general, the investigations cover advisory companies

to mutual funds, broker-dealers, hedge funds and others and

may involve the activities of customers or third parties with

respect to accounts maintained by Wells Fargo affiliates or

transactions in which Wells Fargo affiliates may be involved.

Wells Fargo affiliates have received subpoenas and other

requests for documents and testimony relating to the

investigations, is endeavoring to comply with those requests,

is cooperating with the investigations, and where appropriate,

is engaging in discussions to resolve the investigations or

take other remedial actions. These investigations include an

investigation being conducted by the U.S. Attorney’s Office

for the Southern District of Florida into, among other matters,

Wachovia Bank, N.A.’s correspondent banking relationship

with certain non-domestic exchange houses and Bank

Secrecy Act and anti-money laundering compliance.

Wachovia Bank is cooperating fully with the U.S. Attorney’s

Office’s investigation.

OUTLOOK Based on information currently available, advice

of counsel, available insurance coverage and established

reserves, Wells Fargo believes that the eventual outcome

of the actions against Wells Fargo and/or its subsidiaries,

including the matters described above, will not, individually

or in the aggregate, have a material adverse effect on

Wells Fargo’s consolidated financial position or results

of operations. However, in the event of unexpected future

developments, it is possible that the ultimate resolution of

those matters, if unfavorable, may be material to Wells Fargo’s

results of operations for any particular period.