Wells Fargo 2008 Annual Report Download - page 139

Download and view the complete annual report

Please find page 139 of the 2008 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

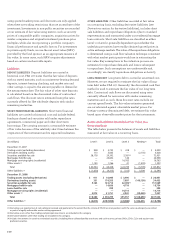

Note 17: Fair Values of Assets and Liabilities

We use fair value measurements to record fair value

adjustments to certain assets and liabilities and to determine

fair value disclosures. Trading assets, securities available

for sale, derivatives, prime residential mortgages held for

sale (MHFS), certain commercial loans held for sale (LHFS),

residential MSRs, principal investments and securities sold

but not yet purchased (short sale liabilities) are recorded at

fair value on a recurring basis. Additionally, from time to

time, we may be required to record at fair value other assets

on a nonrecurring basis, such as nonprime residential and

commercial MHFS, certain LHFS, loans held for investment

and certain other assets. These nonrecurring fair value

adjustments typically involve application of lower-of-cost-or-

market accounting or write-downs of individual assets.

Under FAS 159, we elected to measure MHFS at fair value

prospectively for new prime residential MHFS originations,

for which an active secondary market and readily available

market prices existed to reliably support fair value pricing

models used for these loans. On December 31, 2008, we elected

to measure at fair value prime residential MHFS acquired

from Wachovia. We also elected to remeasure at fair value

certain of our other interests held related to residential loan

sales and securitizations. We believe the election for MHFS

and other interests held (which are now hedged with free-

standing derivatives (economic hedges) along with our

MSRs) reduces certain timing differences and better matches

changes in the value of these assets with changes in the value

of derivatives used as economic hedges for these assets.

There was no transition adjustment required upon adoption

of FAS 159 for MHFS because we continued to account for

MHFS originated prior to 2007 at the lower of cost or market

value. At December 31, 2006, the book value of other interests

held was equal to fair value and, therefore, a transition

adjustment was not required.

Upon the acquisition of Wachovia, we elected to measure

at fair value certain portfolios of LHFS that we intend to hold

for trading purposes and that may be economically hedged

with derivative instruments. In addition, we elected to mea-

sure at fair value certain letters of credit that are hedged with

derivative instruments to better reflect the economics of the

transactions. These letters of credit are included in trading

account assets or liabilities.

Under FAS 159, we were also required to adopt FAS 157,

Fair Value Measurements (FAS 157). FAS 157 defines fair

value, establishes a consistent framework for measuring fair

value and expands disclosure requirements for fair value

measurements. Additionally, FAS 157 amended FAS 107,

Disclosure about Fair Value of Financial Instruments

(FAS 107), and, as such, we follow FAS 157 in determination

of FAS 107 fair value disclosure amounts. The disclosures

required under FAS 159, FAS 157 and FAS 107 are included

in this Note.

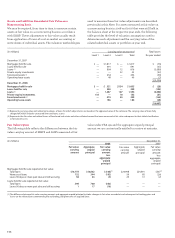

Fair Value Hierarchy

Under FAS 157, we group our assets and liabilities at fair

value in three levels, based on the markets in which the

assets and liabilities are traded and the reliability of the

assumptions used to determine fair value. These levels are:

• Level 1 – Valuation is based upon quoted prices for

identical instruments traded in active markets.

• Level 2 – Valuation is based upon quoted prices for similar

instruments in active markets, quoted prices for identical

or similar instruments in markets that are not active, and

model-based valuation techniques for which all significant

assumptions are observable in the market.

• Level 3 – Valuation is generated from model-based

techniques that use significant assumptions not observable

in the market. These unobservable assumptions reflect

estimates of assumptions that market participants would

use in pricing the asset or liability. Valuation techniques

include use of option pricing models, discounted cash

flow models and similar techniques.

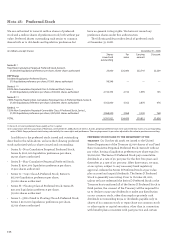

Determination of Fair Value

Under FAS 157, we base our fair values on the price that

would be received to sell an asset or paid to transfer a liability

in an orderly transaction between market participants at the

measurement date. It is our policy to maximize the use of

observable inputs and minimize the use of unobservable

inputs when developing fair value measurements, in

accordance with the fair value hierarchy in FAS 157.

Fair value measurements for assets and liabilities

where there exists limited or no observable market data

and, therefore, are based primarily upon our own estimates,

are often calculated based on current pricing policy, the

economic and competitive environment, the characteristics

of the asset or liability and other such factors. Therefore,

the results cannot be determined with precision and may

not be realized in an actual sale or immediate settlement

of the asset or liability. Additionally, there may be inherent

weaknesses in any calculation technique, and changes in

the underlying assumptions used, including discount rates

and estimates of future cash flows, that could significantly

affect the results of current or future values.

We incorporate lack of liquidity into our fair value

measurement based on the type of asset measured and the

valuation methodology used. For example, for residential

mortgage loans held for sale and certain securities where

the significant inputs have become unobservable due to the

illiquid markets, we use a discounted cash flow technique to

measure fair value. This technique incorporates forecasting

of expected cash flows discounted at an appropriate market

discount rate to reflect the lack of liquidity in the market that

a market participant would consider. For other securities,

we use unadjusted broker quotes or vendor prices to measure