Wells Fargo 2008 Annual Report Download - page 142

Download and view the complete annual report

Please find page 142 of the 2008 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

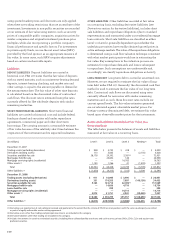

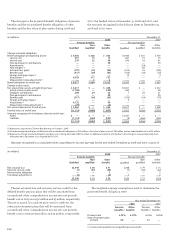

(in millions) Level 1 Level 2 Level 3 Netting(1) Total

December 31, 2007

Trading assets (excluding derivatives) $ 928 $ 2,753 $ 418 $ — $ 4,099

Derivatives (trading assets) 113 5,665 — (2,150) 3,628

Securities available for sale 38,178 29,392 5,381(4) — 72,951

Mortgages held for sale — 24,852 146 — 24,998

Mortgage servicing rights (residential) — — 16,763 — 16,763

Other assets (2) 1,145 1,766 41 (1,559) 1,393

Total $ 40,364 $ 64,428 $ 22,749 $ (3,709) $ 123,832

Other liabilities (3) $ (1,670) $ (4,315) $ (315) $ 3,709 $ (2,591)

December 31, 2008

Trading assets (excluding derivatives) $ 911 $ 16,045 $ 3,495 $ — $ 20,451

Derivatives (trading assets) 331 174,355 7,897 (148,150) 34,433

Securities available for sale 5,163 123,714 22,692(4) — 151,569

Mortgages held for sale — 14,036 4,718 — 18,754

Loans held for sale — 398 — — 398

Mortgage servicing rights (residential) — — 14,714 — 14,714

Other assets (2) 3,975 21,751 2,041 (20,540) 7,227

Total $10,380 $ 350,299 $55,557 $(168,690) $247,546

Other liabilities (3) $ (4,815) $(187,098) $ (9,308) $ 182,435 $ (18,786)

(1) Derivatives are reported net of cash collateral received and paid and, to the extent that the criteria of FIN 39 are met, positions with the same counterparty are netted

as part of a legally enforceable master netting agreement.

(2) Derivative assets other than trading and principal investments are included in this category.

(3) Derivative liabilities other than trading are included in this category.

(4) Includes investments in certain asset-backed securities, including those collateralized by auto leases and cash reserves, private CMOs, CDOs, CLOs and auction-rate

preferred securities.

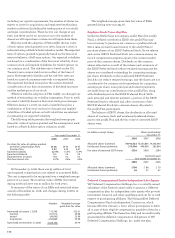

using quoted market prices and discounts are only applied

when there are trading restrictions that are an attribute of the

investment. Investments in non-public securities are recorded

at our estimate of fair value using metrics such as security

prices of comparable public companies, acquisition prices for

similar companies and original investment purchase price

multiples, while also incorporating a portfolio company’s

financial performance and specific factors. For investments

in private equity funds, we use the net asset value (NAV)

provided by the fund sponsor as an appropriate measure of

fair value. In some cases, such NAVs require adjustments

based on certain unobservable inputs.

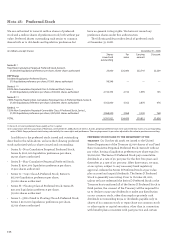

Liabilities

DEPOSIT LIABILITIES Deposit liabilities are carried at

historical cost. FAS 107 states that the fair value of deposits

with no stated maturity, such as noninterest-bearing demand

deposits, interest-bearing checking, and market rate and

other savings, is equal to the amount payable on demand at

the measurement date. The fair value of other time deposits

is calculated based on the discounted value of contractual

cash flows. The discount rate is estimated using the rates

currently offered for like wholesale deposits with similar

remaining maturities.

SHORT-TERM FINANCIAL LIABILITIES Short-term financial

liabilities are carried at historical cost and include federal

funds purchased and securities sold under repurchase

agreements, commercial paper and other short-term

borrowings. The carrying amount is a reasonable estimate

of fair value because of the relatively short time between the

origination of the instrument and its expected realization.

OTHER LIABILITIES Other liabilities recorded at fair value

on a recurring basis, excluding derivative liabilities (see

Derivatives section for derivative liabilities), includes short

sale liabilities and repurchase obligations (due to standard

representations and warranties) under our residential mortgage

loan contracts. Short sale liabilities are classified as either

Level 1 or Level 2, generally dependent upon whether the

underlying securities have readily obtained quoted prices in

active exchange markets. The value of the repurchase obligations

is determined using a cash flow valuation technique consistent

with what market participants would use in estimating the

fair value. Key assumptions in the valuation process are

estimates for repurchase demands and losses subsequent

to repurchase. Such assumptions are unobservable and,

accordingly, we classify repurchase obligations as Level 3.

LONG-TERM DEBT Long-term debt is carried at amortized cost.

However, we are required to estimate the fair value of long-

term debt under FAS 107. Generally, the discounted cash flow

method is used to estimate the fair value of our long-term

debt. Contractual cash flows are discounted using rates

currently offered for new notes with similar remaining

maturities and, as such, these discount rates include our

current spread levels. The fair value estimates generated

are corroborated against observable market prices. For

foreign-currency denominated debt, we estimate fair value

based upon observable market prices for the instruments.

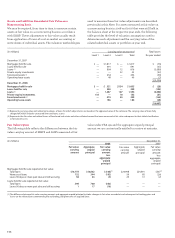

Assets and Liabilities Recorded at Fair Value on a

Recurring Basis

The table below presents the balances of assets and liabilities

measured at fair value on a recurring basis.