Wells Fargo 2008 Annual Report Download - page 118

Download and view the complete annual report

Please find page 118 of the 2008 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

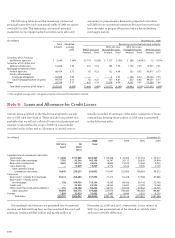

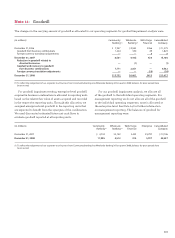

December 31, 2008

Funded Total

asset committed

composition exposure

Auto loans 34.1% 26.7%

Commercial and

middle market loans 27.6 32.6

Equipment loans 14.4 11.4

Trade receivables 8.8 10.9

Credit cards 7.0 7.9

Leases 6.1 7.0

Other 2.0 3.5

Total 100% 100%

act as the collateral manager or servicer. We receive fees

in connection with our role as collateral manager or servicer.

We also earn fees for arranging these transactions and

distributing the securities.

We assess whether we are the primary beneficiary of CDOs

and CLOs at inception of the transactions based on our

expectation of the variability associated with our continuing

involvement. Subsequently, we monitor our ongoing involvement

in these transactions to determine if a more frequent assessment

of variability is necessary. Variability in these transactions

may be created by credit risk, market risk, interest rate risk

or liquidity risk associated with the CDO’s or CLO’s assets.

Our assessment of the variability is performed qualitatively

because our continuing involvement is typically senior in

priority to the third party investors in transactions. In most

cases, we are not the primary beneficiary of these transactions

because we do not retain the subordinate interests in these

transactions and, accordingly, do not absorb the majority

of the variability.

MULTI-SELLER COMMERCIAL PAPER CONDUIT We administer a

multi-seller asset-backed commercial paper (ABCP) conduit

that arranges financing for certain client transactions. We

acquired the relationship with this conduit in the Wachovia

merger. This conduit is a bankruptcy remote entity that

makes loans to, or purchases certificated interests from SPEs

established by our clients (sellers) and which are secured by

pools of financial assets. The conduit funds itself through the

issuance of highly rated commercial paper to third party

investors. The primary source of repayment of the commercial

paper is the cash flows from the conduit’s assets or the

re-issuance of commercial paper upon maturity. The conduit’s

assets are structured with deal-specific credit enhancements

generally in the form of overcollateralization provided by

the seller, but also may include subordinated interests, cash

reserve accounts, third party credit support facilities and

excess spread capture. The table below summarizes the

weighted average credit rating equivalents of the conduit’s

assets. These ratings are as of December 31, 2008, and are

based on internal rating criteria. The weighted average life

of the conduit’s assets was 3.0 years at December 31, 2008.

The composition of the conduit’s assets was as follows:

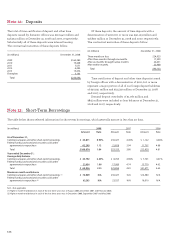

The credit rating of the conduit’s assets was as follows:

December 31, 2008

Funded Total

asset committed

composition exposure

AAA 9.4% 10.4%

AA 8.3 11.7

A 52.2 51.5

BBB 30.1 26.4

Total 100% 100%

The timely repayment of the commercial paper is further

supported by asset-specific liquidity facilities in the form

of asset purchase agreements that we provide. Each facility

is equal to 102% of the conduit’s funding commitments to a

client. The aggregate amount of liquidity must be equal to or

greater than all the commercial paper issued by the conduit.

At the discretion of the administrator, we may be required to

purchase assets from the conduit at par value plus interest,

including situations where the conduit is unable to issue

commercial paper. Par value may be different from fair value.

We receive fees in connection with our role as administrator

and liquidity provider. We may also receive fees related to

the structuring of the conduit’s transactions.

The weighted-average life of the commercial paper was

12.4 days in 2008 and the average yield on the commercial

paper was 2.57%. The ability of the conduit to issue commercial

paper, which is a function of general market conditions and

the credit rating of the liquidity provider was challenging

during 2008 as a result of the credit market disruption.

Although investors continued to purchase the conduit’s

commercial paper, they did so at higher spreads and shorter

maturities. When the conduit’s commercial paper maturities

exceeded investor demand, Wachovia purchased some of the

conduit’s commercial paper. During 2008, the maximum

amount of commercial paper purchased on any given day was

$3.9 billion, or 33.6%, of the then outstanding commercial

paper. These purchases were made at market rates. At

December 31, 2008, we did not hold any of the commercial

paper issued by the conduit. All commercial paper purchased

was repaid at maturity through the issuance of new commer-

cial paper notes to third parties.

The conduit has issued a subordinated note to a third

party investor. The subordinated note is designed to absorb

the expected variability associated with the credit risk in the

conduit’s assets as well as assets that may be funded by us

as a result of a purchase under the provisions of the liquidity

purchase agreements. Actual credit losses incurred on the

conduit’s assets or assets purchased under the liquidity facilities

are absorbed first by the subordinated note prior to any

allocation to us as the liquidity provider. At December 31,

2008, the balance of the subordinated note was $13 million

and it matures in 2016.