Wells Fargo 2008 Annual Report Download - page 120

Download and view the complete annual report

Please find page 120 of the 2008 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

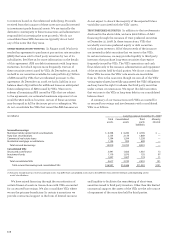

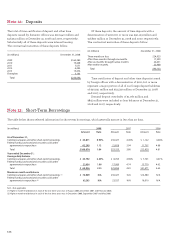

(in millions) Carrying value at December 31, 2008(1)

Total Consolidated Third Minority

assets assets party interest

liabilities

Secured borrowings:

Municipal tender option bond securitizations $ 6,358 $ 6,280 $ 4,765 $ —

Auto loan securitizations 2,134 2,134 1,869 —

Commercial real estate loans 1,294 1,294 1,258 —

Residential mortgage securitizations 1,124 995 699 —

Total secured borrowings 10,910 10,703 8,591 —

Consolidated VIEs:

Structured asset finance 3,491 1,666 1,481 13

Investment funds 1,119 1,070 155 97

Other 1,007 1,007 774 11

Total consolidated VIEs 5,617 3,743 2,410 121

Total secured borrowings and consolidated VIEs $16,527 $14,446 $11,001 $121

(1) Amounts exclude loan loss reserves, and total assets may differ from consolidated assets due to the different measurement methods used depending on the

assets’ classifications.

We have raised financing through the securitization of

certain financial assets in transactions with VIEs accounted

for as secured borrowings. We also consolidate VIEs where

we are the primary beneficiary. In certain transactions we

provide contractual support in the form of limited recourse

and liquidity to facilitate the remarketing of short-term

securities issued to third party investors. Other than this limited

contractual support, the assets of the VIEs are the sole source

of repayment of the securities held by third parties.

to investors based on the referenced underlying. Proceeds

received from the issuance of these notes are usually invested

in investment grade financial assets. We are typically the

derivative counterparty to these transactions and administrator

responsible for investing the note proceeds. We do not

consolidate these SPEs because we typically do not hold

any of the notes that they issue.

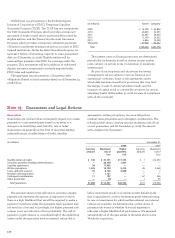

OTHER TRANSACTIONS WITH VIEs In August 2008, Wachovia

reached an agreement to purchase at par auction rate securities

(ARS) that were sold to third party investors by two of its

subsidiaries. See Note 15 for more information on the details

of this agreement. ARS are debt instruments with long-term

maturities, but which reprice more frequently. Certain of

these securities were issued by VIEs. At December 31, 2008,

we held in our securities available-for-sale portfolio $3.7 billion

of ARS issued by VIEs that we redeemed pursuant to this

agreement. At December 31, 2008, we had a liability in our

balance sheet of $91 million for additional losses on anticipated

future redemptions of ARS issued by VIEs. Were we to

redeem all remaining ARS issued by VIEs that are subject

to the agreement, our estimated maximum exposure to loss

would be $620 million; however, certain of these securities

may be repaid in full by the issuer prior to redemption. We

do not consolidate the VIEs that issued the ARS because we

do not expect to absorb the majority of the expected future

variability associated with the VIEs’ assets.

TRUST PREFERRED SECURITIES In addition to the involvements

disclosed in the above table, we have $16.6 billion of debt

financing through the issuance of trust preferred securities

at December 31, 2008. In these transactions, VIEs that

we wholly own issue preferred equity or debt securities

to third party investors. All of the proceeds of the issuance

are invested in debt securities that we issue to the VIEs.

In certain instances, we may provide liquidity to third party

investors that purchase long-term securities that reprice

frequently issued by VIEs. The VIE’s operations and cash

flows relate only to the issuance, administration and repayment

of the securities held by third parties. We do not consolidate

these VIEs because the VIEs’ sole assets are receivables

from us. This is the case even though we own all of the VIEs’

voting equity shares, have fully guaranteed the VIEs’ obligations

and may have the right to redeem the third party securities

under certain circumstances. We report the debt securities

that we issue to the VIEs as long-term debt in our consolidated

balance sheet.

A summary of our transactions with VIEs accounted for

as secured borrowings and involvements with consolidated

VIEs is as follows: