Wells Fargo 2008 Annual Report Download - page 144

Download and view the complete annual report

Please find page 144 of the 2008 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

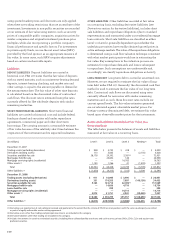

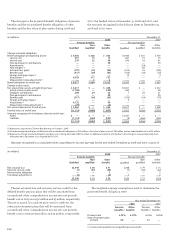

Fair Value Option

The following table reflects the differences between the fair

value carrying amount of MHFS and LHFS measured at fair

value under FAS 159 and the aggregate unpaid principal

amount we are contractually entitled to receive at maturity.

(in millions) December 31,

2008 2007

Fair value Aggregate Fair value Fair value Aggregate Fair value

carrying unpaid carrying carrying unpaid carrying

amount principal amount amount principal amount

less less

aggregate aggregate

unpaid unpaid

principal principal

Mortgages held for sale reported at fair value:

Total loans $18,754 $18,862 $(108)(1) $24,998 $24,691 $307(1)

Nonaccrual loans 152 344 (192) 59 85 (26)

Loans 90 days or more past due and still accruing 58 63 (5) 29 31 (2)

Loans held for sale reported at fair value:

Total loans 398 760 (362) ———

Loans 90 days or more past due and still accruing 1 17 (16) ———

(1) The difference between fair value carrying amount and aggregate unpaid principal includes changes in fair value recorded at and subsequent to funding, gains and

losses on the related loan commitment prior to funding, and premiums on acquired loans.

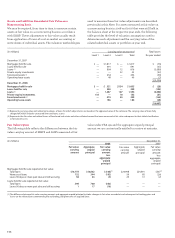

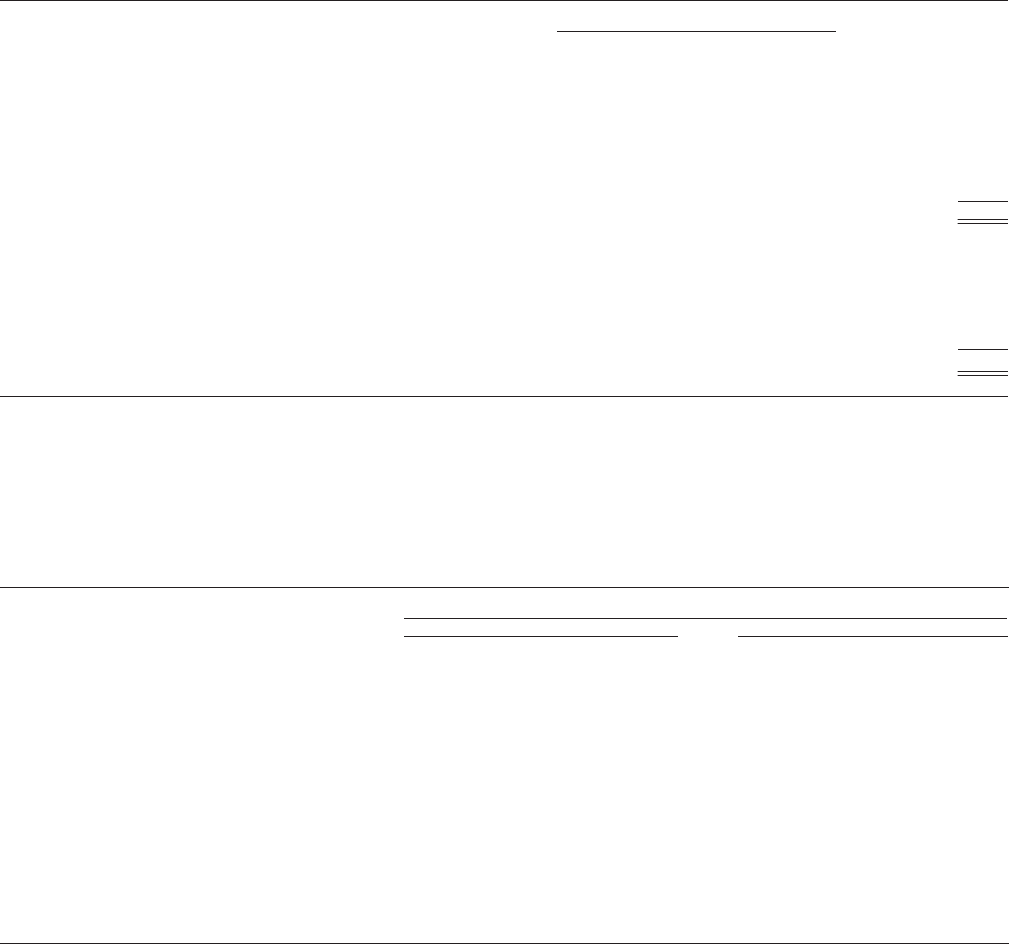

Assets and Liabilities Recorded at Fair Value on a

Nonrecurring Basis

We may be required, from time to time, to measure certain

assets at fair value on a nonrecurring basis in accordance

with GAAP. These adjustments to fair value usually result

from application of lower-of-cost-or-market accounting or

write-downs of individual assets. The valuation methodologies

used to measure these fair value adjustments are described

previously in this Note. For assets measured at fair value on

a nonrecurring basis in 2008 and 2007 that were still held in

the balance sheet at the respective year ends, the following

table provides the level of valuation assumptions used to

determine each adjustment and the carrying value of the

related individual assets or portfolios at year end.

(in millions) Carrying value at year end Total losses

Level 1 Level 2 Level 3 Total for year ended

December 31, 2007

Mortgages held for sale $ — $ 1,817 $ — $ 1,817 $ (76)

Loans held for sale — 691 — 691 (35)

Loans (1) — 804 12 816 (3,080)

Private equity investments — — 22 22 (52)

Foreclosed assets (2) — 454 — 454 (90)

Operating lease assets — 49 — 49 (3)

$ (3,336)

December 31, 2008

Mortgages held for sale $ — $ 521 $534 $1,055 $ (28)

Loans held for sale — 338 — 338 (105)

Loans (1) — 1,487 107 1,594 (6,400)

Private equity investments 134 — 18 152 (81)

Foreclosed assets (2) — 274 55 329 (165)

Operating lease assets — 186 — 186 (28)

$(6,807)

(1) Represents carrying value and related write-downs of loans for which adjustments are based on the appraised value of the collateral. The carrying value of loans fully

charged-off, which includes unsecured lines and loans, is zero.

(2) Represents the fair value and related losses of foreclosed real estate and other collateral owned that were measured at fair value subsequent to their initial classification

as foreclosed assets.