Wells Fargo 2008 Annual Report Download - page 109

Download and view the complete annual report

Please find page 109 of the 2008 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Loan concentrations may exist when there are amounts

loaned to borrowers engaged in similar activities or similar

types of loans extended to a diverse group of borrowers that

would cause them to be similarly impacted by economic or

other conditions. At December 31, 2008 and 2007, we did not

have concentrations representing 10% or more of our total

loan portfolio in commercial loans and lease financing by

industry or commercial real estate loans (other real estate

mortgage and real estate construction) by state or property

type. Our real estate 1-4 family mortgage loans to borrowers

in the state of California represented approximately 14%

of total loans at December 31, 2008, compared with 13% at

December 31, 2007. Of this amount, 3% of total loans were

SOP 03-3 loans. These loans are generally diversified among

the larger metropolitan areas in California, with no single area

consisting of more than 2% of total loans. Changes in real

estate values and underlying economic or market conditions

for these areas are monitored continuously within our credit

risk management process. Beginning in 2007, the residential

real estate markets experienced significant declines in prop-

erty values, and several markets in California, specifically the

Central Valley and several Southern California metropolitan

statistical areas, experienced more severe value adjustments.

Some of our real estate 1-4 family mortgage loans,

including first mortgage and home equity products, include

an interest-only feature as part of the loan terms. At

December 31, 2008, these loans were approximately 11% of

total loans, compared with 20% at December 31, 2007. Most

of these loans are considered to be prime or near prime.

For certain extensions of credit, we may require collateral,

based on our assessment of a customer’s credit risk. We hold

various types of collateral, including accounts receivable,

inventory, land, buildings, equipment, autos, financial

instruments, income-producing commercial properties and

residential real estate. Collateral requirements for each

customer may vary according to the specific credit underwriting,

terms and structure of loans funded immediately or under

a commitment to fund at a later date.

A commitment to extend credit is a legally binding

agreement to lend funds to a customer, usually at a stated

interest rate and for a specified purpose. These commitments

have fixed expiration dates and generally require a fee.

When we make such a commitment, we have credit risk.

The liquidity requirements or credit risk will be lower than

the contractual amount of commitments to extend credit

because a significant portion of these commitments are

expected to expire without being used. Certain commitments

are subject to loan agreements with covenants regarding the

financial performance of the customer or borrowing base

formulas that must be met before we are required to fund the

commitment. We use the same credit policies in extending

credit for unfunded commitments and letters of credit that

we use in making loans. See Note 15 for information on

standby letters of credit.

In addition, we manage the potential risk in credit

commitments by limiting the total amount of arrangements,

both by individual customer and in total, by monitoring the

size and maturity structure of these portfolios and by applying

the same credit standards for all of our credit activities.

The total of our unfunded loan commitments, net of all

funds lent and all standby and commercial letters of credit

issued under the terms of these commitments, is summarized

by loan category in the following table:

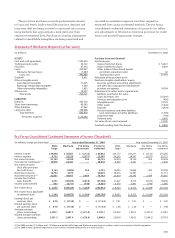

(in millions) December 31,

2008 2007

Commercial and commercial real estate:

Commercial $195,507 $ 89,480

Other real estate mortgage 6,536 2,911

Real estate construction 19,063 9,986

Total commercial and

commercial real estate 221,106 102,377

Consumer:

Real estate 1-4 family first mortgage 36,964 11,861

Real estate 1-4 family junior lien mortgage 78,417 47,763

Credit card 75,776 62,680

Other revolving credit and installment 22,231 16,220

Total consumer 213,388 138,524

Foreign 4,817 980

Total unfunded loan commitments $439,311 $241,881

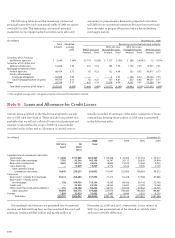

We have an established process to determine the

adequacy of the allowance for credit losses that assesses the

risks and losses inherent in our portfolio. While we attribute

portions of the allowance to specific loan categories as part

of our analytical process, the entire allowance is used to

absorb credit losses inherent in the total loan portfolio.

At December 31, 2008, the portion of the allowance for

credit losses estimated at a pooled level for consumer loans

and some segments of commercial small business loans was

$16.4 billion. For purposes of determining the allowance for

credit losses, we pool certain loans in our portfolio by product

type, primarily for the auto, credit card and real estate mortgage

portfolios. To achieve greater accuracy, we further segment

selected portfolios. As appropriate, the business groups may

attempt to achieve greater accuracy through segmentation by

sub-product, origination channel, vintage, loss type, geography

and other predictive characteristics. For example, credit cards

are segmented by origination channel and the Home Equity

portfolios are further segmented between liquidating and

nonliquidating. In the case of residential mortgages,

we segment the liquidating Pick-a-Pay portfolio, and further

segment this portfolio based on origination channel.

To measure losses inherent in consumer loans and some

commercial small business loans, we use loss models and

other quantitative, mathematical techniques to forecast losses.

Each business group forecasts losses for loans as of the balance

sheet date over the estimated loss emergence period. During

fourth quarter 2008, we conformed our loss emergence period

for these portfolios to cover 12 months of estimated losses,

which is within Federal Financial Institutions Examination

Council (FFIEC) guidelines and resulted in a $2.7 billion

increase to the allowance for credit losses.