Sallie Mae 2007 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2007 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

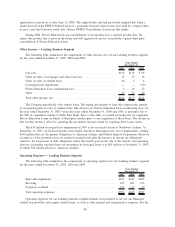

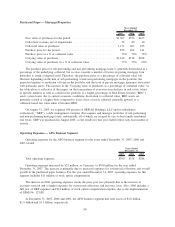

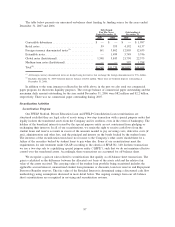

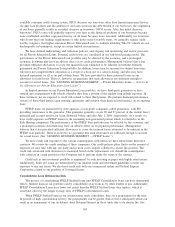

Managed Borrowings

The following tables present the ending and average balances and average interest rates of our Managed

borrowings for the years ended December 31, 2007, 2006 and 2005. The average interest rates include

derivatives that are economically hedging the underlying debt but do not qualify for hedge accounting

treatment under SFAS No. 133. (See “BUSINESS SEGMENTS — Limitations of ‘Core Earnings’ — Pre-tax

Differences between ‘Core Earnings’ and GAAP by Business Segment — Derivative Accounting — Reclassifi-

cation of Realized Gains (Losses) on Derivative and Hedging Activities.”)

Ending Balances

Short

Term

Long

Term

Total

Managed

Basis

Short

Term

Long

Term

Total

Managed

Basis

Short

Term

Long

Term

Total

Managed

Basis

Ending Balance Ending Balance Ending Balance

2007 2006 2005

Years Ended December 31,

Unsecured borrowings . . . . . . . . . . . . $ 8,551 $ 36,796 $ 45,347 $3,187 $ 45,501 $ 48,688 $3,784 $ 37,944 $ 41,728

Indentured trusts (on-balance sheet) . . . . 100 2,481 2,581 93 2,852 2,945 23 3,372 3,395

ABCP facilities (on-balance sheet) . . . . . 25,960 67 26,027 — 4,953 4,953 — 4,960 4,960

Securitizations (on-balance sheet) . . . . . — 68,048 68,048 — 50,147 50,147 — 42,275 42,275

Securitizations (off-balance sheet) . . . . . — 42,088 42,088 — 49,865 49,865 — 43,138 43,138

Other . . . . . . . . . . . . . . . . . . . . . . . 1,342 — 1,342 248 — 248 3 — 3

Total . . . . . . . . . . . . . . . . . . . . . . . $35,953 $149,480 $185,433 $3,528 $153,318 $156,846 $3,810 $131,689 $135,499

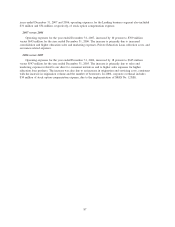

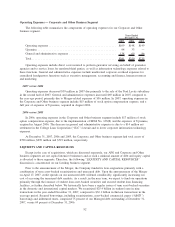

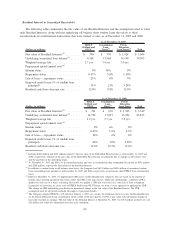

Average Balances

Average

Balance

Average

Rate

Average

Balance

Average

Rate

Average

Balance

Average

Rate

2007 2006 2005

Years Ended December 31,

Unsecured borrowings . ............................. 46,261 5.58% 43,755 5.50% 37,841 3.98%

Indentured trusts (on-balance sheet) . . . ................... 2,768 4.90 3,252 4.57 4,782 3.27

ABCP facilities (on-balance sheet) . . . ................... 13,938 5.85 4,874 5.36 4,533 3.64

Securitizations (on-balance sheet) ....................... 62,765 5.55 43,310 5.40 35,180 3.73

Securitizations (off-balance sheet) ....................... 45,733 5.68 50,112 5.49 44,545 3.77

Other ......................................... 637 4.85 172 5.03 139 3.23

Total . . . ....................................... $172,102 5.60% $145,475 5.44% $127,020 3.80%

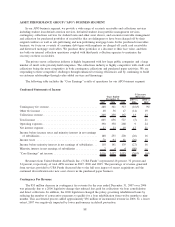

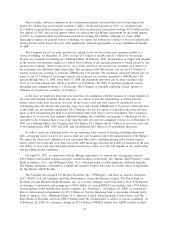

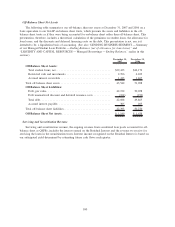

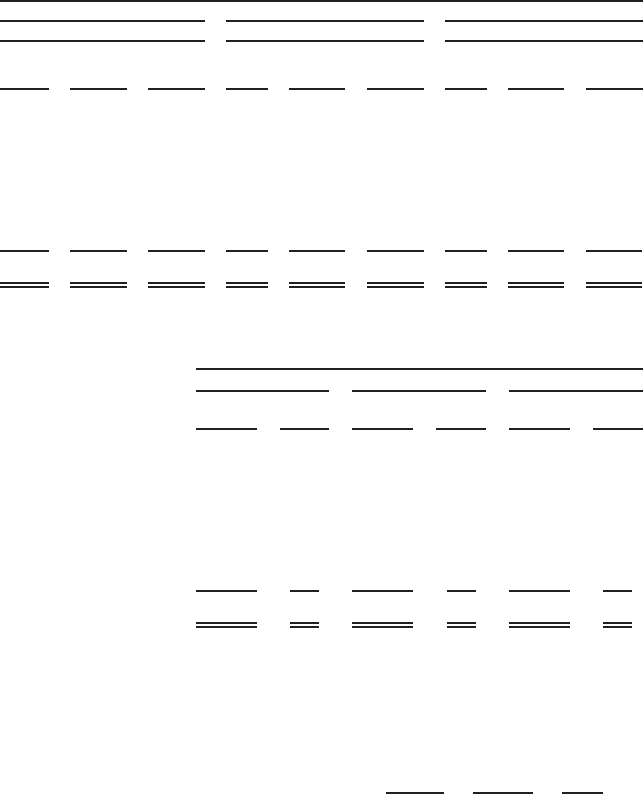

Unsecured On-Balance Sheet Financing Activities

The following table presents the senior unsecured credit ratings assigned by major rating agencies as of

February 28, 2008. Each of the rating agencies has the Company’s current ratings on review for potential

downgrade.

S&P Moody’s Fitch

Short-term unsecured debt................................... A-3 P-2 F3

Long-term senior unsecured debt .............................. BBB⫺Baa1 BBB

96