Sallie Mae 2007 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2007 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

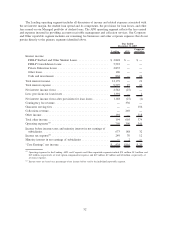

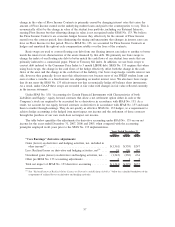

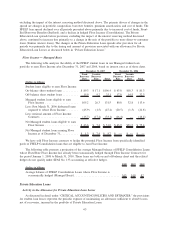

The following table summarizes the Floor Income adjustments in our Lending operating segment for the

years ended December 31, 2007, 2006 and 2005.

2007 2006 2005

Years Ended December 31,

“Core earnings” Floor Income adjustments:

Floor Income earned on Managed loans, net of payments on Floor Income

Contracts . . . ............................................ $ — $ — $ 19

Amortization of net premiums on Floor Income Contracts and futures in

net interest income ........................................ (169) $(209) $(223)

Total “Core Earnings” Floor Income adjustments ................... $(169) $(209) $(204)

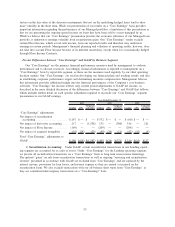

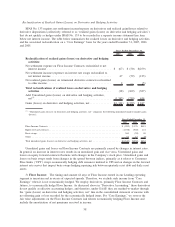

4) Acquired intangibles: Our “Core Earnings” exclude goodwill and intangible impairment and the

amortization of acquired intangibles. For the years ended December 31, 2007, 2006 and 2005, goodwill and

intangible impairment and the amortization of acquired intangibles totaled $112 million, $94 million and

$61 million, respectively. The changes from year to year are mostly due to the amounts of impairment

recognized. In 2007, we recognized impairments related principally to our mortgage origination and mortgage

purchased paper businesses including approximately $20 million of goodwill and $10 million of value

attributed to certain banking relationships. In connection with our acquisition of Southwest Student Services

Corporation and Washington Transferee Corporation, we acquired certain tax exempt bonds that enabled us to

earn a 9.5 percent SAP rate on student loans funded by those bonds in indentured trusts. In 2007 and 2006,

we recognized intangible impairments of $9 million and $21 million, respectively, due to changes in projected

interest rates used to initially value the intangible asset and to a regulatory change that restricts the loans on

which we are entitled to earn a 9.5 percent yield.

LENDING BUSINESS SEGMENT

In our Lending business segment, we originate and acquire federally guaranteed student loans, which are

administered by the U.S. Department of Education (“ED”), and Private Education Loans, which are not

federally or privately guaranteed. The majority of our Private Education Loans is made in conjunction with a

FFELP Stafford loan and as a result is marketed through the same marketing channels as FFELP Stafford

Loans. While FFELP student loans and Private Education Loans have different overall risk profiles due to the

federal guarantee of the FFELP student loans, they share many of the same characteristics, such as similar

repayment terms, the same marketing channel and sales force, and are serviced on the same servicing

platform. Finally, where possible, the borrower receives a single bill for both the federally guaranteed and

privately underwritten loans.

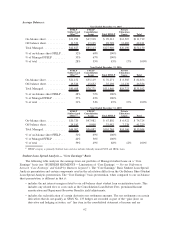

The earnings growth in our Lending business segment is primarily derived from the growth in our

Managed portfolio of student loans. In 2007, the total Managed portfolio grew by $21.5 billion (15 percent)

from $142.1 billion at December 31, 2006 to $163.6 billion at December 31, 2007. At December 31, 2007,

our Managed FFELP student loan portfolio was $135.2 billion or 83 percent of our total Managed student

loans. In addition, our Managed portfolio of Private Education Loans grew to $28.3 billion from $22.6 billion.

Private Education Loans are not insured by the federal government and are underwritten in accordance with

the Company’s credit policies. Our Managed FFELP loans are high quality assets with minimal credit risk as

they are guaranteed by the federal government for at least 97 percent. (See “Item 1. Business — BUSINESS

SEGMENTS — LENDING BUSINESS SEGMENT.”)

59