Sallie Mae 2007 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2007 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

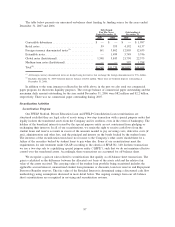

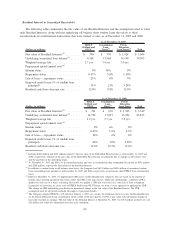

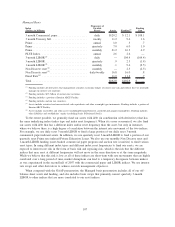

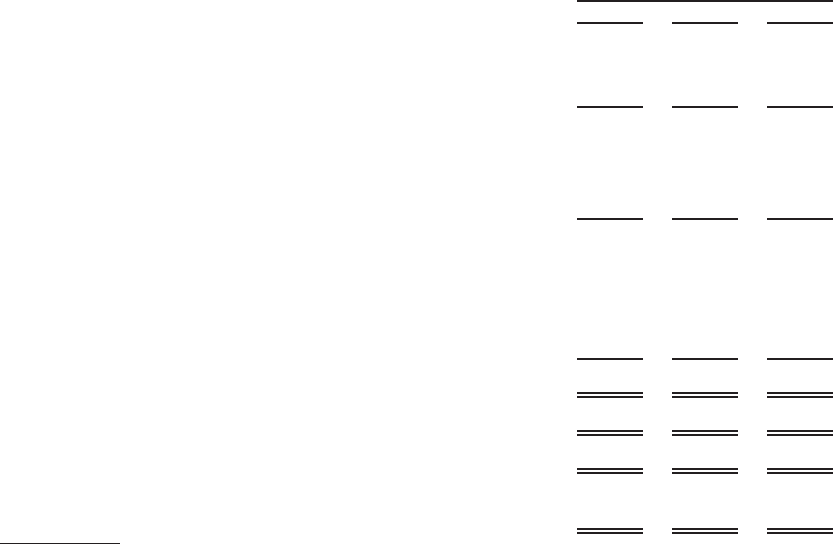

The following table summarizes the components of servicing and securitization revenue for the years

ended December 31, 2007, 2006 and 2005.

2007 2006 2005

Years Ended December 31,

Servicing revenue ..................................... $ 285 $ 336 $ 323

Securitization revenue, before Net Embedded Floor Income,

impairment and unrealized fair value adjustment ............. 419 368 270

Servicing and securitization revenue, before Net Embedded Floor

Income, impairment and unrealized fair value adjustment ...... 704 704 593

Embedded Floor Income ................................ 20 14 81

Less: Floor Income previously recognized in gain calculation ..... (9) (8) (57)

Net Embedded Floor Income ............................. 11 6 24

Servicing and securitization revenue, before impairment and

unrealized fair value adjustment ......................... 715 710 617

Unrealized fair value adjustment

(1)

......................... (24) — —

Retained Interest impairment ............................. (254) (157) (260)

Total servicing and securitization revenue .................... $ 437 $ 553 $ 357

Average off-balance sheet student loans ..................... $42,411 $46,336 $41,220

Average balance of Retained Interest ....................... $ 3,385 $ 3,101 $ 2,476

Servicing and securitization revenue as a percentage of the average

balance of off-balance sheet student loans (annualized) ........ 1.03% 1.19% .87%

(1)

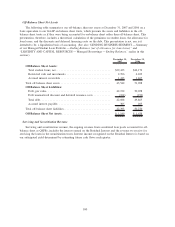

The Company adopted SFAS No. 155 on January 1, 2007. SFAS No. 155 requires the Company to identify and bifurcate embed-

ded derivatives from the Residual Interest. However, SFAS No. 155 does allow the Company to elect to carry the entire Residual

Interest at fair value through earnings rather than bifurcate such embedded derivatives. For the off-balance sheet securitizations

that settled in the year ended December 31, 2007, the Company elected to carry the entire Residual Interest recorded at fair value

through earnings. As a result of this election, all changes in the fair value of the Residual Interests for that securitization are

recorded through earnings. Management anticipates electing to carry future Residual Interests at fair value through earnings. For

securitizations settling prior to January 1, 2007, changes in the fair value of Residual Interest were recorded in other comprehen-

sive income, unless impaired, for the years presented. Effective with the Company’s adoption of SFAS No. 159, “The Fair Value

Option for Financial Assets and Financial Liabilities — Including an Amendment of FASB Statement No. 115,” the Company

has elected the fair value option on all of its Residual Interests and will record future change in fair value through income begin-

ning on January 1, 2008.

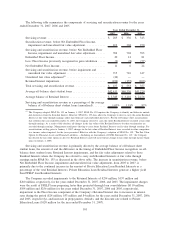

Servicing and securitization revenue is primarily driven by the average balance of off-balance sheet

student loans, the amount of and the difference in the timing of Embedded Floor Income recognition on off-

balance sheet student loans, Retained Interest impairments, and the fair value adjustment related to those

Residual Interests where the Company has elected to carry such Residual Interests at fair value through

earnings under SFAS No. 155 as discussed in the above table. The increase in securitization revenue, before

Net Embedded Floor Income, impairment and unrealized fair value adjustment, from 2005 to 2007, is

primarily due to the continued increase in the amount of Private Education Loan Residual Interests as a

percentage of the total Residual Interests. Private Education Loan Residual Interests generate a higher yield

than FFELP loan Residual Interests.

The Company recorded impairments to the Retained Interests of $254 million, $157 million and

$260 million, respectively, for the years ended December 31, 2007, 2006, and 2005. The impairment charges

were the result of FFELP loans prepaying faster than projected through loan consolidations ($110 million,

$104 million and $256 million for the years ended December 31, 2007, 2006 and 2005, respectively),

impairment to the Floor Income component of the Company’s Retained Interest due to increases in interest

rates during the period ($24 million, $53 million and $4 million for the years ended December 31, 2007, 2006,

and 2005, respectively), and increases in prepayments, defaults, and the discount rate related to Private

Education Loans ($120 million for the year ended December 31, 2007).

101