Sallie Mae 2007 Annual Report Download - page 176

Download and view the complete annual report

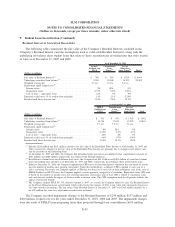

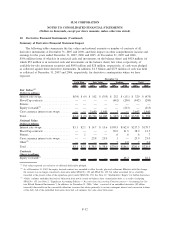

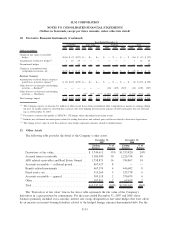

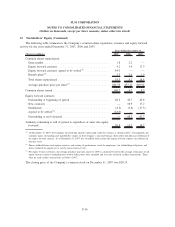

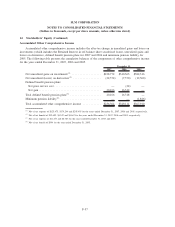

Please find page 176 of the 2007 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.12. Stockholders’ Equity (Continued)

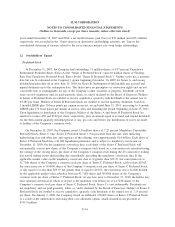

Common Stock

The Company’s shareholders have authorized the issuance of 1.1 billion shares of common stock (par

value of $.20). At December 31, 2007, 466.5 million shares were issued and outstanding and 97 million shares

were unissued but encumbered for outstanding Series C Preferred Stock, outstanding options, and remaining

authority for stock-based compensation plans. The stock-based compensation plans are described in Note 14,

“Stock-Based Compensation Plans and Arrangements.”

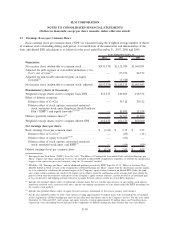

On December 31, 2007, the Company issued 101,781,170 shares of its common stock at a price of $19.65

per share. Net proceeds from the sale, after deducting underwriting fees and other fees and expenses of the

offering, were approximately $1.9 billion. The Company used approximately $2.0 billion of the net proceeds

from the sale of Series C Preferred Stock and the sale of its common stock to settle its outstanding equity

forward contract (see “Common Stock Repurchase Program and Equity Forward Contracts” below). The

remaining proceeds will be used for general corporate purposes. The Company issued 9,781,170 shares of the

102 million share offering from its treasury stock. These shares were removed from treasury stock at an

average cost of $43.13, resulting in a $422 million decrease to the balance of treasury stock with an offsetting

$235 million decrease to retained earnings.

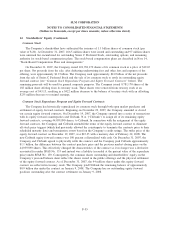

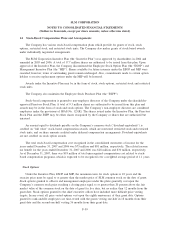

Common Stock Repurchase Program and Equity Forward Contracts

The Company has historically repurchased its common stock through both open market purchases and

settlement of equity forward contracts. Beginning on November 29, 2007, the Company amended or closed

out certain equity forward contracts. On December 19, 2007, the Company entered into a series of transactions

with its equity forward counterparties and Citibank, N.A. (“Citibank”) to assign all of its remaining equity

forward contracts, covering 44,039,890 shares, to Citibank. In connection with the assignment of the equity

forward contracts, the Company and Citibank amended the terms of the equity forward contract to eliminate

all stock price triggers (which had previously allowed the counterparty to terminate the contracts prior to their

scheduled maturity date) and termination events based on the Company’s credit ratings. The strike price of the

equity forward contract on December 19, 2007, was $45.25 with a maturity date of February 22, 2008. The

new Citibank equity forward contract was 100 percent collateralized with cash. On December 31, 2007, the

Company and Citibank agreed to physically settle the contract and the Company paid Citibank approximately

$1.1 billion, the difference between the contract purchase price and the previous market closing price on the

44,039,890 shares. This effectively changed the characteristics of the contract so it no longer was a derivative

accounted for under SFAS No. 133 and instead was a liability (recorded at the present value of the repurchase

price) under SFAS No. 150. Consequently, the common shares outstanding and shareholders’ equity on the

Company’s year-end balance sheet reflect the shares issued in the public offerings and the physical settlement

of the equity forward contract. As of December 31, 2007, the 44 million shares under this equity forward

contract are reflected in treasury stock. The Company paid Citibank the remaining balance of approximately

$0.9 billion due under the contract on January 9, 2008. The Company has no outstanding equity forward

positions outstanding after the contract settlement on January 9, 2008.

F-55

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Dollars in thousands, except per share amounts, unless otherwise stated)