Sallie Mae 2007 Annual Report Download - page 191

Download and view the complete annual report

Please find page 191 of the 2007 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

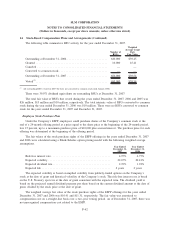

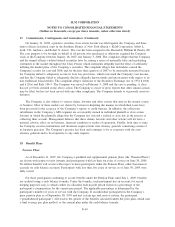

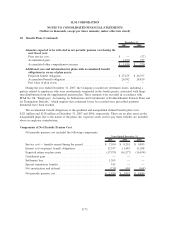

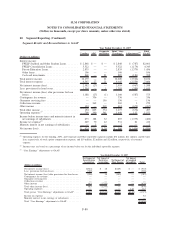

18. Benefit Plans (Continued)

The Company adopted SFAS No. 158, “Employers’ Accounting for Defined Benefit Pension and Other

Postretirement Plans — an amendment of FASB Statements Nos. 87, 88, 106 and 132(R),” on December 31,

2006.

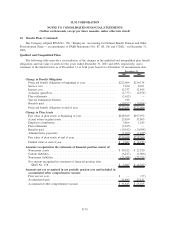

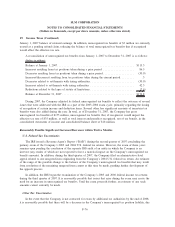

Qualified and Nonqualified Plans

The following tables provide a reconciliation of the changes in the qualified and nonqualified plan benefit

obligations and fair value of assets for the years ended December 31, 2007 and 2006, respectively, and a

statement of the funded status as of December 31 of both years based on a December 31 measurement date.

2007 2006

December 31,

Change in Benefit Obligation

Projected benefit obligation at beginning of year.................... $222,606 $216,138

Service cost............................................... 7,100 8,291

Interest cost............................................... 12,337 11,445

Actuarial (gain)/loss......................................... (1,777) (2,274)

Plan settlements............................................ (2,615) —

Special termination benefits ................................... 912 —

Benefits paid .............................................. (10,912) (10,994)

Projected benefit obligation at end of year ........................ $227,651 $222,606

Change in Plan Assets

Fair value of plan assets at beginning of year ...................... $218,369 $197,972

Actual return on plan assets ................................... 23,850 31,805

Employer contribution ....................................... 3,466 1,015

Plan settlements............................................ (2,615) —

Benefits paid .............................................. (10,912) (10,994)

Administrative payments ..................................... (1,460) (1,429)

Fair value of plan assets at end of year . . . ........................ $230,698 $218,369

Funded status at end of year................................... $ 3,047 $ (4,237)

Amounts recognized in the statement of financial position consist of:

Noncurrent assets .......................................... $ 30,322 $ 22,520

Current liabilities ........................................... (6,227) (1,006)

Noncurrent liabilities ........................................ (21,048) (25,751)

Net amount recognized in statement of financial position after

SFASNo.158........................................... $ 3,047 $ (4,237)

Amounts not yet recognized in net periodic pension cost and included in

accumulated other comprehensive income:

Prior service cost ........................................... $ — (37)

Accumulated gain .......................................... 31,843 25,142

Accumulated other comprehensive income ........................ $ 31,843 $ 25,105

F-70

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Dollars in thousands, except per share amounts, unless otherwise stated)