Sallie Mae 2007 Annual Report Download - page 138

Download and view the complete annual report

Please find page 138 of the 2007 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.2. Significant Accounting Policies (Continued)

The “gains (losses) on derivative and hedging activities, net” line item in the consolidated statements of

income includes the unrealized changes in the fair value of the Company’s derivatives (except effective cash

flow hedges which are recorded in other comprehensive income), the unrealized changes in fair value of

hedged items in qualifying fair value hedges, as well as the realized changes in fair value related to derivative

net settlements and dispositions that do not qualify for hedge accounting. Net settlement income/expense on

derivatives that qualify as hedges under SFAS No. 133 are included with the income or expense of the hedged

item (mainly interest expense).

Goodwill and Intangible Assets

The Company accounts for goodwill and other intangible assets in accordance with SFAS No. 142,

“Goodwill and Other Intangible Assets,” pursuant to which goodwill and intangible assets with indefinite lives

are not amortized but are tested for impairment annually or more frequently if an event indicates that the

asset(s) might be impaired, employing standard industry appraisal methodologies, principally the discounted

cash flow method. Such assets are impaired when the estimated fair value is less than the current carrying

value. Intangible assets with finite lives are amortized over their estimated useful lives. Such assets are

amortized in proportion to the estimated economic benefit using the straight line method or another acceptable

amortization method depending on the asset class. Finite lived intangible assets are reviewed for impairment

using an undiscounted cash flow analysis when an event occurs that indicates the asset(s) may be impaired.

Guarantor Servicing Fees

The Company provides a full complement of administrative services to FFELP guarantors including

guarantee issuance, process, account maintenance, and guarantee fulfillment services for guarantor agencies,

the U.S. Department of Education (“ED”), educational institutions and financial institutions. The fees

associated with these services are recognized as earned based on contractually determined rates. The Company

is party to a guarantor servicing contract with United Student Aid Funds, Inc. (“USA Funds”), which

accounted for 86 percent, 83 percent and 82 percent of guarantor servicing fees for the years ended

December 31, 2007, 2006, and 2005, respectively.

Contingency Fee Revenue

The Company receives fees for collections of delinquent debt on behalf of clients performed on a

contingency basis. Revenue is earned and recognized upon receipt of the borrower funds.

The Company also receives fees from guarantor agencies for performing default aversion services on

delinquent loans prior to default. The fee is received when the loan is initially placed with the Company and

the Company is obligated to provide such services for the remaining life of the loan for no additional fee. In

the event that the loan defaults, the Company is obligated to rebate a portion of the fee to the guarantor

agency in proportion to the principal and interest outstanding when the loan defaults. The Company recognizes

fees received, net of actual rebates for defaults, over the service period which is estimated to be the life of the

loan.

Collections Revenue

The Company purchases delinquent and charged-off receivables on various types of consumer debt with a

primary emphasis on charged-off credit card receivables, and sub-performing and non-performing mortgage

loans. The Company accounts for its investments in charged-off receivables and sub-performing and non-

performing mortgage loans in accordance with AICPA’s SOP 03-3, “Accounting for Certain Loans or Debt

F-17

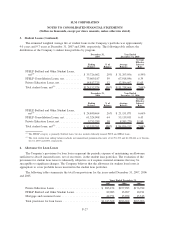

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Dollars in thousands, except per share amounts, unless otherwise stated)