Sallie Mae 2007 Annual Report Download - page 135

Download and view the complete annual report

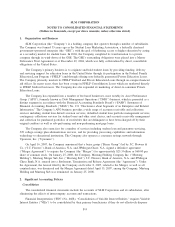

Please find page 135 of the 2007 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.2. Significant Accounting Policies (Continued)

contracts that qualify and are designated as hedges under GAAP. Interest expense also includes the

amortization of deferred gains and losses on closed hedge transactions that qualified as cash flow hedges.

Amortization of debt issue costs, premiums, discounts and terminated hedge basis adjustments are recognized

using the effective interest rate method.

Securitization Accounting

To meet the sale criteria of SFAS No. 140, the Company’s securitizations use a two-step structure with a

QSPE that legally isolates the transferred assets from the Company, even in the event of bankruptcy.

Transactions receiving sale treatment are also structured to ensure that the holders of the beneficial interests

issued by the QSPE are not constrained from pledging or exchanging their interests, and that the Company

does not maintain effective control over the transferred assets. If these criteria are not met, then the transaction

is accounted for as an on-balance sheet secured borrowing. In all cases, irrespective of whether they qualify as

sales under SFAS No. 140, the Company’s securitizations are structured such that they are legally sales of

assets that isolate the transferred assets from the Company.

The Company assesses the financial structure of each securitization to determine whether the trust or

other securitization vehicle meets the sale criteria as defined in SFAS No. 140 and accounts for the transaction

accordingly. To be a QSPE, the trust must meet all of the following conditions:

• It is demonstrably distinct from the Company and cannot be unilaterally dissolved by the Company and

at least 10 percent of the fair value of its interests is held by independent third parties.

• The permitted activities in which the trust can participate are significantly limited. These activities must

be entirely specified in the legal documents at the inception of the QSPE.

• There are limits to the assets the QSPE can hold; specifically, it can hold only financial assets

transferred to it that are passive in nature, passive derivative instruments pertaining to the beneficial

interests held by independent third parties, servicing rights, temporary investments pending distribution

to security holders and cash.

• It can only dispose of its assets in automatic response to the occurrence of an event specified in the

applicable legal documents and must be outside the control of the Company.

In certain securitizations there are certain terms present within the deal structure that result in such

securitizations not qualifying for sale treatment by failing to meet the criteria required for the securitization

entity (trust) to be a QSPE. Accordingly, these securitization trusts are accounted for as variable interest

entities (“VIEs”). Because the Company is considered the primary beneficiary in such VIEs, the transfer is

deemed a financing and the trust is consolidated in the financial statements. The terms present in these

structures that prevent sale treatment are: (1) the Company holds rights that can affect the remarketing of

specific trust bonds that are not significantly limited, (2) the trust has the right to enter into interest rate cap

agreements after its settlement date that do not relate to the reissuance of third-party beneficial interests and

(3) the Company may hold an unconditional call option related to a certain percentage of trust assets.

Retained Interest

The Company securitizes its student loan assets, and for transactions qualifying as sales, retains Residual

Interests and servicing rights (as the Company retains the servicing responsibilities), all of which are referred

to as the Company’s Retained Interest in off-balance sheet securitized loans. The Residual Interest is the right

to receive cash flows from the student loans and reserve accounts in excess of the amounts needed to pay

servicing, derivative costs (if any), other fees, and the principal and interest on the bonds backed by the

F-14

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Dollars in thousands, except per share amounts, unless otherwise stated)