Sallie Mae 2007 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2007 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

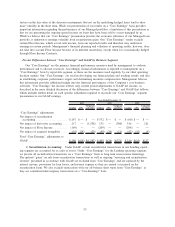

excluding the impact of the interest reserving method discussed above. The primary drivers of changes in the

spread are changes in portfolio composition, borrower benefits, premium amortization, and cost of funds. The

FFELP loan spread declined over all periods presented above primarily due to increased cost of funds, Front-

End Borrower Benefits (Stafford), and a decline in hedged Floor Income (Consolidation). The Private

Education Loan spreads before provision, excluding the impact of the interest reserving method discussed

above, continued to increase due primarily to a change in the mix of the portfolio to more direct-to-consumer

loans (Tuition Answer loans). The changes in the Private Education Loan spreads after provision for all

periods was primarily due to the timing and amount of provision associated with our allowance for Private

Education Loan Losses as discussed below in “Private Education Loans.”

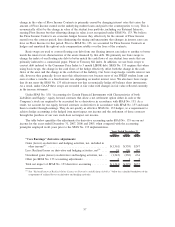

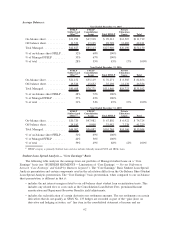

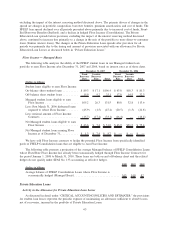

Floor Income — Managed Basis

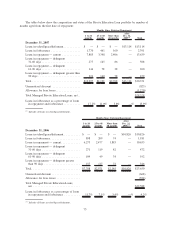

The following table analyzes the ability of the FFELP student loans in our Managed student loan

portfolio to earn Floor Income after December 31, 2007 and 2006, based on interest rates as of those dates.

Fixed

Borrower

Rate

Variable

Borrower

Rate Total

Fixed

Borrower

Rate

Variable

Borrower

Rate Total

December 31, 2007 December 31, 2006

(Dollars in billions)

Student loans eligible to earn Floor Income:

On-balance sheet student loans .......... $ 89.3 $ 17.1 $106.4 $ 63.0 $18.3 $ 81.3

Off-balance sheet student loans .......... 15.9 9.2 25.1 17.8 14.5 32.3

Managed student loans eligible to earn

Floor Income ..................... 105.2 26.3 131.5 80.8 32.8 113.6

Less: Post March 31, 2006 disbursed loans

required to rebate Floor Income ........ (45.9) (1.5) (47.4) (20.5) (1.3) (21.8)

Less: notional amount of Floor Income

Contracts ........................ (15.7) (17.4) (33.1) (16.4) — (16.4)

Net Managed student loans eligible to earn

Floor Income ..................... $ 43.6 $ 7.4 $ 51.0 $ 43.9 $31.5 $ 75.4

Net Managed student loans earning Floor

Income as of December 31, ........... $ 1.3 $ 7.4 $ 8.7 $ — $ — $ —

We have sold Floor Income contracts to hedge the potential Floor Income from specifically identified

pools of FFELP Consolidation loans that are eligible to earn Floor Income.

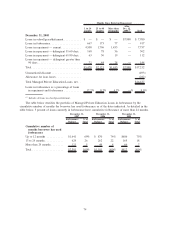

The following table presents a projection of the average Managed balance of FFELP Consolidation Loans

whose Fixed Rate Floor Income has already been economically hedged through Floor Income Contracts for

the period January 1, 2008 to March 31, 2010. These loans are both on and off-balance sheet and the related

hedges do not qualify under SFAS No. 133 accounting as effective hedges.

2008 2009 2010

(Dollars in billions)

Average balance of FFELP Consolidation Loans whose Floor Income is

economically hedged (Managed Basis) ............................. $15 $10 $2

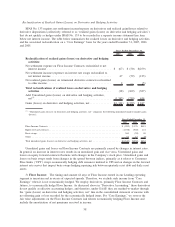

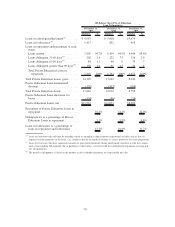

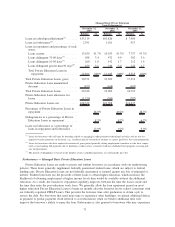

Private Education Loans

Activity in the Allowance for Private Education Loan Losses

As discussed in detail under “CRITICAL ACCOUNTING POLICIES AND ESTIMATES,” the provisions

for student loan losses represent the periodic expense of maintaining an allowance sufficient to absorb losses,

net of recoveries, incurred in the portfolio of Private Education Loans.

65