Sallie Mae 2007 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2007 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

In recent years we have diversified our APG contingency revenue stream into the purchase of distressed

and defaulted receivables to complement our student loan business. We now have the expertise to acquire and

manage portfolios of sub-performing and non-performing mortgage loans, substantially all of which are

secured by one-to-four family residential real estate. We also have a servicing platform and a disciplined

portfolio pricing approach to several consumer debt asset classes.

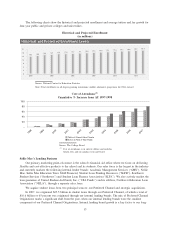

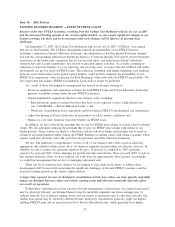

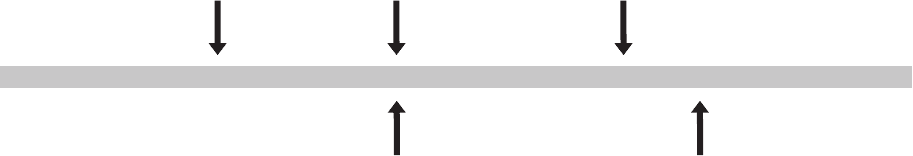

APG Segment Timeline

January

2002

PCR

August

2005

GRP

July 2000

USA Group

January

2002

GRC

September

2004

AFS

1999 2000 2001 2002 2003 2004 2005 20072006

In 2007, our APG business segment had revenues totaling $605 million and net income of $116 million.

Our largest customer, USA Funds, accounted for 28 percent of our revenue in 2007.

Products and Services

Student Loan Default Aversion Services

We provide default aversion services for five guarantors, including the nation’s largest, USA Funds. These

services are designed to prevent a default once a borrower’s loan has been placed in delinquency status.

Defaulted Student Loan Portfolio Management Services

Our APG business segment manages the defaulted student loan portfolios for six guarantors under long-

term contracts. APG’s largest customer, USA Funds, represents approximately 17 percent of defaulted student

loan portfolios in the market. Our portfolio management services include selecting collection agencies and

determining account placements to those agencies, processing loan consolidations and loan rehabilitations, and

managing federal and state offset programs.

Contingency Collection Services

Our APG business segment is also engaged in the collection of defaulted student loans and other debt on

behalf of various clients including guarantors, federal agencies, schools, credit card issuers, utilities, and other

retail clients. We earn fees that are contingent on the amounts collected. We provide collection services for

ED and now have approximately 11 percent of the total market for such services. We have relationships with

more than 900 colleges and universities to provide collection services for delinquent student loans and other

receivables from various campus-based programs.

Collection of Purchased Receivables

In our APG business, we also purchase delinquent and defaulted receivables from credit originators and

other holders of receivables at a significant discount from the face value of the debt instruments. In addition,

we purchase sub-performing and non-performing mortgage receivables at a discount usually calculated as a

percentage of the underlying collateral. We use a combination of internal collectors and outside collection

agencies to collect on these portfolios, seeking to attain the highest cost/benefit for our overall collection

strategy. We recognize revenue primarily using the effective yield method, though we use the cost recovery

18