Sallie Mae 2007 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2007 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

“Core Earnings” basis student loan spread includes the spread on loans that we have sold to securitization

trusts.

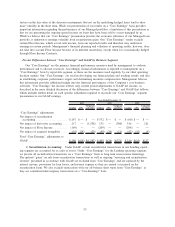

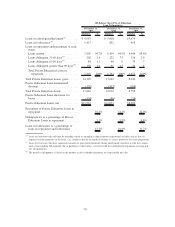

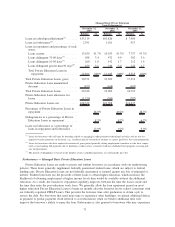

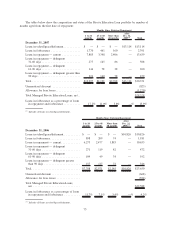

2007 2006 2005

Years Ended December 31,

“Core Earnings” basis student loan yield .................. 8.16% 8.09% 6.32%

Consolidation Loan Rebate Fees ........................ (.55) (.55) (.50)

Repayment Borrower Benefits ......................... (.11) (.09) (.07)

Premium and discount amortization ..................... (.16) (.16) (.17)

“Core Earnings” basis student loan net yield ............... 7.34 7.29 5.58

“Core Earnings” basis student loan cost of funds . . . ......... (5.57) (5.45) (3.80)

“Core Earnings” basis student loan spread, before Interim

ABCP Facility Fees

(1)(2)

............................ 1.77% 1.84% 1.78%

Interim ABCP Facility Fees

(2)

.......................... (.03) — —

“Core Earnings” basis student loan spread

(1)(3)

........... 1.74% 1.84% 1.78%

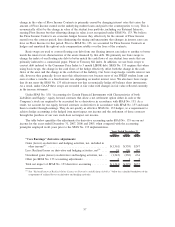

“Core Earnings” basis student loan spreads by product:

FFELP Loan Spreads, before Interim ABCP Facility Fees:

Stafford .......................................... 1.17% 1.40% 1.48%

Consolidation ...................................... 1.00 1.18 1.31

Total FFELP Loan Spread, before Interim ABCP Facility

Fees

(1)(2)

........................................ 1.04 1.26 1.39

Private Education Loan Spread, before Interim ABCP Facility

Fees

(2)

......................................... 5.15 5.13 4.62

Private Education Loan Spread, after provision and before

Interim ABCP Facility Fees

(2)

........................ .44 3.75 3.88

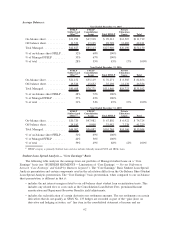

Average Balances

On-balance sheet student loans

(1)

....................... $104,740 $ 84,173 $ 74,724

Off-balance sheet student loans......................... 42,411 46,336 41,220

Managed student loans ............................... $147,151 $130,509 $115,944

(1)

Excludes the effect of the Wholesale Consolidation Loan portfolio on the student loan spread and average balances for the

years ended December 31, 2007 and 2006.

(2)

The Interim ABCP Facility Fees are the commitment and liquidity fees related to a financing facility in connection with

the Merger Agreement.

(3)

“Core Earnings” basis student loan spread, including the effect of Wholesale

Consolidation Loans . . ................................... 1.67% 1.84% 1.78%

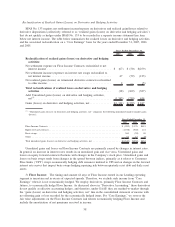

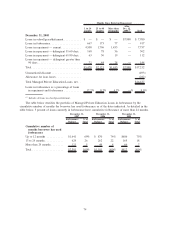

The Company’s “Core Earnings” basis student loan spread before Interim ABCP Facility Fees and the

effect of Wholesale Consolidation Loans decreased 7 basis points from the prior year primarily due to the

interest income reserve on our Private Education Loans. We estimate the amount of Private Education Loan

accrued interest on our balance sheet that is not reasonably expected to be collected in the future using a

methodology consistent with the status-based migration analysis used for the allowance for Private Education

Loans. We use this estimate to offset accrued interest in the current period through a charge to student loan

interest income. As our provision for loan losses increased significantly in 2007, we had a similar rise in the

estimate of uncollectable accrued interest receivable. The Company experienced a higher cost of funds in 2007

primarily due to the disruption in the credit markets, as previously discussed. This was mostly offset by the

growth in the Private Education Loan portfolio which earns a higher margin (before considering provision).

The Company’s “Core Earnings” basis student loan spread before Interim ABCP Facility Fees and the

effect of Wholesale Consolidation Loans remained relatively consistent over all periods presented above,

64