Sallie Mae 2007 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2007 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

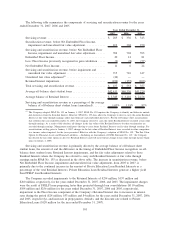

The Company assessed the appropriateness of the current risk premium, which is added to the risk free

rate, for the purpose of arriving at a discount rate in light of the current economic and credit uncertainty that

exists in the market as of December 31, 2007. This discount rate is applied to the projected cash flows to

arrive at a fair value representative of the current economic conditions. The Company increased the risk

premium by 100 basis points (to LIBOR plus 850 basis points) to better take into account the current level of

cash flow uncertainty and lack of liquidity that exists with the Private Education Residual Interests. During

2007, the Company increased its loan loss allowance related to the non-traditional or higher-risk loans within

our Private Education Loan portfolio that the Company does not generally securitize. As a result, the Company

does not expect the default rates used for the Residual Interest valuations to correspond with the expected

default rates contemplated by the provision expense related to the non-traditional Private Education Loans

recorded in 2007.

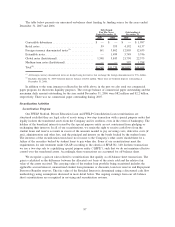

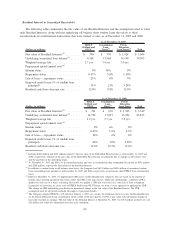

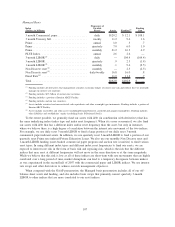

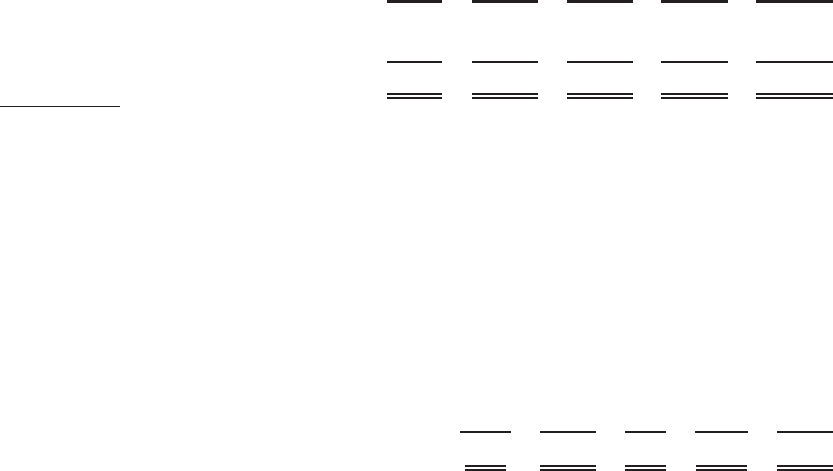

CONTRACTUAL CASH OBLIGATIONS

The following table provides a summary of our obligations associated with long-term notes and equity

forward contracts at December 31, 2007. For further discussion of these obligations, see Note 8, “Long-Term

Borrowings,” Note 10, “Derivative Financial Instruments,” and Note 12, “Stockholders’ Equity,” to the

consolidated financial statements.

1 Year

or Less

2to3

Years

4to5

Years

Over

5 Years Total

Long-term notes

(1)(2)

.................. $6,841 $27,090 $20,461 $53,000 $107,392

Equity forward contract

(3)

.............. 865 — — — 865

Total contractual cash obligations ........ $7,706 $27,090 $20,461 $53,000 $108,257

(1)

Only includes principal obligations and specifically excludes SFAS No. 133 derivative market value adjustments of $3.7 billion

for long-term notes.

(2)

Includes Financial Interpretation (“FIN”) No. 46 long-term beneficial interests of $68.1 billion of notes issued by consolidated

variable interest entities in conjunction with our on-balance sheet securitization transactions and included in long-term notes in

the consolidated balance sheet. Timing of obligations is estimated based on the Company’s current projection of prepayment

speeds of the securitized assets.

(3)

Includes remaining balance of equity forward contract paid to Citibank on January 9, 2008. The Company has no outstanding

equity forward positions outstanding after the contract settlement on January 9, 2008. See Note 12, “Stockholders’ Equity,” to

the consolidated financial statements.

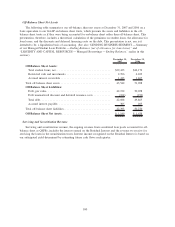

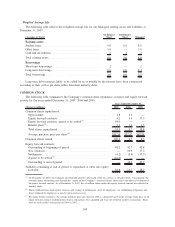

OFF-BALANCE SHEET LENDING ARRANGEMENTS

The following table summarizes the contractual amounts related to off-balance sheet lending related

financial instruments at December 31, 2007.

1 Year

or Less

2to3

Years

4to5

Years

Over

5 Years Total

Lines of credit ............................. $486 $1,350 $200 $ — $2,036

We have issued lending-related financial instruments including lines of credit to meet the financing needs

of our customers. The contractual amount of these financial instruments represents the maximum possible

credit risk should the counterparty draw down the commitment and the counterparty subsequently fails to

perform according to the terms of our contract. The remaining total contractual amount available to be

borrowed under these commitments is $2.0 billion. We do not believe that these instruments are representative

of our actual future credit exposure or funding requirements. To the extent that the lines of credit are drawn

upon, the balance outstanding is collateralized by student loans. At December 31, 2007, draws on lines of

credit were approximately $379 million, and are reflected in other loans in the consolidated balance sheet. For

additional information, see Note 17, “Commitments, Contingencies and Guarantees,” to the consolidated

financial statements.

The Company maintains forward contracts to purchase loans from our lending partners at contractual

prices. These contracts typically have a maximum amount we are committed to buy, but lack a fixed or

determinable amount as it ultimately is based on the lending partner’s origination activity. FFELP forward

purchase contracts typically contain language relieving us of most of our responsibilities under the contract

102