Sallie Mae 2007 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2007 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.temporary hardship after entering repayment, when we believe that it will increase the likelihood of ultimate

collection of the loan. Forbearance can be requested by the borrower or initiated by the Company and is

granted within established policies that include limits on the number of forbearance months granted

consecutively and limits on the total number of forbearance months granted over the life of the loan. In some

instances of forbearance, we require good-faith payments or continuing partial payments. Exceptions to

forbearance policies are permitted in limited circumstances and only when such exceptions are judged to

increase the likelihood of ultimate collection of the loan.

Forbearance does not grant any reduction in the total repayment obligation (principal or interest) but does

allow for the temporary cessation of borrower payments (on a prospective and/or retroactive basis) or a

reduction in monthly payments for an agreed period of time. The forbearance period extends the original term

of the loan. While the loan is in forbearance, interest continues to accrue and is capitalized as principal upon

the loan re-entering repayment status. Loans exiting forbearance into repayment status are considered current

regardless of their previous delinquency status.

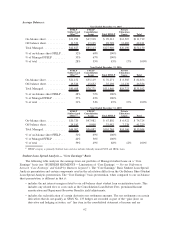

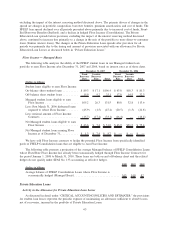

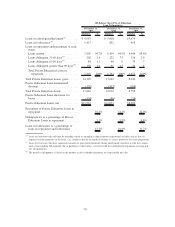

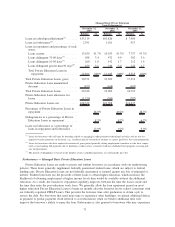

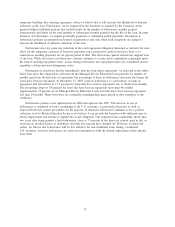

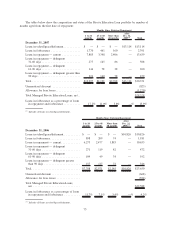

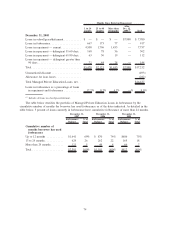

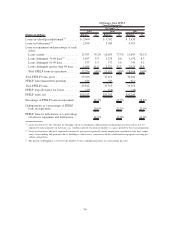

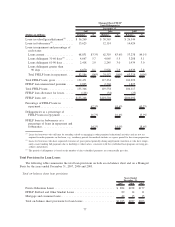

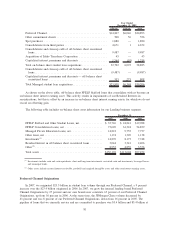

Forbearance is used most heavily immediately after the loan enters repayment. As indicated in the tables

below that show the composition and status of the Managed Private Education Loan portfolio by number of

months aged from the first date of repayment, the percentage of loans in forbearance decreases the longer the

loans have been in repayment. At December 31, 2007, loans in forbearance as a percentage of loans in

repayment and forbearance is 17.2 percent for loans that have been in repayment one to twenty-four months.

The percentage drops to 5.8 percent for loans that have been in repayment more than 48 months.

Approximately 74 percent of our Managed Private Education Loans in forbearance have been in repayment

less than 24 months. These borrowers are essentially extending their grace period as they transition to the

workforce.

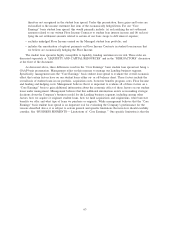

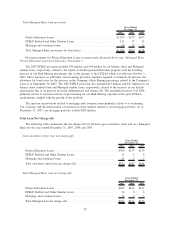

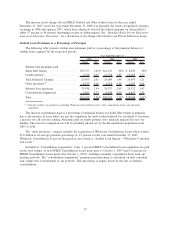

Forbearance policies were tightened in late 2006 and again in late 2007. The increase in use of

forbearance is attributed to both a weakening of the U.S. economy, as previously discussed, as well as

improved borrower contact procedures. In the majority of situations forbearance continues to be a positive

collection tool for Private Education Loans as we believe it can provide the borrower with sufficient time to

obtain employment and income to support his or her obligation. Our experience has consistently shown that

two years after being granted a first forbearance, close to 75 percent of the loans are current, paid in full, or

receiving an in-school grace or deferment, and only five percent have charged off. However, as discussed

earlier, we believe that forbearance will be less effective for non-traditional loans during a weakened

U.S. economy. Loans in forbearance are reserved commensurate with the default expectation of this specific

loan status.

72