Sallie Mae 2007 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2007 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

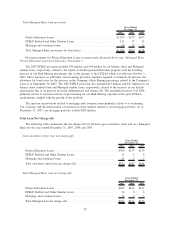

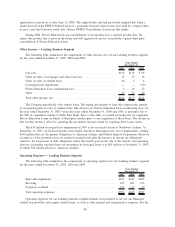

applications received on or after June 15, 2006. The single-holder rule had previously required that when a

lender held all of the FFELP Stafford loans of a particular borrower whose loans were held by a single lender,

in most cases that borrower could only obtain a FFELP Consolidation Loan from that lender.

During 2006, Private Education Loan consolidations were introduced as a separate product line. We

expect this product line to grow in the future and will aggressively protect our portfolio against third-party

consolidation of Private Education Loans.

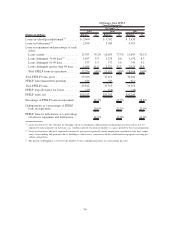

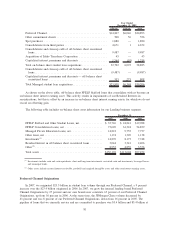

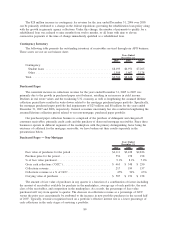

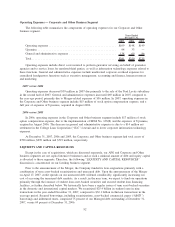

Other Income — Lending Business Segment

The following table summarizes the components of other income, net, for our Lending business segment

for the years ended December 31, 2007, 2006 and 2005.

2007 2006 2005

Years Ended

December 31,

Late fees ................................................... $134 $119 $ 96

Gains on sales of mortgages and other loan fees...................... 11 15 18

Gains on sales of student loans .................................. 24 2 4

Leveraged lease impairment..................................... — — (39)

Private Education Loan warehousing fees........................... 2 16 12

Other ..................................................... 23 25 20

Total other income, net ........................................ $194 $177 $111

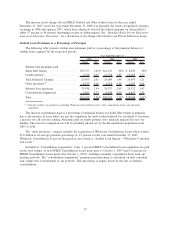

The Company periodically sells student loans. The timing and amount of loan sales impacts the amount

of recognized gains on sales of student loans. The decrease in “Private Education Loan warehousing fees” for

the year ended December 31, 2007 versus the years ended December 31, 2006 and 2005, is primarily due to

the shift of origination volume to Sallie Mae Bank. Prior to this shift, we earned servicing fees for originated

Private Education Loans on behalf of third-party lenders prior to our acquisition of those loans. The decline in

this revenue stream is offset by capturing the net interest income earned by acquiring these loans earlier.

The $39 million leveraged lease impairment in 2005 is for an aircraft leased to Northwest Airlines. At

December 31, 2007, we had investments in leveraged and direct financing leases, net of impairments, totaling

$100 million that are the general obligations of American Airlines and Federal Express Corporation. Based on

an analysis of the potential losses on certain leveraged leases plus the increase in current tax obligations

related to the forgiveness of debt obligations and/or the taxable gain on the sale of the aircraft, our remaining

after-tax accounting exposure from our investment in leveraged leases was $63 million at December 31, 2007,

of which $46 million relates to American Airlines.

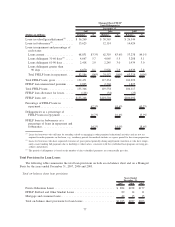

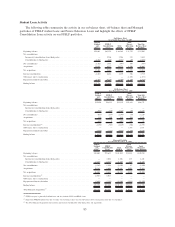

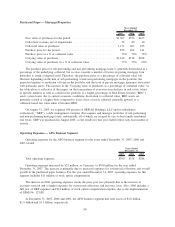

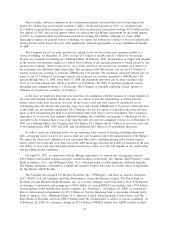

Operating Expenses — Lending Business Segment

The following table summarizes the components of operating expenses for our Lending business segment

for the years ended December 31, 2007, 2006 and 2005.

2007 2006 2005

Years Ended

December 31,

Sales and originations ......................................... $351 $327 $285

Servicing .................................................. 227 201 193

Corporate overhead ........................................... 131 117 69

Total operating expenses ....................................... $709 $645 $547

Operating expenses for our Lending business segment include costs incurred to service our Managed

student loan portfolio and acquire student loans, as well as other general and administrative expenses. For the

86