Sallie Mae 2007 Annual Report Download - page 186

Download and view the complete annual report

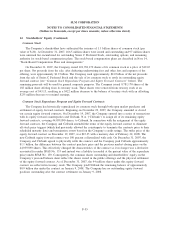

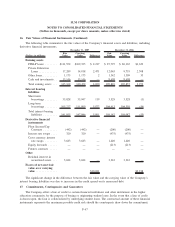

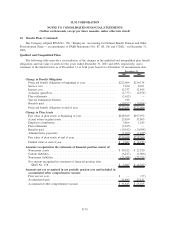

Please find page 186 of the 2007 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.16. Fair Values of Financial Instruments (Continued)

• In the consolidated balance sheet for instruments carried lower of cost or market with impairment

charges recorded in the consolidated statement of income; and

• In the notes to the financial statements as required by SFAS No. 107, “Disclosures About Fair Value of

Financial Instruments”.

In general, the Company’s policy in estimating fair values is to first obtain observable market prices for

identical assets and liabilities in active markets, where available. When these are not available, other inputs are

used to model fair value such as prices of similar instruments, yield curves, volatilities, prepayment speeds,

default rates and credit spreads (including the Company’s liabilities) relying first on observable data from

active markets. Additional adjustments may be made for factors including liquidity, bid/offer spreads, etc.,

depending on current market conditions. When possible, the Company seeks to validate the model’s output to

market transactions. Depending on the availability of observable inputs and prices, different valuation models

could produce materially different fair value estimates. The values presented may not represent future fair

values and may not be realizable.

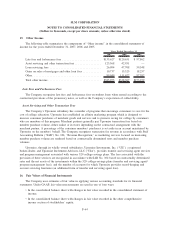

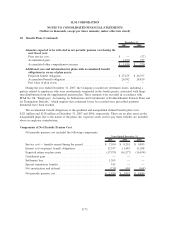

Student Loans

The Company’s FFELP loans and Private Education Loans are accounted for at cost or at the lower of

cost or market if the loan is held-for-sale (see Note 2, “Significant Accounting Policies — Loans,” for a

discussion of the accounting treatment); however, the fair value is disclosed in compliance with SFAS No. 107.

For both FFELP loans and Private Education Loans, fair value was determined by modeling loan level cash

flows using stated terms of the assets and internally-developed assumptions to determine aggregate portfolio

yield, net present value and average life. The significant assumptions used to project cash flows are

prepayment speeds, default rates, cost of funds/capital, required return on equity, and expected Repayment

Borrower Benefits to be earned. In addition, the Floor Income component of the Company’s FFELP loan

portfolio is valued through discounted cash flow and option models using both observable market inputs and

internally developed inputs. Significant inputs into the models are not observable. When possible, market

transactions are used to validate the model. In most cases these are either infrequent or not observable.

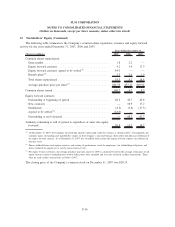

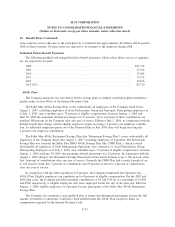

Other Loans

Warehousing, facilities financings, and mortgage and consumer loans held for investment are accounted

for at cost with fair values being disclosed as required by SFAS No. 107. Mortgage loans held for sale are

accounted for at lower of cost or market. Valuations were determined with discounted cash flow models using

the stated terms of the loans and observable market yield curves and credit spreads. In addition, adjustments

and assumptions were made for liquidity, prepayment speeds and defaults.

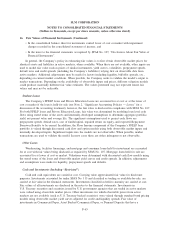

Cash and Investments (Including “Restricted”)

Cash and cash equivalents are carried at cost. Carrying value approximated fair value for disclosure

purposes. Investments accounted for under SFAS No. 115 and classified as trading or available-for-sale, are

carried at fair value in the financial statements. Investments classified as held-to-maturity are carried at cost.

Fair values of all investments are disclosed in the notes to the financial statements. Investments in

U.S. Treasury securities and securities issued by U.S. government agencies that are traded in active markets

were valued using observable market prices. Other investments for which observable prices from active

markets are not available (such as U.S. Treasury-backed securities) were valued through standard bond pricing

models using observable market yield curves adjusted for credit and liquidity spreads. Fair value of

investments in Commercial Paper, Asset Backed Commercial Paper, or Demand Deposits that have a

F-65

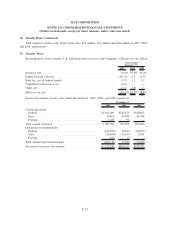

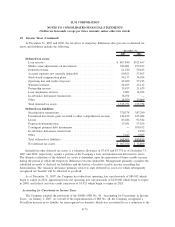

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Dollars in thousands, except per share amounts, unless otherwise stated)