Sallie Mae 2007 Annual Report Download - page 145

Download and view the complete annual report

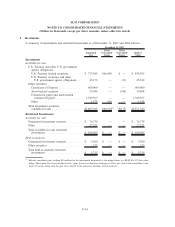

Please find page 145 of the 2007 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.2. Significant Accounting Policies (Continued)

permit fair value measurements. Accordingly, this statement does not change which types of instruments are

carried at fair value, but rather establishes the framework for measuring fair value. The Company does not

expect the adoption of SFAS No. 157 to have a material impact on its financial statements.

On February 12, 2008, the FASB issued FASB Staff Position (“FSP”) SFAS No. 157-2 “Effective Date of

SFAS No. 157” which defers the effective date of SFAS No. 157 for nonfinancial assets and liabilities, except

for items that are recognized or disclosed at fair value in the financial statements on a recurring basis. This

FSP will delay the implementation of SFAS No. 157 for the Company’s accounting of goodwill, acquired

intangibles, and other nonfinancial assets and liabilities that are measured at the lower of cost or market until

January 1, 2009.

The Fair Value Option for Financial Assets and Financial Liabilities — Including an Amendment of

FASB Statement No. 115

In February 2007, the FASB issued SFAS No. 159, “The Fair Value Option for Financial Assets and

Financial Liabilities — Including an Amendment of FASB Statement No. 115.” This statement permits entities

to choose to measure many financial instruments and certain other items at fair value (on an instrument by

instrument basis). Most recognized financial assets and liabilities are eligible items for the measurement option

established by the statement. There are a few exceptions, including an investment in a subsidiary or an interest

in a variable interest entity that is required to be consolidated, certain obligations related to post-employment

benefits, assets or liabilities recognized under leases, various deposits, and financial instruments classified as

shareholder’s equity. A business entity shall report unrealized gains and losses on items for which the fair

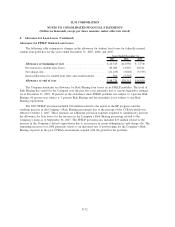

value option has been elected in earnings at each reporting date. The Company adopted SFAS No. 159 and has

elected the fair value option on all of the Residual Interests effective January 1, 2008. The Company chose

this election in order to simplify the accounting for Residual Interests by having all Residual Interests under

one accounting model. Prior to this election, Residual Interests were accounted for either under SFAS No. 115

with changes in fair value recorded through other comprehensive income or under SFAS No. 155 with changes

in fair value recorded through income. At transition, the Company recorded a pre-tax gain to retained earnings

as a cumulative-effect adjustment totaling $301 million ($198 million net of tax). This amount was in

accumulated other comprehensive income as of December 31, 2007, and as a result equity was not impacted at

transition on January 1, 2008. Changes in value of Residual Interests in future periods will be recorded in the

income statement. The Company has not selected the fair value option for any other financial instruments at

this time.

Business Combinations

In December 2007, the FASB issued SFAS No. 141(R), “Business Combinations”. SFAS No. 141(R)

requires the acquiring entity in a business combination to recognize the entire acquisition-date fair value of

assets acquired and liabilities assumed in both full and partial acquisitions; changes the recognition of assets

acquired and liabilities assumed related to contingencies; changes the recognition and measurement of

contingent consideration; requires expensing of most transaction and restructuring costs; and requires

additional disclosures to enable the users of the financial statements to evaluate and understand the nature and

financial effect of the business combination. SFAS No. 141(R) applies to all transactions or other events in

which the Company obtains control of one or more businesses. SFAS No. 141(R) applies prospectively to

business combinations for which the acquisition date is on or after the beginning of the reporting period

beginning on or after December 15, 2008, which for the Company is January 1, 2009. Early adoption is not

permitted.

F-24

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Dollars in thousands, except per share amounts, unless otherwise stated)