Sallie Mae 2007 Annual Report Download - page 126

Download and view the complete annual report

Please find page 126 of the 2007 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

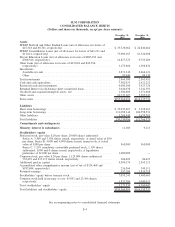

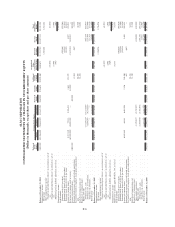

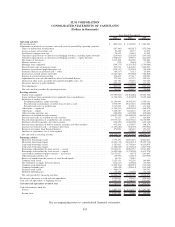

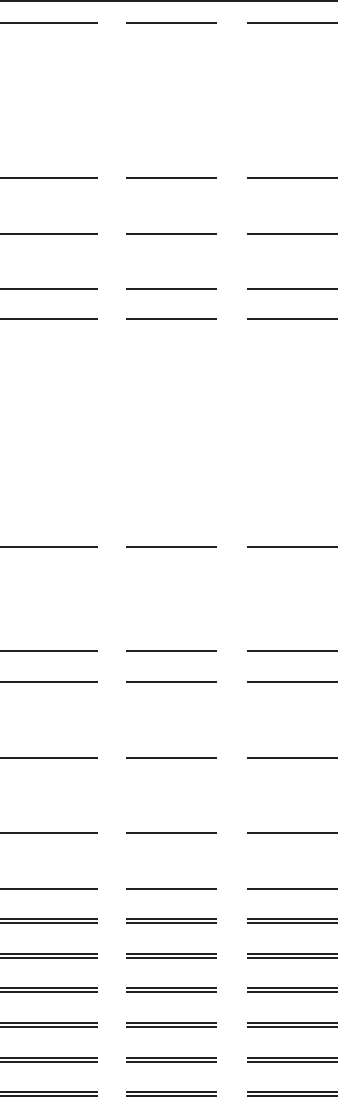

SLM CORPORATION

CONSOLIDATED STATEMENTS OF INCOME

(Dollars and shares in thousands, except per share amounts)

2007 2006 2005

Years Ended December 31,

Interest income:

FFELP Stafford and Other Student Loans .................. $2,060,993 $1,408,938 $1,014,851

FFELP Consolidation Loans............................ 4,343,138 3,545,857 2,500,008

Private Education Loans............................... 1,456,471 1,021,221 633,884

Other loans ........................................ 105,843 97,954 84,664

Cash and investments................................. 707,577 503,002 276,756

Total interest income ................................... 8,674,022 6,576,972 4,510,163

Total interest expense .................................. 7,085,772 5,122,855 3,058,718

Net interest income .................................... 1,588,250 1,454,117 1,451,445

Less: provisions for loan losses ........................... 1,015,308 286,962 203,006

Net interest income after provisions for loan losses ............ 572,942 1,167,155 1,248,439

Other income:

Gains on student loan securitizations ..................... 367,300 902,417 552,546

Servicing and securitization revenue ...................... 437,097 553,541 356,730

Losses on loans and securities, net ....................... (95,492) (49,357) (63,955)

Gains (losses) on derivative and hedging activities, net ........ (1,360,584) (339,396) 246,548

Guarantor servicing fees .............................. 156,429 132,100 115,477

Contingency fee revenue .............................. 335,737 396,830 359,907

Collections revenue .................................. 271,547 239,829 166,840

Other............................................. 385,075 338,307 273,259

Total other income .................................... 497,109 2,174,271 2,007,352

Operating expenses:

Salaries and benefits ................................. 773,863 703,210 625,024

Other............................................. 777,984 642,942 513,304

Total operating expenses ................................ 1,551,847 1,346,152 1,138,328

Income (loss) before income taxes and minority interest in net

earnings of subsidiaries ............................... (481,796) 1,995,274 2,117,463

Income tax expense .................................... 412,283 834,311 728,767

Income (loss) before minority interest in net earnings of

subsidiaries ........................................ (894,079) 1,160,963 1,388,696

Minority interest in net earnings of subsidiaries . .............. 2,315 4,007 6,412

Net income (loss) ..................................... (896,394) 1,156,956 1,382,284

Preferred stock dividends................................ 37,145 35,567 21,903

Net income (loss) attributable to common stock . .............. $ (933,539) $1,121,389 $1,360,381

Basic earnings (loss) per common share ..................... $ (2.26) $ 2.73 $ 3.25

Average common shares outstanding ....................... 412,233 410,805 418,374

Diluted earnings (loss) per common share ................... $ (2.26) $ 2.63 $ 3.05

Average common and common equivalent shares outstanding ..... 412,233 451,170 460,260

Dividends per common share ............................. $ .25 $ .97 $ .85

See accompanying notes to consolidated financial statements.

F-5