Sallie Mae 2007 Annual Report Download - page 110

Download and view the complete annual report

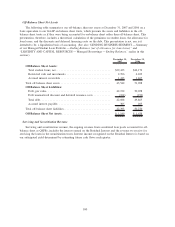

Please find page 110 of the 2007 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Beginning on November 29, 2007, the Company amended or closed out certain equity forward contracts.

On December 19, 2007, the Company entered into a series of transactions with its equity forward

counterparties and Citibank to assign all of its remaining equity forward contracts, covering 44,039,890 shares,

to Citibank. In connection with the assignment of the equity forward contracts, the Company and Citibank

amended the terms of the equity forward contract to eliminate all stock price triggers (which had previously

allowed the counterparty to terminate the contracts prior to their scheduled maturity date) and termination

events based on the Company’s credit ratings. The strike price of the equity forward contract on December 19,

2007, was $45.25 with a maturity date of February 22, 2008. The new Citibank equity forward contract was

100 percent collateralized with cash. On December 31, 2007, the Company and Citibank agreed to physically

settle the contract and the Company paid Citibank approximately $1.1 billion, the difference between the

contract purchase price and the previous market closing price on the 44,039,890 shares. Consequently, the

common shares outstanding and shareholders’ equity on the Company’s year-end balance sheet reflect the

shares issued in the public offerings and the physical settlement of the equity forward contract. As of

December 31, 2007, the 44 million shares under this equity forward contract are reflected in treasury stock.

The Company paid Citibank the remaining balance of approximately $0.9 billion due under the contract on

January 9, 2008. The Company now has no outstanding equity forward positions.

On December 31, 2007, the Company issued 101,781,170 shares of its common stock at a price of $19.65

per share. Net proceeds from the sale, after deducting underwriting fees and other fees and expenses of the

offering, were approximately $1.9 billion. The Company used approximately $2.0 billion of the net proceeds

from the sale of Series C Preferred Stock and the sale of its common stock to settle its outstanding equity

forward contract (see Note 12, “Stockholders’ Equity,” for further discussion). The remaining proceeds will be

used for general corporate purposes. The Company issued 9,781,170 shares of the 102 million share offering

from its treasury stock. These shares were removed from treasury stock at an average cost of $43.13, resulting

in a $422 million decrease to the balance of treasury stock with an offsetting $235 million decrease to retained

earnings.

The closing price of the Company’s common stock on December 31, 2007 was $20.14.

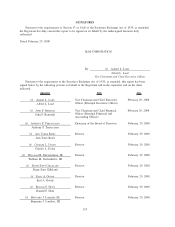

RECENT DEVELOPMENTS

Higher Education Reauthorization

On October 30, 2007, the House and Senate passed S. 2258, “The Third Higher Education Extension Act

of 2007,” which extends the authorization of the Higher Education Act through March 31, 2008. The

reauthorization of the Higher Education Act remains one of the outstanding issues for this Congress.

On July 24, 2007, the Senate passed the full HEA reauthorization bill, S. 1642. The Senate bill includes

some provisions that would affect the student loan programs. The Senate bill includes provisions that would

regulate gifts, travel, entertainment, and services provided to institutions of higher education by guarantors and

lenders. It includes new disclosure requirements on lenders and would prohibit schools from designating

preferred lender lists. The Senate bill would allow schools to keep standard lists of lenders but would require

the schools to include any lender on the list that requested inclusion. The bill would also eliminate school-as-

lender, effective June 30, 2011.

On February 7, 2008, the House of Representatives passed H.R. 4137, the College Opportunity and

Affordability Act of 2007, its version of the Higher Education Act Reauthorization. The legislation includes

the previously-passed Student Loan Sunshine Act (H.R. 890). In addition, the House legislation includes

provisions similar to Senate Banking Committee legislation, Private Student Loan Transparency, which

provides for certain disclosures and prohibits certain activities in connection with Private Education Loans.

Once House action is completed, it is expected that the House and Senate will resolve the differences between

the two bills in conference committee and complete action on reauthorization prior to the expiration of the

latest temporary extension.

109