Sallie Mae 2007 Annual Report Download - page 190

Download and view the complete annual report

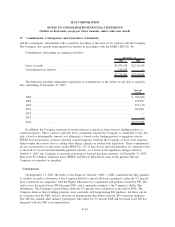

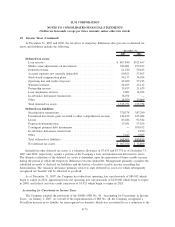

Please find page 190 of the 2007 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.17. Commitments, Contingencies and Guarantees (Continued)

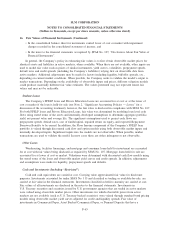

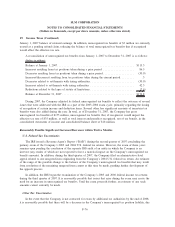

On January 31, 2008, a putative securities class action lawsuit was filed against the Company and three

senior officers in federal court in the Southern District of New York (Burch v. SLM Corporation, Albert L.

Lord, C.E. Andrews, and Robert S. Autor). The case has been assigned to the Honorable William H. Pauley, III.

The case purports to be brought on behalf of all persons who purchased or otherwise acquired the Common

stock of the Company between January 18, 2007 and January 3, 2008. The complaint alleges that the Company

and the named officers violated federal securities laws by issuing a series of materially false and misleading

statements to the market throughout the Class Period, which statements allegedly had the effect of artificially

inflating the market price of the Company’s securities. The complaint alleges that defendants caused the

Company’s results for year-end 2006 and for the first three quarters of 2007 to be materially misstated because

the Company failed to adequately accrue its loan loss provisions, which overstated the Company’s net income,

and that the Company failed to adequately disclose allegedly known trends and uncertainties with respect to its

non-traditional loan portfolio. The complaint alleges violations of the Securities Exchange Act of 1934 § 10(b)

and § 20(a) and Rule 10b-5. The Company was served on February 5, 2008 and the case is pending. A class

has not yet been certified in the above action. The Company is aware of press reports that other similar actions

may be filed, but has not been served with any other complaints. The Company intends to vigorously assert its

defenses.

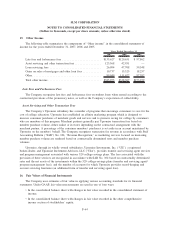

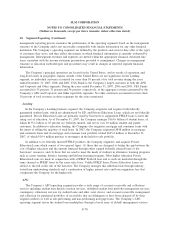

The Company is also subject to various claims, lawsuits and other actions that arise in the normal course

of business. Most of these matters are claims by borrowers disputing the manner in which their loans have

been processed or the accuracy of the Company’s reports to credit bureaus. In addition, the collections

subsidiaries in the Company’s APG segment are occasionally named in individual plaintiff or class action

lawsuits in which the plaintiffs allege that the Company has violated a federal or state law in the process of

collecting their account. Management believes that these claims, lawsuits and other actions will not have a

material adverse effect on its business, financial condition or results of operations. Finally, from time to time,

the Company receives information and document requests from state attorney generals concerning certain of

its business practices. The Company’s practice has been and continues to be to cooperate with the state

attorney generals and to be responsive to any such requests.

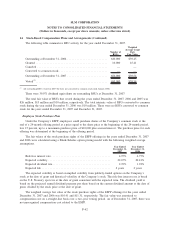

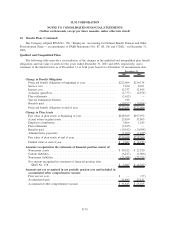

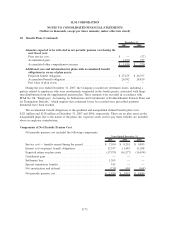

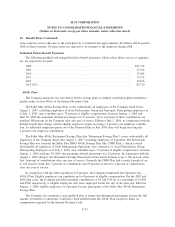

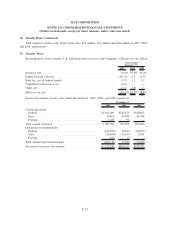

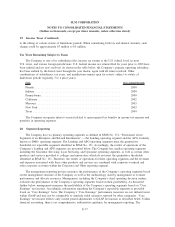

18. Benefit Plans

Pension Plans

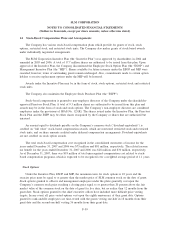

As of December 31, 2007, the Company’s qualified and supplemental pension plans (the “Pension Plans”)

are frozen with respect to new entrants and participants with less than ten years of service on June 30, 2004.

No further benefits will accrue with respect to these participants under the Pension Plans, other than interest

accruals on cash balance accounts. Participants with less than five years of service as of June 30, 2004 were

fully vested.

For those participants continuing to accrue benefits under the Pension Plans until July 1, 2009, benefits

are credited using a cash balance formula. Under the formula, each participant has an account, for record

keeping purposes only, to which credits are allocated each payroll period based on a percentage of the

participant’s compensation for the current pay period. The applicable percentage is determined by the

participant’s number of years of service with the Company. If an individual participated in the Company’s

prior pension plan as of September 30, 1999 and met certain age and service criteria, the participant

(“grandfathered participant”) will receive the greater of the benefits calculated under the prior plan, which uses

a final average pay plan method, or the current plan under the cash balance formula.

F-69

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Dollars in thousands, except per share amounts, unless otherwise stated)