Sallie Mae 2007 Annual Report Download - page 205

Download and view the complete annual report

Please find page 205 of the 2007 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

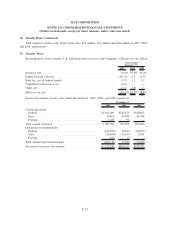

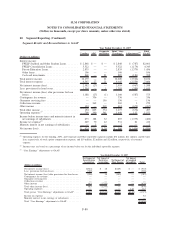

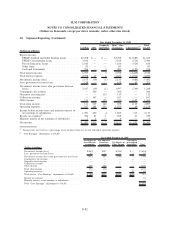

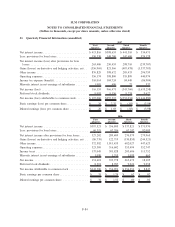

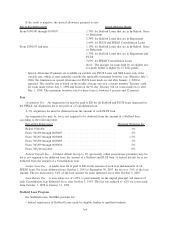

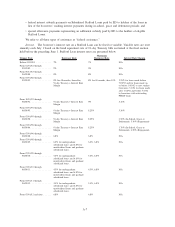

21. Quarterly Financial Information (unaudited)

First

Quarter

Second

Quarter

Third

Quarter

Fourth

Quarter

2007

Net interest income ............................ $413,816 $398,653 $ 441,310 $ 334,471

Less: provisions for loan losses ................... 150,330 148,200 142,600 574,178

Net interest income (loss) after provisions for loan

losses .................................... 263,486 250,453 298,710 (239,707)

Gains (losses) on derivative and hedging activities, net . . (356,969) 821,566 (487,478) (1,337,703)

Other income ................................ 876,829 398,672 285,433 296,759

Operating expenses ............................ 356,174 398,800 355,899 440,974

Income tax expense (benefit) ..................... 310,014 104,724 84,449 (86,904)

Minority interest in net earnings of subsidiaries ....... 1,005 696 77 537

Net income (loss) ............................. 116,153 966,471 (343,760) (1,635,258)

Preferred stock dividends........................ 9,093 9,156 9,274 9,622

Net income (loss) attributable to common stock ....... $107,060 $957,315 $(353,034) $(1,644,880)

Basic earnings (loss) per common share ............. $ .26 $ 2.32 $ (.85) $ (3.98)

Diluted earnings (loss) per common share . . . ........ $ .26 $ 1.03 $ (.85) $ (3.98)

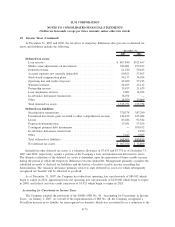

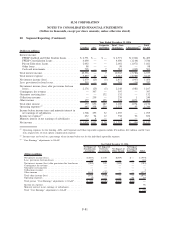

First

Quarter

Second

Quarter

Third

Quarter

Fourth

Quarter

2006

Net interest income ............................ $387,521 $ 356,805 $ 337,821 $ 371,970

Less: provisions for loan losses .................... 60,319 67,396 67,242 92,005

Net interest income after provisions for loan losses ..... 327,202 289,409 270,579 279,965

Gains (losses) on derivative and hedging activities, net . . (86,739) 122,719 (130,855) (244,521)

Other income ................................. 372,582 1,011,435 682,027 447,623

Operating expenses............................. 323,309 316,602 353,494 352,747

Income taxes ................................. 137,045 381,828 203,686 111,752

Minority interest in net earnings of subsidiaries ........ 1,090 1,355 1,099 463

Net income .................................. 151,601 723,778 263,472 18,105

Preferred stock dividends ........................ 8,301 8,787 9,221 9,258

Net income attributable to common stock ............ $143,300 $ 714,991 $ 254,251 $ 8,847

Basic earnings per common share .................. $ .35 $ 1.74 $ .62 $ .02

Diluted earnings per common share ................ $ .34 $ 1.52 $ .60 $ .02

F-84

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Dollars in thousands, except per share amounts, unless otherwise stated)