Sallie Mae 2007 Annual Report Download - page 185

Download and view the complete annual report

Please find page 185 of the 2007 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

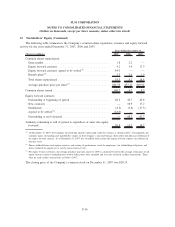

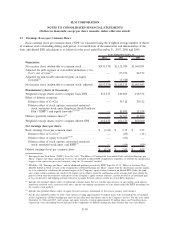

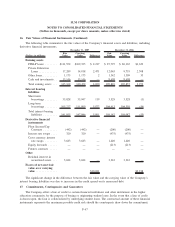

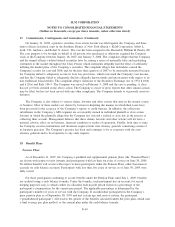

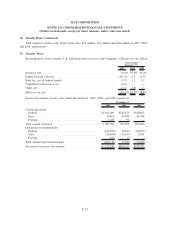

15. Other Income

The following table summarizes the components of “Other income” in the consolidated statements of

income for the years ended December 31, 2007, 2006 and 2005.

2007 2006 2005

Years Ended December 31,

Late fees and forbearance fees ......................... $135,627 $120,651 $ 97,862

Asset servicing and other transaction fees ................. 123,568 42,951 —

Loan servicing fees ................................. 26,094 47,708 59,548

Gains on sales of mortgages and other loan fees . . . ......... 10,737 15,325 18,257

Other ............................................ 89,049 111,672 97,592

Total other income .................................. $385,075 $338,307 $273,259

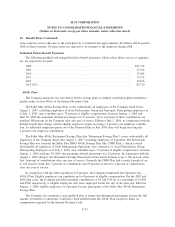

Late Fees and Forbearance Fees

The Company recognizes late fees and forbearance fees on student loans when earned according to the

contractual provisions of the promissory notes, as well as the Company’s expectation of collectability.

Asset Servicing and Other Transaction Fees

The Company’s Upromise subsidiary has a number of programs that encourage consumers to save for the

cost of college education. Upromise has established an affinity marketing program which is designed to

increase consumer purchases of merchant goods and services and to promote saving for college by consumers

who are members of this program. Merchant partners generally pay Upromise transaction fees based on

member purchase volume, either online or in stores depending on the contractual arrangement with the

merchant partner. A percentage of the consumer members’ purchases is set aside in an account maintained by

Upromise on the members’ behalf. The Company recognizes transaction fee revenue in accordance with Staff

Accounting Bulletin (“SAB”) No. 104, “Revenue Recognition,” as marketing services focused on increasing

member purchase volume are rendered based on contractually determined rates and member purchase

volumes.

Upromise, through its wholly owned subsidiaries, Upromise Investments, Inc. (“UII”), a registered

broker-dealer, and Upromise Investment Advisors, LLC (“UIA”), provides transfer and servicing agent services

and program management associated with various 529 college-savings plans. The fees associated with the

provision of these services are recognized in accordance with SAB No. 104 based on contractually determined

rates and the net assets of the investments within the 529 college-savings plans (transfer and servicing agent/

program management fees), and the number of accounts for which Upromise provides record-keeping and

account servicing functions (an additional form of transfer and servicing agent fees).

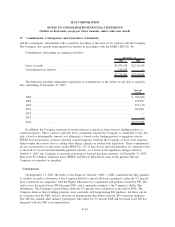

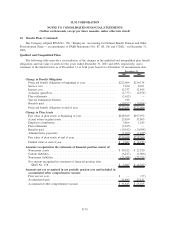

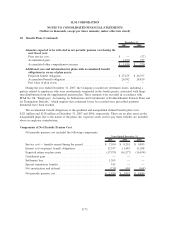

16. Fair Values of Financial Instruments

The Company uses estimates of fair value in applying various accounting standards for its financial

statements. Under GAAP, fair value measurements are used in one of four ways:

• In the consolidated balance sheet with changes in fair value recorded in the consolidated statement of

income;

• In the consolidated balance sheet with changes in fair value recorded in the other comprehensive

income section of stockholders’ equity;

F-64

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Dollars in thousands, except per share amounts, unless otherwise stated)