Sallie Mae 2007 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2007 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219

|

|

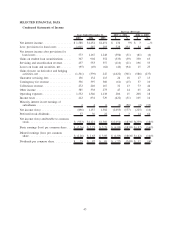

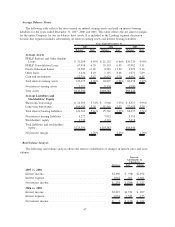

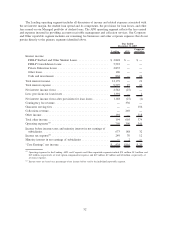

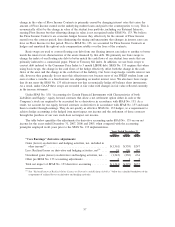

Average Balance Sheets

The following table reflects the rates earned on interest earning assets and paid on interest bearing

liabilities for the years ended December 31, 2007, 2006 and 2005. This table reflects the net interest margin

for the entire Company for our on-balance sheet assets. It is included in the Lending segment discussion

because that segment includes substantially all interest earning assets and interest bearing liabilities.

Balance Rate Balance Rate Balance Rate

2007 2006 2005

Years Ended December 31,

Average Assets

FFELP Stafford and Other Student

Loans ....................... $ 31,294 6.59% $ 21,152 6.66% $20,720 4.90%

FFELP Consolidation Loans ........ 67,918 6.39 55,119 6.43 47,082 5.31

Private Education Loans ........... 12,507 11.65 8,585 11.90 6,922 9.16

Other loans ..................... 1,246 8.49 1,155 8.48 1,072 7.89

Cash and investments ............. 12,710 5.57 8,824 5.70 6,662 4.15

Total interest earning assets ......... 125,675 6.90% 94,835 6.94% 82,458 5.47%

Non-interest earning assets ......... 9,715 8,550 6,990

Total assets ..................... $135,390 $103,385 $89,448

Average Liabilities and

Stockholders’ Equity

Short-term borrowings............. $ 16,385 5.74% $ 3,902 5.33% $ 4,517 3.93%

Long-term borrowings............. 109,984 5.59 91,461 5.37 77,958 3.70

Total interest bearing liabilities . . . . . . 126,369 5.61% 95,363 5.37% 82,475 3.71%

Non-interest bearing liabilities ....... 4,272 3,912 3,555

Stockholders’ equity .............. 4,749 4,110 3,418

Total liabilities and stockholders’

equity ....................... $135,390 $103,385 $89,448

Net interest margin ............... 1.26% 1.53% 1.76%

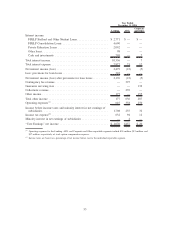

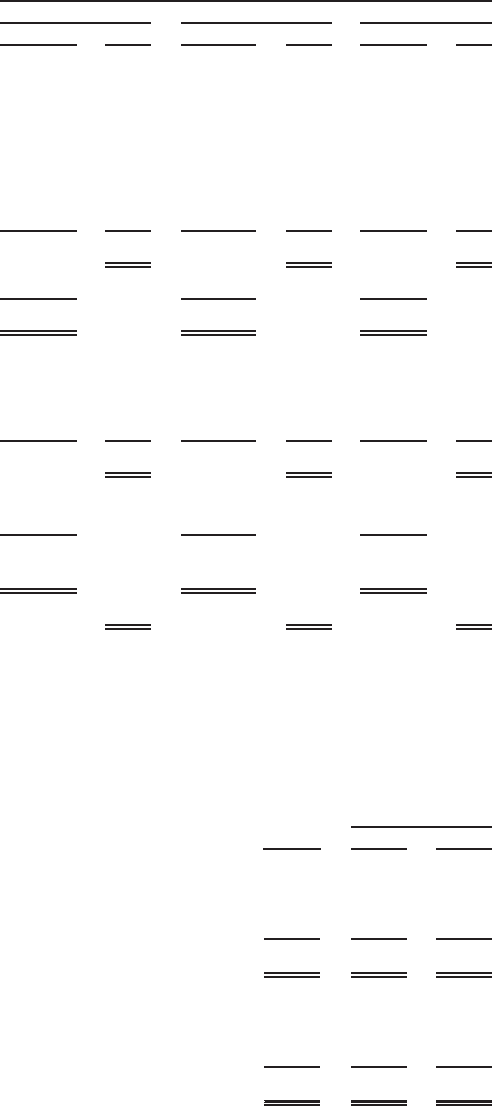

Rate/Volume Analysis

The following rate/volume analysis shows the relative contribution of changes in interest rates and asset

volumes.

Increase Rate Volume

Increase

Attributable to

Change in

2007 vs. 2006

Interest income .......................................... $2,096 $ (98) $2,194

Interest expense ......................................... 1,962 301 1,661

Net interest income....................................... $ 134 $(399) $ 533

2006 vs. 2005

Interest income .......................................... $2,067 $1,370 $ 697

Interest expense ......................................... 2,064 1,589 475

Net interest income....................................... $ 3 $(219) $ 222

47