Sallie Mae 2007 Annual Report Download - page 159

Download and view the complete annual report

Please find page 159 of the 2007 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

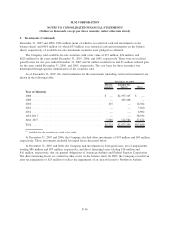

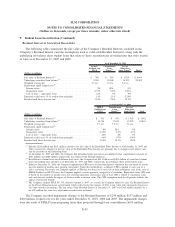

6. Goodwill and Acquired Intangible Assets (Continued)

loans on which the Company is entitled to earn a 9.5 percent yield. These impairment charges were recorded

to operating expense in the Lending operating segment.

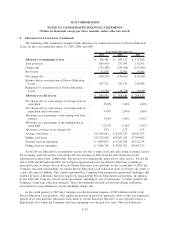

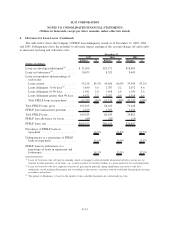

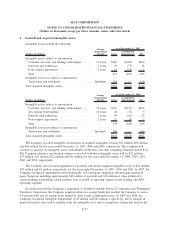

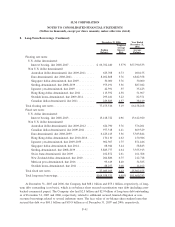

A summary of changes in the Company’s goodwill by reportable segment is as follows:

(Dollars in millions)

December 31,

2006

Acquisitions/

Other

December 31,

2007

Lending ..................................... $406 $(18) $388

Asset Performance Group ........................ 349 28 377

Corporate and Other ............................ 215 (15) 200

Total ....................................... $970 $ (5) $965

(Dollars in millions)

December 31,

2005

Acquisitions/

Other

December 31,

2006

Lending ..................................... $410 $ (4) $406

Asset Performance Group ........................ 299 50 349

Corporate and Other ............................ 64 151 215

Total ....................................... $773 $197 $970

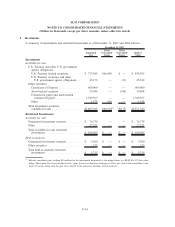

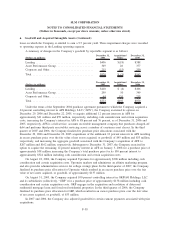

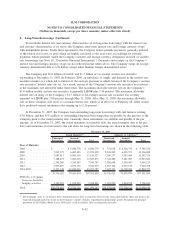

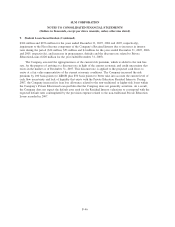

Under the terms of the September 2004 purchase agreement pursuant to which the Company acquired a

64 percent controlling interest in AFS Holdings, LLC (“AFS”), the Company exercised its options on

December 29, 2006 and December 22, 2005, to acquire additional 12 percent interests in AFS for

approximately $61 million and $59 million, respectively, including cash consideration and certain acquisition

costs, increasing the Company’s interest in AFS to 88 percent and 76 percent, as of December 31, 2006 and

2005, respectively. AFS is a full-service, accounts receivable management company that purchases charged-off

debt and performs third-party receivables servicing across a number of consumer asset classes. In the third

quarter of 2007 and 2006, the Company finalized its purchase price allocations associated with the

December 29, 2006 and December 22, 2005 acquisitions of the additional 12 percent interests in AFS resulting

in excess purchase price over the fair value of net assets acquired, or goodwill, of $45 million and $53 million,

respectively, and increasing the aggregate goodwill associated with the Company’s acquisition of AFS to

$207 million and $162 million, respectively. Subsequent to December 31, 2007, the Company exercised its

option to acquire the remaining 12 percent minority interest in AFS on January 3, 2008 for a purchase price of

approximately $38 million increasing the Company’s total purchase price for its 100 percent interest to

approximately $324 million including cash consideration and certain acquisition costs.

On August 22, 2006, the Company acquired Upromise for approximately $308 million including cash

consideration and certain acquisition costs. Upromise markets and administers an affinity marketing program

and also provides administration services for college savings plans. In the third quarter of 2007, the Company

finalized its purchase price allocation for Upromise which resulted in an excess purchase price over the fair

value of net assets acquired, or goodwill, of approximately $137 million.

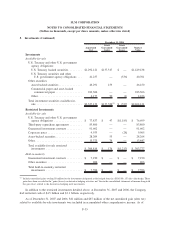

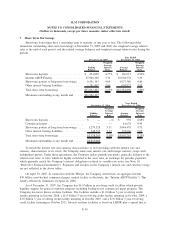

On August 31, 2005, the Company acquired 100 percent controlling interest in GRP/AG Holdings, LLC

and its subsidiaries (collectively, “GRP”) for a purchase price of approximately $138 million including cash

consideration and certain acquisition costs. GRP engages in the acquisition and resolution of distressed

residential mortgage loans and foreclosed residential properties. In the third quarter of 2006, the Company

finalized its purchase price allocation for GRP, which resulted in an excess purchase price over the fair value

of net assets acquired, or goodwill, of $53 million.

In 2007 and 2006, the Company also adjusted goodwill for certain earnout payments associated with prior

acquisitions.

F-38

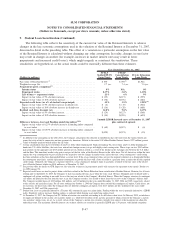

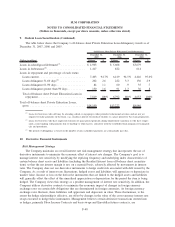

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Dollars in thousands, except per share amounts, unless otherwise stated)