Sallie Mae 2007 Annual Report Download - page 165

Download and view the complete annual report

Please find page 165 of the 2007 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

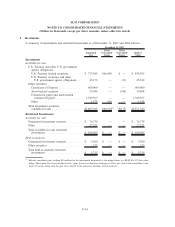

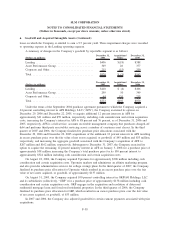

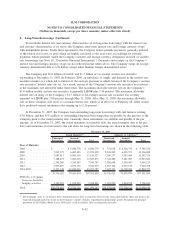

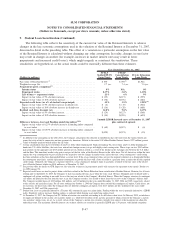

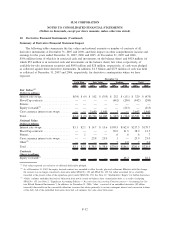

9. Student Loan Securitization (Continued)

Key economic assumptions used in estimating the fair value of the Residual Interests at the date of

securitization resulting from the student loan securitization sale transactions completed during the years ended

December 31, 2007, 2006 and 2005 were as follows:

FFELP

Stafford

and

PLUS

(1)

FFELP

Consolidation

Loans

(1)

Private

Education

Loans

FFELP

Stafford

and PLUS

FFELP

Consolidation

Loans

Private

Education

Loans

FFELP

Stafford

and PLUS

FFELP

Consolidation

Loans

Private

Education

Loans

2007 2006 2005

Years Ended December 31,

Prepayment speed

(annual rate)

(2)

. . . . . — — — * 6% 4% ** 6% 4%

Interim status . . . . . — — 0% — — — — — —

Repayment status . . . — — 4-7% — — — — — —

Life of loan

repayment status . . — — 6% — — — — — —

Weighted average life . . — — 9.4 yrs. 3.7 yrs. 8.2 yrs. 9.4 yrs. 3.8 yrs. 7.9 yrs. 8.9 yrs.

Expected credit losses

(% of principal

securitized) ....... — — 4.69% .15% .19% 4.79% —% —% 4.41%

Residual cash flows

discounted at

(weighted average) . . — — 12.5% 12.4% 10.8% 12.9% 12.2% 10.1% 12.3%

(1)

No securitizations qualified for sale treatment in the period.

(2)

Effective December 31, 2006, the Company implemented Constant Prepayment Rates (“CPR”) curves for Residual Interest valuations

that are based on the number of months since entering repayment that better reflect the CPR as the loan seasons. Under this method-

ology, a different CPR is applied to each year of a loan’s seasoning. Previously, the Company applied a CPR that was based on a

static life of loan assumption, irrespective of seasoning, or, in the case of FFELP Stafford and PLUS loans, the Company used a vec-

tor approach in applying the CPR. The repayment status CPR depends on the number of months since first entering repayment or as

the loans seasons through the portfolio. Life of loan CPR is related to repayment status only and does not include the impact of the

loan while in interim status. The CPR assumption used for all periods includes the impact of projected defaults.

*

CPR of 20 percent for 2006, 15 percent for 2007, and 10 percent thereafter.

**

Securitizations through August 2005 used a CPR of 20 percent for 2005, 15 percent for 2006 and 6 percent thereafter. Securitizations

from September 2005 through December 2005 used a CPR of 30 percent for 2005, 20 percent for 2006, 15 percent for 2007 and

10 percent thereafter.

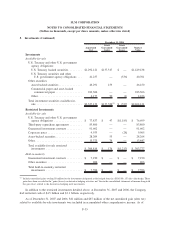

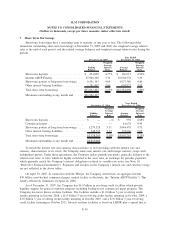

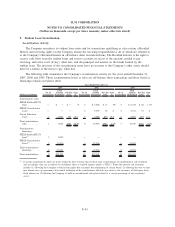

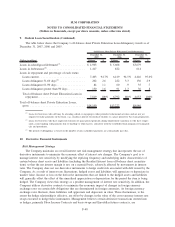

The following table summarizes cash flows received from or paid to the off-balance sheet securitization

trusts during the years ended December 31, 2007, 2006 and 2005:

2007 2006 2005

Years Ended December 31,

(Dollars in millions)

Net proceeds from new securitizations completed during the

period ............................................. $1,977 $19,521 $13,523

Purchases of Private Education Loans from securitization trusts .... (162) (72) (63)

Servicing fees received

(1)

................................. 286 327 320

Cash distributions from trusts related to Residual Interests ........ 782 598 630

(1)

The Company receives annual servicing fees of 90 basis points, 50 basis points and 70 basis points of the outstanding securitized

loan balance related to its FFELP Stafford, FFELP Consolidation Loan and Private Education Loan securitizations, respectively.

F-44

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Dollars in thousands, except per share amounts, unless otherwise stated)