Sallie Mae 2007 Annual Report Download - page 189

Download and view the complete annual report

Please find page 189 of the 2007 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

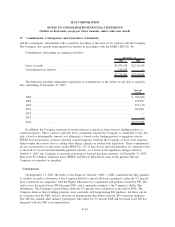

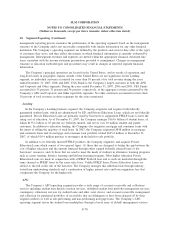

17. Commitments, Contingencies and Guarantees (Continued)

and the counterparty subsequently fails to perform according to the terms of its contract with the Company.

The Company also records unrecognized tax benefits in accordance with the FASB’s FIN No. 48.

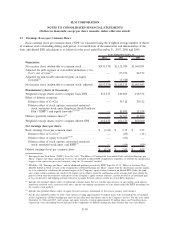

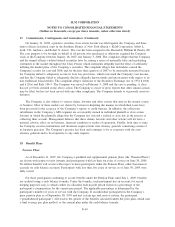

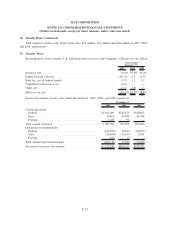

Commitments outstanding are summarized below:

2007 2006

December 31,

Lines of credit ............................................ $2,035,638 $2,145,624

Unrecognized tax benefits ................................... 175,563 —

$2,211,201 $2,145,624

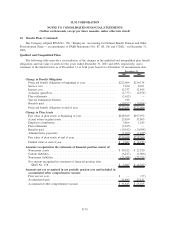

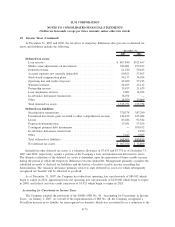

The following schedule summarizes expirations of commitments to the earlier of call date or maturity

date outstanding at December 31, 2007.

Lines of

Credit

2008 .............................................................. $ 485,680

2009 .............................................................. 478,827

2010 .............................................................. 871,130

2011 .............................................................. 200,001

2012 .............................................................. —

2013 .............................................................. —

Total .............................................................. $2,035,638

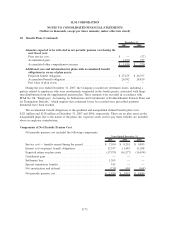

In addition, the Company maintains forward contracts to purchase loans from its lending partners at

contractual prices. These contracts typically have a maximum amount the Company is committed to buy, but

lack a fixed or determinable amount as it ultimately is based on the lending partner’s origination activity.

FFELP forward purchase contracts typically contain language relieving the Company of most of its responsi-

bilities under the contract due to, among other things, changes in student loan legislation. These commitments

are not accounted for as derivatives under SFAS No. 133 as they do not meet the definition of a derivative due

to the lack of a fixed and determinable purchase amount. As a result of the legislative changes effective

October 1, 2007, the Company is currently reviewing its forward purchase contracts. At December 31, 2007,

there were $5.4 billion originated loans (FFELP and Private Education Loans) in the pipeline that the

Company is committed to purchase.

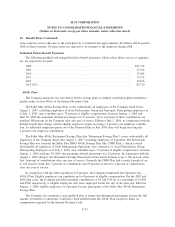

Contingencies

On September 11, 2007, the Office of the Inspector General (“OIG”) of ED, confirmed that they planned

to conduct an audit to determine if the Company billed for special allowance payments, under the 9.5 percent

floor calculation, in compliance with the Higher Education Act, regulations and guidance issued by ED. The

audit covers the period from 2003 through 2006, and is currently confined to the Company’s Nellie Mae

subsidiaries. The Company ceased billing under the 9.5 percent floor calculation at the end of 2006. The

Company believes that its billing practices were consistent with longstanding ED guidance, but there can be

no assurance that the OIG will not advocate an interpretation that differs from the ED’s previous guidance.

The OIG has audited other industry participants who billed for 9.5 percent SAP and in certain cases ED has

disagreed with the OIG’s recommendation.

F-68

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Dollars in thousands, except per share amounts, unless otherwise stated)