Sallie Mae 2007 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2007 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

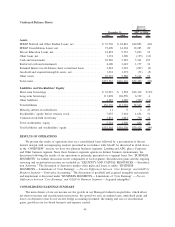

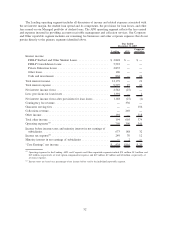

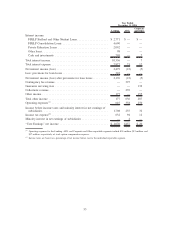

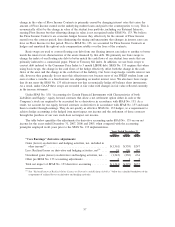

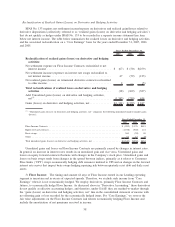

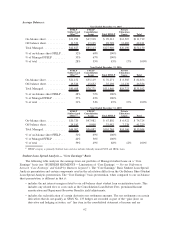

Lending APG

Corporate

and Other

Year Ended

December 31, 2005

Interest income:

FFELP Stafford and Other Student Loans .................... $2,298 $ — $ —

FFELP Consolidation Loans .............................. 3,014 — —

Private Education Loans ................................. 1,160 — —

Other loans........................................... 85 — —

Cash and investments ................................... 396 — 5

Total interest income ..................................... 6,953 — 5

Total interest expense ..................................... 4,798 19 6

Net interest income (loss) .................................. 2,155 (19) (1)

Less: provisions for loan losses .............................. 138 — —

Net interest income (loss) after provisions for loan losses .......... 2,017 (19) (1)

Contingency fee revenue................................... — 360 —

Guarantor serving fees .................................... — — 115

Collections revenue ...................................... — 167 —

Other income ........................................... 111 — 125

Total other income ....................................... 111 527 240

Operating expenses....................................... 547 288 235

Income before income taxes and minority interest in net earnings of

subsidiaries........................................... 1,581 220 4

Income tax expense

(1)

..................................... 586 81 1

Minority interest in net earnings of subsidiaries .................. 2 4 —

“Core Earnings” net income ................................ $ 993 $135 $ 3

(1)

Income taxes are based on a percentage of net income before tax for the individual reportable segment.

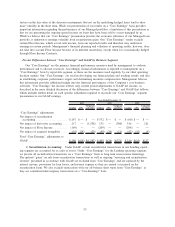

Limitations of “Core Earnings”

While GAAP provides a uniform, comprehensive basis of accounting, for the reasons described above,

management believes that “Core Earnings” are an important additional tool for providing a more complete

understanding of the Company’s results of operations. Nevertheless, “Core Earnings” are subject to certain

general and specific limitations that investors should carefully consider. For example, as stated above, unlike

financial accounting, there is no comprehensive, authoritative guidance for management reporting. Our “Core

Earnings” are not defined terms within GAAP and may not be comparable to similarly titled measures

reported by other companies. Unlike GAAP, “Core Earnings” reflect only current period adjustments to GAAP.

Accordingly, the Company’s “Core Earnings” presentation does not represent a comprehensive basis of

accounting. Investors, therefore, may not compare our Company’s performance with that of other financial

services companies based upon “Core Earnings.” “Core Earnings” results are only meant to supplement GAAP

results by providing additional information regarding the operational and performance indicators that are most

closely used by management, the Company’s board of directors, rating agencies and lenders to assess

performance.

Other limitations arise from the specific adjustments that management makes to GAAP results to derive

“Core Earnings” results. For example, in reversing the unrealized gains and losses that result from

SFAS No. 133, “Accounting for Derivative Instruments and Hedging Activities,” on derivatives that do not

qualify for “hedge treatment,” as well as on derivatives that do qualify but are in part ineffective because they

are not perfect hedges, we focus on the long-term economic effectiveness of those instruments relative to the

underlying hedged item and isolate the effects of interest rate volatility, changing credit spreads and changes

in our stock price on the fair value of such instruments during the period. Under GAAP, the effects of these

54