Sallie Mae 2007 Annual Report Download - page 147

Download and view the complete annual report

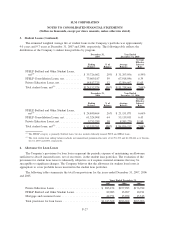

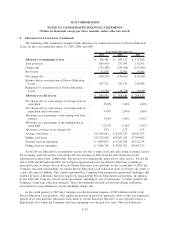

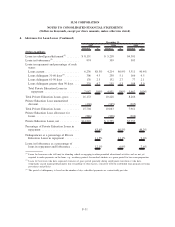

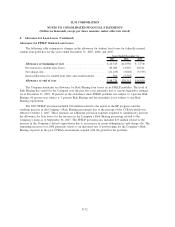

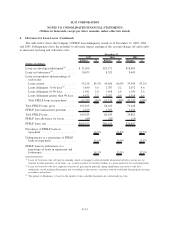

Please find page 147 of the 2007 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.3. Student Loans (Continued)

In addition to FFELP loan programs, which place statutory limits on per year and total borrowing, the

Company offers a variety of Private Education Loans. Private Education Loans for post-secondary education

and loans for career training can be subdivided into two main categories: loans that supplement FFELP student

loans primarily for higher and lifelong learning programs and loans for career training. For the majority of

the Private Education Loan portfolio, the Company bears the full risk of any losses experienced and as a

result, these loans are underwritten and priced based upon standardized consumer credit scoring criteria. In

addition, students who do not meet the Company’s minimum underwriting standards are generally required to

obtain a credit-worthy cosigner. Approximately 52 percent of the Company’s Private Education Loans have a

cosigner.

Private Education Loans are not federally guaranteed nor insured against any loss of principal or interest.

Student borrowers use the proceeds of these loans to obtain higher education. The Company believes the

borrowers’ repayment capability improves between the time the loan is made and the time they enter the post-

education work force. The Company generally allows the loan repayment period on higher education Private

Education Loans to begin six months after the borrower leaves school (consistent with FFELP loans). This

provides the borrower time after graduation to obtain a job to service the debt. For borrowers that need more

time or experience other hardships, the Company permits additional delays in payment or partial payments

(both referred to as forbearances) when it believes additional time will improve the borrower’s ability to repay

the loan. Forbearance is also granted to borrowers who may experience temporary hardship after entering

repayment, when the Company believes that it will increase the likelihood of ultimate collection of the loan.

Loans for career training require repayment while the borrower is still in school.

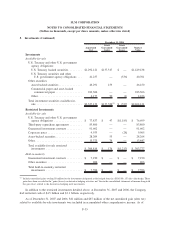

Forbearance does not grant any reduction in the total repayment obligation (principal or interest) but does

allow for the temporary cessation of borrower payments (on a prospective and/or retroactive basis) or a

reduction in monthly payments for an agreed period of time. The forbearance period extends the original term

of the loan. While the loan is in forbearance, interest continues to accrue and is recorded in interest income in

the accompanying consolidated financial statements, and is capitalized as principal upon the loan re-entering

repayment status. Loans exiting forbearance into repayment status are considered current regardless of their

previous delinquency status.

The Company may charge the borrower fees on certain Private Education Loans, either at origination,

when the loan enters repayment, or both. Such fees are deferred and recognized into income as a component

of interest over the estimated average life of the related pool of loans.

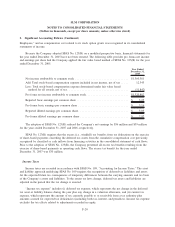

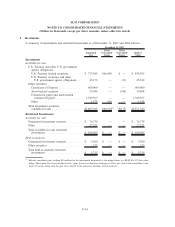

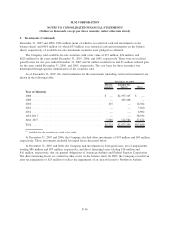

As of December 31, 2007 and 2006, 58 percent and 61 percent, respectively, of the Company’s on-

balance sheet student loan portfolio was in repayment.

F-26

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Dollars in thousands, except per share amounts, unless otherwise stated)