Sallie Mae 2007 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2007 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

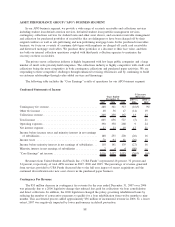

CORPORATE AND OTHER BUSINESS SEGMENT

Our Corporate and Other reportable segment reflects the aggregate activity of our smaller operating units

including our Guarantor Servicing and Loan Servicing operating units,Upromise (acquired in August 2006),

other products and services, as well as corporate expenses that do not pertain directly to our operating

segments.

In our Guarantor Servicing operating unit, we provide a full complement of administrative services to

FFELP guarantors including guarantee issuance, processing, account maintenance, and guarantee fulfillment.

In our Loan Servicing operating unit, we originate and service student loans on behalf of lenders who are

unrelated to SLM Corporation. In our Upromise operating unit, we provide 529 college-savings plan

administration services and operate an affinity marketing program.

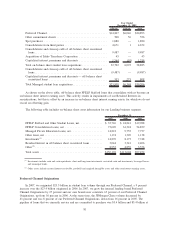

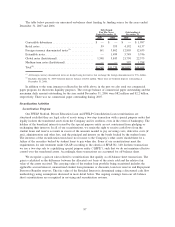

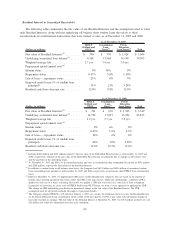

Condensed Statements of Income

2007 2006 2005 2007 vs. 2006 2006 vs. 2005

Years Ended

December 31, % Increase (Decrease)

Net interest income (loss) after provisions for

losses ............................. $ (1) $ (5) $ (1) 80% 400%

Guarantor servicing fees ................. 156 132 115 18 15

Loan servicing fees..................... 23 29 44 (21) (34)

Upromise ............................ 124 43 — 188 100

Other ............................... 71 83 81 (14) 2

Total other income ..................... 374 287 240 30 20

Operating expenses ..................... 341 250 235 36 6

Income before income taxes .............. 32 32 4 — 700

Income tax expense .................... 12 12 1 — 1,100

“Core Earnings” net income .............. $ 20 $ 20 $ 3 —% 567%

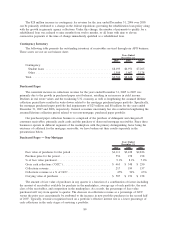

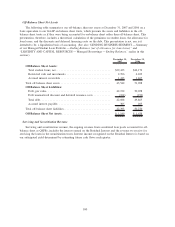

USA Funds, the nation’s largest guarantee agency, accounted for 86 percent, 83 percent, and 82 percent,

respectively, of guarantor servicing fees and 16 percent, 25 percent, and 27 percent, respectively, of revenues

associated with other products and services for the years ended December 31, 2007, 2006 and 2005.

2007 versus 2006

The increase in guarantor servicing fees versus the year-ago period was primarily due to the recognition

of $15 million of previously deferred guarantee account maintenance fee revenue related to a negotiated

settlement with USA Funds in the second quarter of 2006. The negotiated settlement with USA Funds would

have resulted in the Company having to return the $15 million to USA Funds, if certain events occurred prior

to December 31, 2007. These events did not occur prior to December 31, 2007, as stipulated in the negotiated

settlement. As a result, all such contingencies were removed, resulting in the recognition of this deferred

revenue in 2007. This amount is non-recurring in nature.

The increase in fees from Upromise for the year ended December 31, 2007 versus the year-ago period

was primarily due to the acquisition of Upromise in August 2006.

2006 versus 2005

The increase in guarantor servicing fees in 2006 versus 2005 is primarily due to a negotiated settlement

with USA Funds such that USA Funds was able to pay account maintenance fees that were previously held up

by the cap on payments from ED to guarantors in 2005. This cap was removed by legislation reauthorizing the

student loan programs of the Higher Education Act on October 1, 2006.

91