Sallie Mae 2007 Annual Report Download - page 158

Download and view the complete annual report

Please find page 158 of the 2007 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

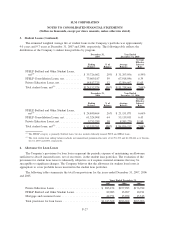

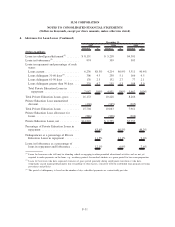

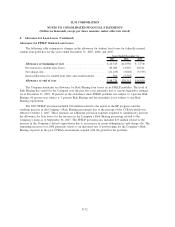

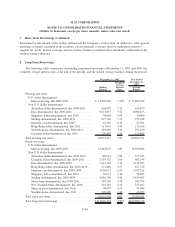

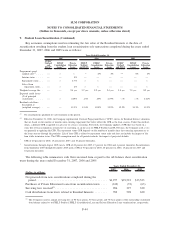

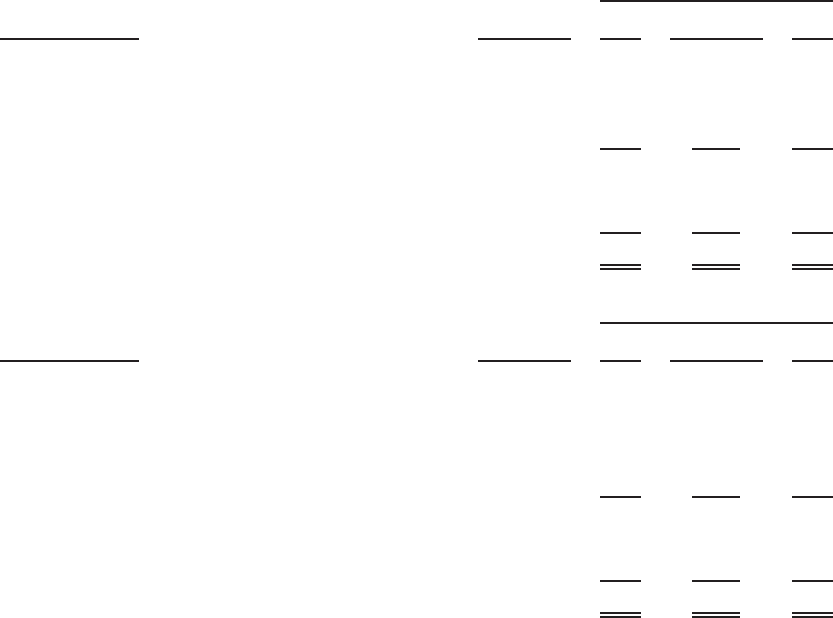

6. Goodwill and Acquired Intangible Assets

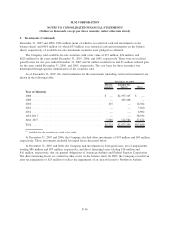

Intangible assets include the following:

(Dollars in millions)

Average

Amortization

Period Gross

Accumulated

Amortization Net

As of December 31, 2007

Intangible assets subject to amortization:

Customer, services, and lending relationships ...... 13years $366 $(160) $206

Software and technology ..................... 7years 95 (77) 18

Non-compete agreements ..................... 2years 12 (10) 2

Total .................................... 473 (247) 226

Intangible assets not subject to amortization:

Trade name and trademark .................... Indefinite 110 — 110

Total acquired intangible assets .................. $583 $(247) $336

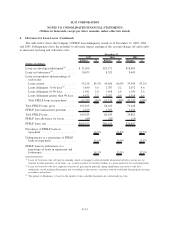

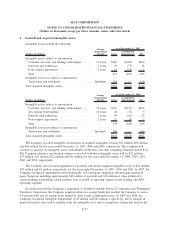

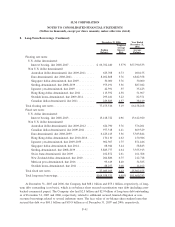

(Dollars in millions)

Average

Amortization

Period Gross

Accumulated

Amortization Net

As of December 31, 2006

Intangible assets subject to amortization:

Customer, services, and lending relationships ...... 12years $367 $(115) $252

Tax exempt bond funding ..................... 10years 46 (37) 9

Software and technology ..................... 7years 94 (62) 32

Non-compete agreements ..................... 2years 12 (9) 3

Total .................................... 519 (223) 296

Intangible assets not subject to amortization:

Trade name and trademark .................... Indefinite 106 — 106

Total acquired intangible assets .................. $625 $(223) $402

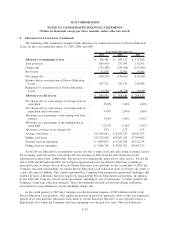

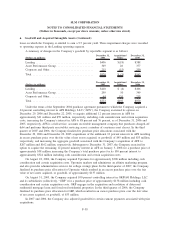

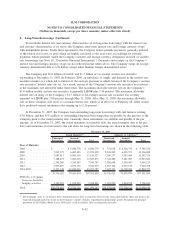

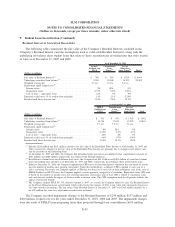

The Company recorded intangible amortization of acquired intangibles totaling $67 million, $65 million,

and $60 million for the years ended December 31, 2007, 2006 and 2005, respectively. The Company will

continue to amortize its intangible assets with definite useful lives over their remaining estimated useful lives.

The Company estimates amortization expense associated with these intangible assets will be $52 million,

$37 million, $31 million, $22 million and $16 million for the years ended December 31, 2008, 2009, 2010,

2011 and 2012, respectively.

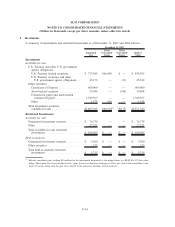

The Company also recorded impairment of goodwill and certain acquired intangible assets of $45 million,

$29 million and $1 million, respectively, for the years ended December 31, 2007, 2006 and 2005. In 2007, the

Company recognized impairments related principally to its mortgage origination and mortgage purchased

paper businesses including approximately $20 million of goodwill and $10 million of value attributed to

certain banking relationships which amounts were recorded as operating expense in the Lending and APG

operating segments.

In connection with the Company’s acquisition of Southwest Student Services Corporation and Washington

Transferee Corporation, the Company acquired certain tax exempt bonds that enabled the Company to earn a

9.5 percent SAP rate on student loans funded by those bonds in indentured trusts. In 2007 and 2006, the

Company recognized intangible impairments of $9 million and $21 million, respectively, due to changes in

projected interest rates used to initially value the intangible asset and to a regulatory change that restricts the

F-37

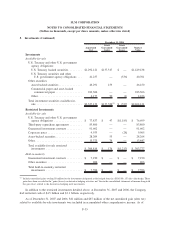

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Dollars in thousands, except per share amounts, unless otherwise stated)