Sallie Mae 2007 Annual Report Download - page 202

Download and view the complete annual report

Please find page 202 of the 2007 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

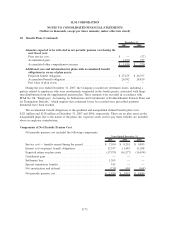

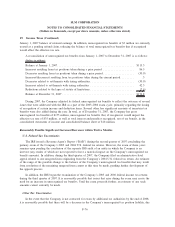

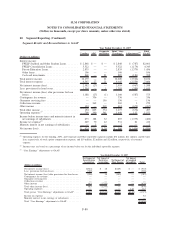

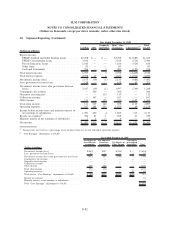

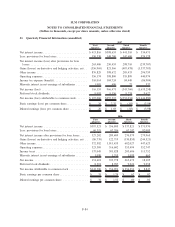

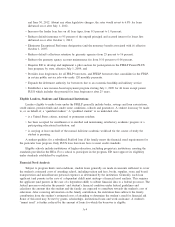

20. Segment Reporting (Continued)

Lending APG

Corporate

and Other

Total “Core

Earnings” Adjustments

(3)

Total

GAAP

Year Ended December 31, 2006

(Dollars in millions)

Interest income:

FFELP Stafford and Other Student Loans . . . . . . . . $ 2,771 $ — $ — $ 2,771 $(1,362) $1,409

FFELP Consolidation Loans . . . . . . . . . . . . . . . . . 4,690 — — 4,690 (1,144) 3,546

Private Education Loans . . . . . . . . . . . . . . . . . . . . 2,092 — — 2,092 (1,071) 1,021

Otherloans............................. 98 — — 98 — 98

Cash and investments . . . . . . . . . . . . . . . . . . . . . . 705 — 7 712 (209) 503

Total interest income . . . . . . . . . . . . . . . . . . . . . . . . 10,356 — 7 10,363 (3,786) 6,577

Total interest expense . . . . . . . . . . . . . . . . . . . . . . . 7,877 23 12 7,912 (2,789) 5,123

Net interest income (loss). . . . . . . . . . . . . . . . . . . . . 2,479 (23) (5) 2,451 (997) 1,454

Less: provisions for loan losses. . . . . . . . . . . . . . . . . 303 — — 303 (16) 287

Net interest income (loss) after provisions for loan

losses . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2,176 (23) (5) 2,148 (981) 1,167

Contingency fee revenue . . . . . . . . . . . . . . . . . . . . . — 397 — 397 — 397

Guarantor servicing fees . . . . . . . . . . . . . . . . . . . . . — — 132 132 — 132

Collections revenue . . . . . . . . . . . . . . . . . . . . . . . . . — 239 — 239 1 240

Other income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 177 — 155 332 1,073 1,405

Total other income . . . . . . . . . . . . . . . . . . . . . . . . . 177 636 287 1,100 1,074 2,174

Operating expenses

(1)

. . . . . . . . . . . . . . . . . . . . . . . 645 358 250 1,253 93 1,346

Income before income taxes and minority interest in

net earnings of subsidiaries . . . . . . . . . . . . . . . . . . 1,708 255 32 1,995 — 1,995

Income tax expense

(2)

....................... 632 94 12 738 96 834

Minority interest in net earnings of subsidiaries . . . . . — 4 — 4 — 4

Net income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 1,076 $157 $ 20 $ 1,253 $ (96) $1,157

(1)

Operating expenses for the Lending, APG, and Corporate and Other reportable segments include $34 million, $12 million, and $17 mil-

lion, respectively, of stock option compensation expense.

(2)

Income taxes are based on a percentage of net income before tax for the individual reportable segment.

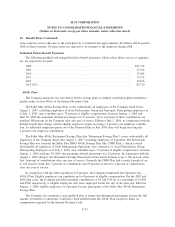

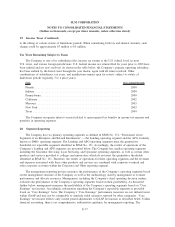

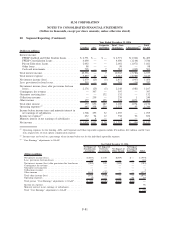

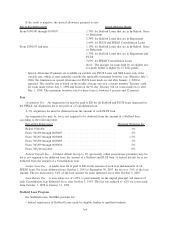

(3)

“Core Earnings” adjustments to GAAP:

Net Impact of

Securitization

Accounting

Net Impact of

Derivative

Accounting

Net Impact of

Floor Income

Net Impact

of Acquired

Intangibles Total

Year Ended December 31, 2006

(Dollars in millions)

Net interest income (loss) . . . .................... $(897) $ 109 $(209) $ — $ (997)

Less: provisions for loan losses ................... (16) — — — (16)

Net interest income (loss) after provisions for loan losses . . (881) 109 (209) — (981)

Contingency fee revenue ........................ — — — — —

Guarantor servicing fees ........................ — — — — —

Collections revenue . . ......................... 1 — — — 1

Other income . .............................. 1,411 (338) — — 1,073

Total other income (loss) . . . .................... 1,412 (338) — — 1,074

Operating expenses . . ......................... (1) — — 94 93

Total pre-tax “Core Earnings” adjustments to GAAP . . . . . . $ 532 $(229) $(209) $(94) —

Income tax expense . . ......................... 96

Minority interest in net earnings of subsidiaries ......... —

Total “Core Earnings” adjustments to GAAP . . ......... $ (96)

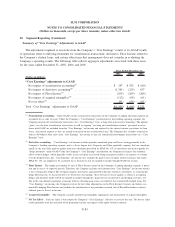

F-81

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Dollars in thousands, except per share amounts, unless otherwise stated)