Sallie Mae 2007 Annual Report Download - page 164

Download and view the complete annual report

Please find page 164 of the 2007 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

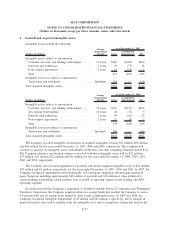

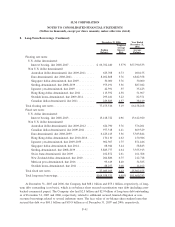

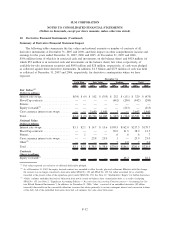

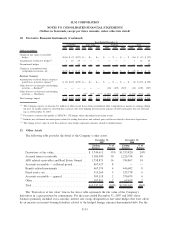

9. Student Loan Securitization

Securitization Activity

The Company securitizes its student loan assets and for transactions qualifying as sales retains a Residual

Interest and servicing rights (as the Company retains the servicing responsibilities), all of which are referred to

as the Company’s Retained Interest in off-balance sheet securitized loans. The Residual Interest is the right to

receive cash flows from the student loans and reserve accounts in excess of the amounts needed to pay

servicing, derivative costs (if any), other fees, and the principal and interest on the bonds backed by the

student loans. The investors of the securitization trusts have no recourse to the Company’s other assets should

there be a failure of the trusts to pay when due.

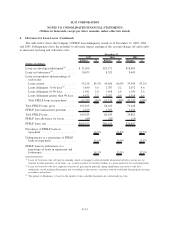

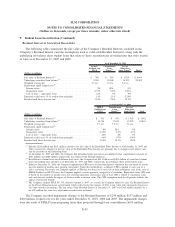

The following table summarizes the Company’s securitization activity for the years ended December 31,

2007, 2006 and 2005. Those securitizations listed as sales are off-balance sheet transactions and those listed as

financings remain on-balance sheet.

(Dollars in millions)

No. of

Transactions

Loan

Amount

Securitized

Pre-Tax

Gain

Gain

%

No. of

Transactions

Loan

Amount

Securitized

Pre-Tax

Gain

Gain

%

No. of

Transactions

Loan

Amount

Securitized

Pre-Tax

Gain

Gain

%

2007 2006 2005

Years Ended December 31,

Securitizations sales:

FFELP Stafford/PLUS

loans . . ........ — $ — $ — % 2 $ 5,004 $ 17 .3% 3 $ 6,533 $ 68 1.1%

FFELP Consolidation

Loans . . ........ — — — 4 9,503 55 .6 2 4,011 31 .8

Private Education

Loans . . ........ 1 2,001 367 18.4 3 5,088 830 16.3 2 3,005 453 15.1

Total securitizations

sales. . . ........ 1 2,001 $367 18.4% 9 19,595 $902 4.6% 7 13,549 $552 4.1%

Securitizations

financings:

FFELP Stafford/PLUS

loans

(1)

......... 3 8,955 — — — —

FFELP Consolidation

Loans

(1)

........ 5 14,476 4 12,506 5 12,503

Total securitizations

financings ....... 8 23,431 4 12,506 5 12,503

Total securitizations . . 9 $25,432 13 $32,101 12 $26,052

(1)

In certain securitizations there are terms within the deal structure that result in such securitizations not qualifying for sale treatment

and accordingly, they are accounted for on-balance sheet as variable interest entities (“VIEs”). Terms that prevent sale treatment

include: (1) allowing the Company to hold certain rights that can affect the remarketing of certain bonds, (2) allowing the trust to enter

into interest rate cap agreements after initial settlement of the securitization, which do not relate to the reissuance of third-party bene-

ficial interests or (3) allowing the Company to hold an unconditional call option related to a certain percentage of the securitized

assets.

F-43

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Dollars in thousands, except per share amounts, unless otherwise stated)