Sallie Mae 2007 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2007 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

“CRITICAL ACCOUNTING POLICIES AND ESTIMATES — Effects of Consolidation Activity on Esti-

mates.” Also, we must maintain sufficient, short-term liquidity to enable us to cost-effectively refinance

previously securitized FFELP loans as they are consolidated back on to our balance sheet.

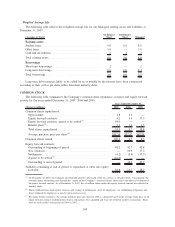

Interest Rate Risk Management

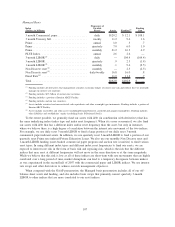

Asset and Liability Funding Gap

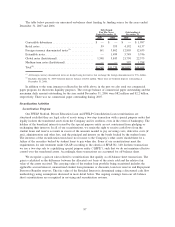

The tables below present our assets and liabilities (funding) arranged by underlying indices as of

December 31, 2007. In the following GAAP presentation, the funding gap only includes derivatives that

qualify as effective SFAS No. 133 hedges (those derivatives which are reflected in net interest margin, as

opposed to those reflected in the “gains/(losses) on derivatives and hedging activities, net” line in the

consolidated statement of income). The difference between the asset and the funding is the funding gap for the

specified index. This represents our exposure to interest rate risk in the form of basis risk and repricing risk,

which is the risk that the different indices may reset at different frequencies or may not move in the same

direction or at the same magnitude.

Management analyzes interest rate risk on a Managed basis, which consists of both on-balance sheet and

off-balance sheet assets and liabilities and includes all derivatives that are economically hedging our debt

whether they qualify as effective hedges under SFAS No. 133 or not. Accordingly, we are also presenting the

asset and liability funding gap on a Managed basis in the table that follows the GAAP presentation.

GAAP Basis

Index

(Dollars in billions)

Frequency of

Variable

Resets Assets Funding

(1)

Funding

Gap

3 month Commercial paper . . ............. daily $ 98.6 $ — $ 98.6

3 month Treasury bill ................... weekly 7.8 .2 7.6

Prime ............................... annual .6 — .6

Prime ............................... quarterly 1.5 — 1.5

Prime ............................... monthly 13.6 — 13.6

PLUS Index .......................... annual 1.6 — 1.6

3-month LIBOR ....................... daily — — —

3-month LIBOR ....................... quarterly 1.0 104.0 (103.0)

1-month LIBOR

(2)

..................... monthly .1 14.3 (14.2)

CMT/CPI index ....................... monthly/quarterly — 3.8 (3.8)

Non Discrete reset

(3)

.................... monthly — 2.8 (2.8)

Non Discrete reset

(4)

.................... daily/weekly 14.0 16.5 (2.5)

Fixed Rate

(5)

.......................... 16.8 14.0 2.8

Total................................ $155.6 $155.6 $ —

(1)

Funding includes all derivatives that qualify as hedges under SFAS No. 133.

(2)

Funding includes a portion of Interim ABCP Facility.

(3)

Funding includes auction rate securities.

(4)

Assets include restricted and non-restricted cash equivalents and other overnight type instruments. Funding includes a portion of

Interim ABCP Facility.

(5)

Assets include receivables and other assets (including Retained Interests, goodwill and acquired intangibles). Funding includes

other liabilities and stockholders’ equity (excluding Series B Preferred Stock).

The “Funding Gaps” in the above table are primarily interest rate mismatches in short-term indices

between our assets and liabilities. We address this issue typically through the use of basis swaps that typically

convert quarterly 3-month LIBOR to other indices that are more correlated to our asset indices. These basis

swaps do not qualify as effective hedges under SFAS No. 133 and as a result the effect on the funding index

is not included in our interest margin and is therefore excluded from the GAAP presentation.

106