Sallie Mae 2007 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2007 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219

|

|

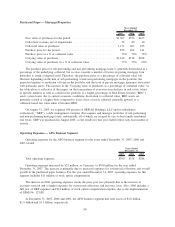

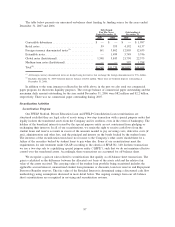

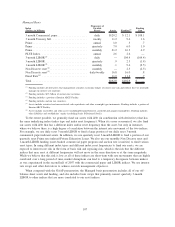

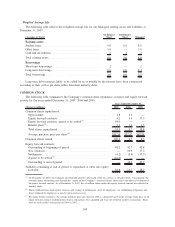

Off-Balance Sheet Net Assets

The following table summarizes our off-balance sheet net assets at December 31, 2007 and 2006 on a

basis equivalent to our GAAP on-balance sheet trusts, which presents the assets and liabilities in the off-

balance sheet trusts as if they were being accounted for on-balance sheet rather than off-balance sheet. This

presentation, therefore, includes a theoretical calculation of the premiums on student loans, the allowance for

loan losses, and the discounts and deferred financing costs on the debt. This presentation is not, nor is it

intended to be, a liquidation basis of accounting. (See also “LENDING BUSINESS SEGMENT — Summary

of our Managed Student Loan Portfolio — Ending Balances (net of allowance for loan losses)” and

“LIQUIDITY AND CAPITAL RESOURCES — Managed Borrowings — Ending Balances,” earlier in this

section.)

December 31,

2007

December 31,

2006

Off-Balance Sheet Assets:

Total student loans, net ................................... $39,423 $46,172

Restricted cash and investments ............................ 2,706 4,269

Accrued interest receivable ................................ 1,413 1,467

Total off-balance sheet assets ................................ 43,542 51,908

Off-Balance Sheet Liabilities:

Debt, par value ......................................... 42,192 50,058

Debt unamortized discount and deferred issuance costs ........... (104) (193)

Total debt............................................. 42,088 49,865

Accrued interest payable .................................. 305 405

Total off-balance sheet liabilities.............................. 42,393 50,270

Off-Balance Sheet Net Assets ............................... $ 1,149 $ 1,638

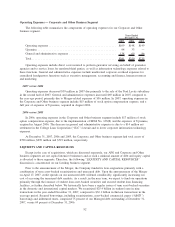

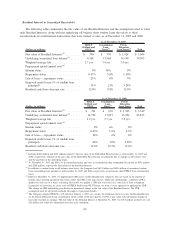

Servicing and Securitization Revenue

Servicing and securitization revenue, the ongoing revenue from securitized loan pools accounted for off-

balance sheet as QSPEs, includes the interest earned on the Residual Interest and the revenue we receive for

servicing the loans in the securitization trusts. Interest income recognized on the Residual Interest is based on

our anticipated yield determined by estimating future cash flows each quarter.

100