Sallie Mae 2007 Annual Report Download - page 27

Download and view the complete annual report

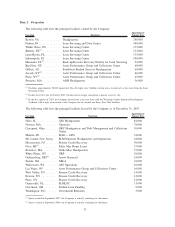

Please find page 27 of the 2007 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.ASSET PERFORMANCE GROUP BUSINESS SEGMENT

Our APG business segment may not be able to purchase defaulted consumer receivables at prices that man-

agement believes to be appropriate, and a decrease in our ability to purchase portfolios of receivables could

adversely affect our net income.

If our APG business segment is not able to purchase defaulted consumer receivables at planned levels and

at prices that management believes to be appropriate, we could experience short-term and long-term decreases

in income.

The availability of receivables portfolios at prices which generate an appropriate return on our investment

depends on a number of factors both within and outside of our control, including the following:

• the continuation of current growth trends in the levels of consumer obligations;

• sales of receivables portfolios by debt owners;

• competitive factors affecting potential purchasers and credit originators of receivables; and

• the ability to continue to service portfolios to yield an adequate return.

Because of the length of time involved in collecting defaulted consumer receivables on acquired portfolios

and the volatility in the timing of our collections, we may not be able to identify trends and make changes in

our purchasing strategies in a timely manner.

LIQUIDITY AND CAPITAL RESOURCES

Future sales or issuances of our common stock may dilute the ownership interest of existing shareholders

and depress the trading price of our common stock.

Future sales or issuances of our common stock may dilute the ownership interests of our existing

shareholders. In addition, future sales or issuances of substantial amounts of our common stock may be at

prices below current market prices and may adversely impact the market price of our common stock. Our

mandatory convertible preferred stock, Series C has dividend and liquidation preference over our common

stock.

The 7.25 percent mandatory convertible preferred stock, Series C may adversely affect the market price of

our common stock.

The market price of our common stock is likely to be influenced by the 7.25 percent mandatory

convertible preferred stock, Series C. For example, the market price of our common stock could become more

volatile and could be depressed by:

• investors’ anticipation of the potential resale in the market of a substantial number of additional shares

of our common stock received upon conversion of the 7.25 percent mandatory convertible preferred

stock, Series C;

• possible sales of our common stock by investors who view the 7.25 percent mandatory convertible

preferred stock, Series C as a more attractive means of equity participation in us than owning shares of

our common stock; and

• hedging or arbitrage trading activity that may develop involving the 7.25 percent mandatory convertible

preferred stock, series C and our common stock.

We do not currently pay regular dividends on our common stock.

We have not paid dividends on our common stock since the execution of the Merger Agreement with the

Buyer Group in April 2007. While the restriction on the payment of dividends under the Merger Agreement

has been terminated, we expect to continue not paying dividends in the near term in order to focus on balance

sheet improvement and expect to re-examine our dividend policy in the second half of 2008. Subject to

26